温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

编写要求:

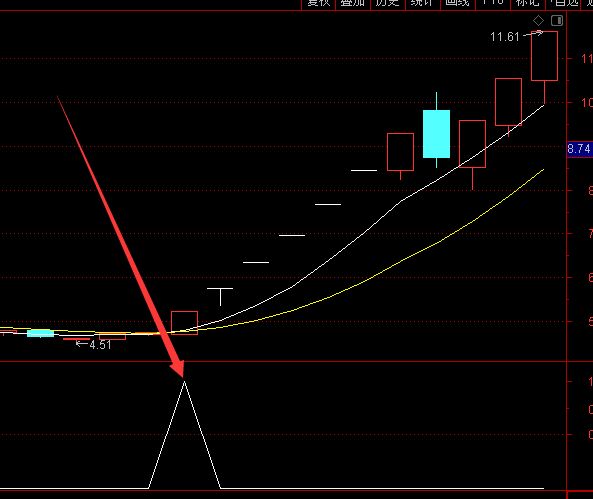

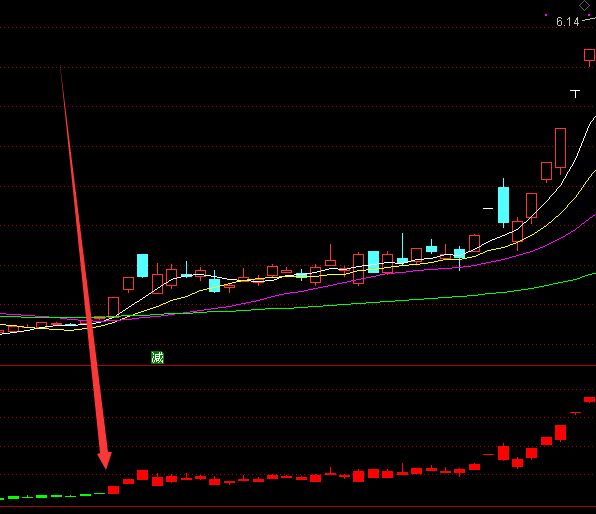

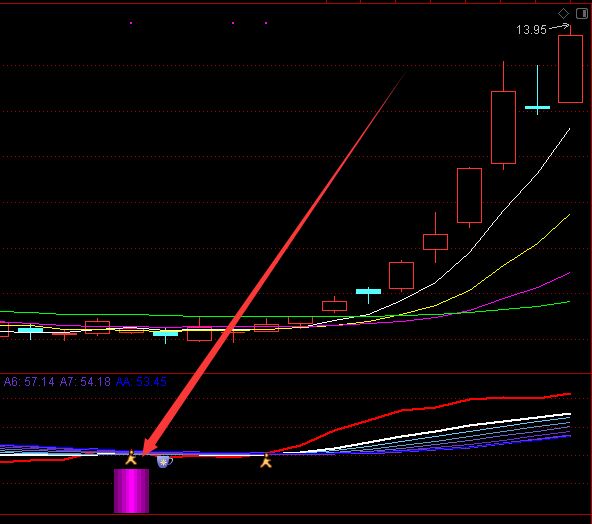

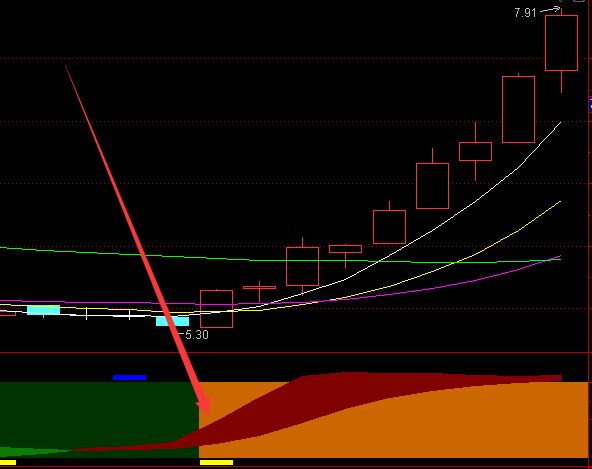

量比大于2,换手率大于1.3的选股公式。

公式指标网解答:

vol/ref(ma(vol,5),1)>2 and hsl>1.3;

基础公式定义

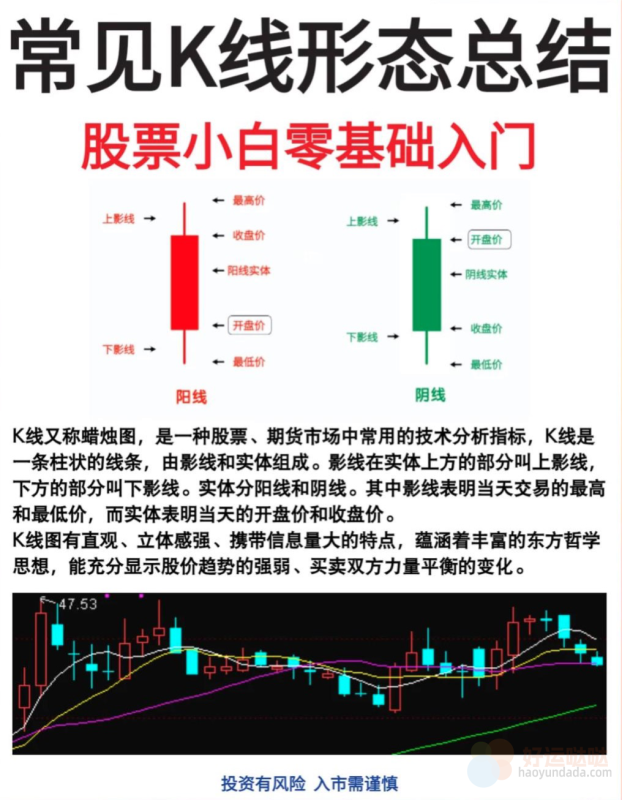

量比=当日即时成交量/过去5日平均每分钟成交量×当日累计交易时间

换手率=(成交股数/流通股股数)×100%

好运哒哒指标网解答:

{通达信公式}

换手率:=VOL/CAPITAL*100; //VOL为成交量,CAPITAL为流通股本

量比:=V/REF(MA(V,5),1); //当前成交量/5日均量

XG:量比>2 AND 换手率>1.3; //选股条件

参数优化建议

量比阈值可根据市场环境调整:牛市可放宽至2.5-3倍,震荡市建议保持2倍

换手率需结合市值:小盘股1.3%可能已达标,大盘股需更高比例

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0UUQ4TGhnOVA1TFRTWEtZb0xYMzYwa1MxYzQxWFZLa2p0OWw2S2ZWQnhGQmpsTmU1WnJhNXREQ25BZEpuMWlUUTRSQ1d4allsNjl1d3JiRFNvKzVHMFE4TmhObWw2ZlhZenQ5eXE2Y2Q4VUhrS0dsNjEwYlJ2WTlhQnRwODBXNC9GQ1NRVXhwUWN1a2liRnVCUWE3T2dhR2MweE12QXYwK0ttZXVXdjFTNGx2NXhOZHBqOWw0dFpkY0h5dWRSbUdpbHpTMDJRMGt5R1ljVTRuWlc4eTZxZWpVdWVGUUIxeHJucWVWUjVmTVdlWEJqMjdERk1NZmowYUZHeFVwb29rdlhEcXJsanBseDVPOGVtbXlJWXZZaG1DN1pwRFpoQ3RvS0E4cmV0bFd5eFVQc0pjU1dlZ3RHYURadURJZ2N2b3EvTHBRbGY0ZUEzK0tIQTZjMUk0RCtETEVUTytBMHhTTk4yMXh3TVdROEF1V0svV2szakhOcFUyRUxTQlZKUUVKbjlTdnZMNEhjQ1NUdTA2ajM0SlBQS2xZbWIySjVUR2gzVUk1dzAvcTBraFNHcDNxVnp3Rkl5b1dtWUJPQ1VBdE9tN25QYjlpa3kzS2NTeGcvMHllcks4NGJMeWNPSnV6YTV4aElSZlV4aFg5Y3g5bXNmVjhHUXYxNk5rQTZuamZET0lRWHNiQ1p6cHJuS1N5WVovUjA3VnN4TmhXN1RicnpNTnVUb01XblR6QVhTY08xZDdabzlEZ2JZbWtoZHZiajlKQWJSc1F1NENFb3pwaXBldmRudE9pNFZmdGNYNUlicDV2UCt2UndaSW4vMkYvUUZaYmRVVktWTGlWWjc4bmZhUFNSbEhHWlNRa2puQVlXVlpQRzVSbm5PVE05eTZqY2w4blAwTmV3NnFESXVYejA3UVVsRGlpZndROXdVMXNIRGRWdmdsS04yZnBzYk1lOEJibDdUb255VXQxUWZmZEpvSVpIbXovN1RkaVZSQ1hJeUEzWmhEZjdHYUZ6dnh3OVlVS2tsRy83NGN5ZnE5bXZ0c2p3amt4SDA0SjVGV3ZGRTdrL3NyR3JMTFFPTkNiNmRlbWpxVU9FS1VnRXpDUGp1RnFrdTE1eEJOTUI2bFlrY2FiSUMzUThhUTFkenJVSjNPcUk1QzIxcWJvZytTVjlhRG1aZzBidUFnNEF2QVE2dUpmZHJPRWdWMmtNLzdSRERMeXRLSGFFdjQ1cnd2SGVNSnN6MUx4ODAxOG9naFU4V1B6dll2MWhiUzhCS2JKY1ZodmNIdFhnWnpXYmF2RTE1UVRUUnFsZHNHZ2hZN3g4ZkVVVjQ1bFNCMHk3SmZJZmZydVBJUHBCUys2MUZLNlZaVnhlbURFNWNXc2d3c0JDeUgxalNMS1Y5RS9BWWkzSWtLQVRFVzJtL3lDOCtJcTFXMXIwMlFUOFcxbG5ZSUZXODlHa2JlODZSdjRXWkZJWGVzZmQrdGQ3eHplbTk4b2QxSEo3NURXd2dmTUNuUjNYcDVIRDYwQThpdXFwbkFHd1BaNGxTUW1IREVnQm9ISlFON1ZPSnI1dkUyOWtacThMTE1xSHNJU0FQSndnRHd5bGMwTVpLTGpGcUhha0hxUTlMVEFCTitXQUZvbFd0UFhIYlNtcmpzbmN4dU5HOC92VWdzc3QvRTlZOEZjWjNaWHN6ZFNhR1FsNngrMjZVVTJHL0hXWWR6V1dyNlZFUitEZ2ZaQWxHNFYzVlBXcDRTTWNOUzVDelNFNXRCTVc2TERqZEloblR6UDhXa1lZU1ZGdVVtbndjNkRnWEpDRlZPenV3ZUZjS0VZOWVTTkJESm5ERWV0QWFmck5JbUVqTUlYM2xPdlhWZ2NuUHRuWUFtRFp1bWV5YnlOZDlSb1BMRDdKTkx1cUN4Vk5tTUxPYWNTZnprbDdvelhKK0pYUHloZExKcXdXNUtSbkVsRVAyeTlra1pFRjRCd1FpNW9pMzJyTHJMdDJTSlBIYU04VHo5UXZmOGdUN2d2Y0VFdmk1VzJQbmRxRDV3NXgvM0cxZmV0U3Q2cEN1L0Z0ZDdxcWhvQW1qVnlYSWJQYXNFbDYyM0h6dGZRQzNwYnUyMERxdWR3NHpDeFo3RXZ6Y1JBSFZVMTdLYzFRZlBXTmVrUG9LSVhaK3BLbEN3UzluSHpaUFNkVHBCb21DbmlHbzhvdnJaMVZwMkI2UStKR3ExemQzU3hZNk14Umd6WjUyVy9ia0xQTDRWc2lPUzVZa0J5NW51dEVOT2NEenRaZTY4ZFdpMDFaKzE3Z3QrWm1jVnBtRWgxQ1h0TENvMGNMS3dINmJVVjNUNy9DODNMY0VpeTUycnc2Slk1Nm9sb1hUcnRsK2FhV2p5dU9EL0pnMWVLSGV0UzZOcjVFa0hqVDBaTlJWQjBhaHRGVDZ2R0ZLVU9WU3V5anVSZkFUaGpQNENRcGsrb0dpS1F6cWFRVHFQOTR3MVRaR2RzVERvOUxSS29oSTV4K1pPRzhVRU1CYnI0R29VZm51TEEyUnozN3U3b0JjNi9HUGsxaEUvVHZReUFnQUdQYTF2OUdDd0NNWU5ZVXBEekFQL2VlckJhRzh0MWlxeC9wdjAzcjNCa3AwNmpmN3AzQWhpK2ttVncwNW9XeFc3eGd6ZnhwQzdSUWhLMU82VHFQRERLaFdBRnJkaXU2MjllQnVMVXRsU0E1NHJHdUo1c09OZVNrNjlxYmJIWGsveGV6RXlNYThYZldsVEFzelhwU3dRUVMrQzdhVzdDTC9vNkdkWUowcDUzbDdabGp1UFJ6TTZlejZDZ1pJNndpRFhPUXNVREtobFlTUlFvdk5KYVVRRk1CZHpjcEZnQ25MUHgwUkR4Q09ZZVBNQzRQaVhTZ1pVb01Ldjk1WVIxa2JOdGpuQjdvSEVtcVpqdDl1TjdaQ2h6R3g0allYUXhxaHhJK2lCNEFvRkNlS3hKN2hvNDZMelJYN1FNTldOQmEycVNQMkM1UlM0YzlpYjMrcEh2N2VZNVo3T2RiaG84QWF0ZjU5MlhKT1ZZL2Z0WVN2ajREZWpHQk93eklSQWl6VFI1UzNyY25OQzNNaHlGL2lUMmhSZjBlaE5ORGxRZ1VMdWRKMko0VkFhbHVXb0pGMnZiQ3I0OXpwVWNKOGFsejY1NWh2MVFqbWZTd05VR1lXWk1ZNlFwUTkxM2V0V1lGYzhFbU00WG50NEJQbXBsbkZscW4xTFYzRHpZNFo0Tm9SZHNFbXZUSHFwL294SjAzbGJsVktYb0p5bGlUV2FGN0tpT0pqVEp1TG0zVm8rcUdiMDl1SjRmVXBOcVBpckVWc2ZLRitUUTJvZEZTay95OUtRRldvQThVOXdTOGFRYlUweDd3MCtOWjI4Z2V2Vg==

RVdTOUtDenh1c1RzcTJZc216SUM0UUQ4TGhnOVA1TFRTWEtZb0xYMzYwa1MxYzQxWFZLa2p0OWw2S2ZWQnhGQmpsTmU1WnJhNXREQ25BZEpuMWlUUTRSQ1d4allsNjl1d3JiRFNvKzVHMFE4TmhObWw2ZlhZenQ5eXE2Y2Q4VUhrS0dsNjEwYlJ2WTlhQnRwODBXNC9GQ1NRVXhwUWN1a2liRnVCUWE3T2dhR2MweE12QXYwK0ttZXVXdjFTNGx2NXhOZHBqOWw0dFpkY0h5dWRSbUdpbHpTMDJRMGt5R1ljVTRuWlc4eTZxZWpVdWVGUUIxeHJucWVWUjVmTVdlWEJqMjdERk1NZmowYUZHeFVwb29rdlhEcXJsanBseDVPOGVtbXlJWXZZaG1DN1pwRFpoQ3RvS0E4cmV0bFd5eFVQc0pjU1dlZ3RHYURadURJZ2N2b3EvTHBRbGY0ZUEzK0tIQTZjMUk0RCtETEVUTytBMHhTTk4yMXh3TVdROEF1V0svV2szakhOcFUyRUxTQlZKUUVKbjlTdnZMNEhjQ1NUdTA2ajM0SlBQS2xZbWIySjVUR2gzVUk1dzAvcTBraFNHcDNxVnp3Rkl5b1dtWUJPQ1VBdE9tN25QYjlpa3kzS2NTeGcvMHllcks4NGJMeWNPSnV6YTV4aElSZlV4aFg5Y3g5bXNmVjhHUXYxNk5rQTZuamZET0lRWHNiQ1p6cHJuS1N5WVovUjA3VnN4TmhXN1RicnpNTnVUb01XblR6QVhTY08xZDdabzlEZ2JZbWtoZHZiajlKQWJSc1F1NENFb3pwaXBldmRudE9pNFZmdGNYNUlicDV2UCt2UndaSW4vMkYvUUZaYmRVVktWTGlWWjc4bmZhUFNSbEhHWlNRa2puQVlXVlpQRzVSbm5PVE05eTZqY2w4blAwTmV3NnFESXVYejA3UVVsRGlpZndROXdVMXNIRGRWdmdsS04yZnBzYk1lOEJibDdUb255VXQxUWZmZEpvSVpIbXovN1RkaVZSQ1hJeUEzWmhEZjdHYUZ6dnh3OVlVS2tsRy83NGN5ZnE5bXZ0c2p3amt4SDA0SjVGV3ZGRTdrL3NyR3JMTFFPTkNiNmRlbWpxVU9FS1VnRXpDUGp1RnFrdTE1eEJOTUI2bFlrY2FiSUMzUThhUTFkenJVSjNPcUk1QzIxcWJvZytTVjlhRG1aZzBidUFnNEF2QVE2dUpmZHJPRWdWMmtNLzdSRERMeXRLSGFFdjQ1cnd2SGVNSnN6MUx4ODAxOG9naFU4V1B6dll2MWhiUzhCS2JKY1ZodmNIdFhnWnpXYmF2RTE1UVRUUnFsZHNHZ2hZN3g4ZkVVVjQ1bFNCMHk3SmZJZmZydVBJUHBCUys2MUZLNlZaVnhlbURFNWNXc2d3c0JDeUgxalNMS1Y5RS9BWWkzSWtLQVRFVzJtL3lDOCtJcTFXMXIwMlFUOFcxbG5ZSUZXODlHa2JlODZSdjRXWkZJWGVzZmQrdGQ3eHplbTk4b2QxSEo3NURXd2dmTUNuUjNYcDVIRDYwQThpdXFwbkFHd1BaNGxTUW1IREVnQm9ISlFON1ZPSnI1dkUyOWtacThMTE1xSHNJU0FQSndnRHd5bGMwTVpLTGpGcUhha0hxUTlMVEFCTitXQUZvbFd0UFhIYlNtcmpzbmN4dU5HOC92VWdzc3QvRTlZOEZjWjNaWHN6ZFNhR1FsNngrMjZVVTJHL0hXWWR6V1dyNlZFUitEZ2ZaQWxHNFYzVlBXcDRTTWNOUzVDelNFNXRCTVc2TERqZEloblR6UDhXa1lZU1ZGdVVtbndjNkRnWEpDRlZPenV3ZUZjS0VZOWVTTkJESm5ERWV0QWFmck5JbUVqTUlYM2xPdlhWZ2NuUHRuWUFtRFp1bWV5YnlOZDlSb1BMRDdKTkx1cUN4Vk5tTUxPYWNTZnprbDdvelhKK0pYUHloZExKcXdXNUtSbkVsRVAyeTlra1pFRjRCd1FpNW9pMzJyTHJMdDJTSlBIYU04VHo5UXZmOGdUN2d2Y0VFdmk1VzJQbmRxRDV3NXgvM0cxZmV0U3Q2cEN1L0Z0ZDdxcWhvQW1qVnlYSWJQYXNFbDYyM0h6dGZRQzNwYnUyMERxdWR3NHpDeFo3RXZ6Y1JBSFZVMTdLYzFRZlBXTmVrUG9LSVhaK3BLbEN3UzluSHpaUFNkVHBCb21DbmlHbzhvdnJaMVZwMkI2UStKR3ExemQzU3hZNk14Umd6WjUyVy9ia0xQTDRWc2lPUzVZa0J5NW51dEVOT2NEenRaZTY4ZFdpMDFaKzE3Z3QrWm1jVnBtRWgxQ1h0TENvMGNMS3dINmJVVjNUNy9DODNMY0VpeTUycnc2Slk1Nm9sb1hUcnRsK2FhV2p5dU9EL0pnMWVLSGV0UzZOcjVFa0hqVDBaTlJWQjBhaHRGVDZ2R0ZLVU9WU3V5anVSZkFUaGpQNENRcGsrb0dpS1F6cWFRVHFQOTR3MVRaR2RzVERvOUxSS29oSTV4K1pPRzhVRU1CYnI0R29VZm51TEEyUnozN3U3b0JjNi9HUGsxaEUvVHZReUFnQUdQYTF2OUdDd0NNWU5ZVXBEekFQL2VlckJhRzh0MWlxeC9wdjAzcjNCa3AwNmpmN3AzQWhpK2ttVncwNW9XeFc3eGd6ZnhwQzdSUWhLMU82VHFQRERLaFdBRnJkaXU2MjllQnVMVXRsU0E1NHJHdUo1c09OZVNrNjlxYmJIWGsveGV6RXlNYThYZldsVEFzelhwU3dRUVMrQzdhVzdDTC9vNkdkWUowcDUzbDdabGp1UFJ6TTZlejZDZ1pJNndpRFhPUXNVREtobFlTUlFvdk5KYVVRRk1CZHpjcEZnQ25MUHgwUkR4Q09ZZVBNQzRQaVhTZ1pVb01Ldjk1WVIxa2JOdGpuQjdvSEVtcVpqdDl1TjdaQ2h6R3g0allYUXhxaHhJK2lCNEFvRkNlS3hKN2hvNDZMelJYN1FNTldOQmEycVNQMkM1UlM0YzlpYjMrcEh2N2VZNVo3T2RiaG84QWF0ZjU5MlhKT1ZZL2Z0WVN2ajREZWpHQk93eklSQWl6VFI1UzNyY25OQzNNaHlGL2lUMmhSZjBlaE5ORGxRZ1VMdWRKMko0VkFhbHVXb0pGMnZiQ3I0OXpwVWNKOGFsejY1NWh2MVFqbWZTd05VR1lXWk1ZNlFwUTkxM2V0V1lGYzhFbU00WG50NEJQbXBsbkZscW4xTFYzRHpZNFo0Tm9SZHNFbXZUSHFwL294SjAzbGJsVktYb0p5bGlUV2FGN0tpT0pqVEp1TG0zVm8rcUdiMDl1SjRmVXBOcVBpckVWc2ZLRitUUTJvZEZTay95OUtRRldvQThVOXdTOGFRYlUweDd3MCtOWjI4Z2V2Vg==

指标使用通用经验总结

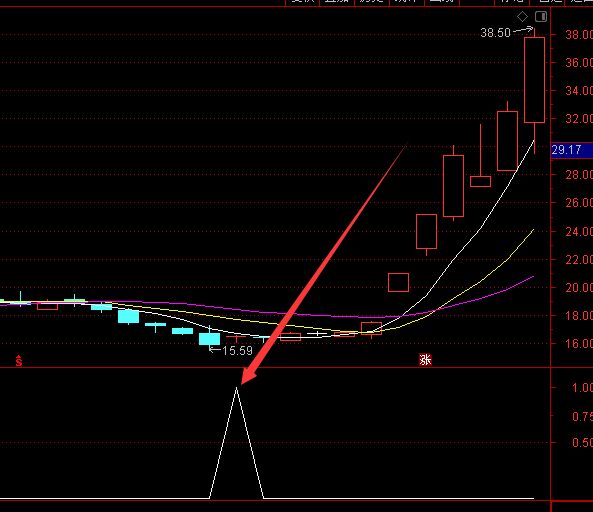

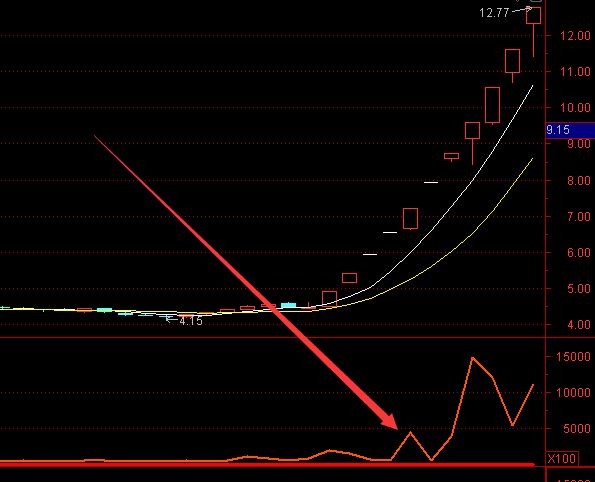

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

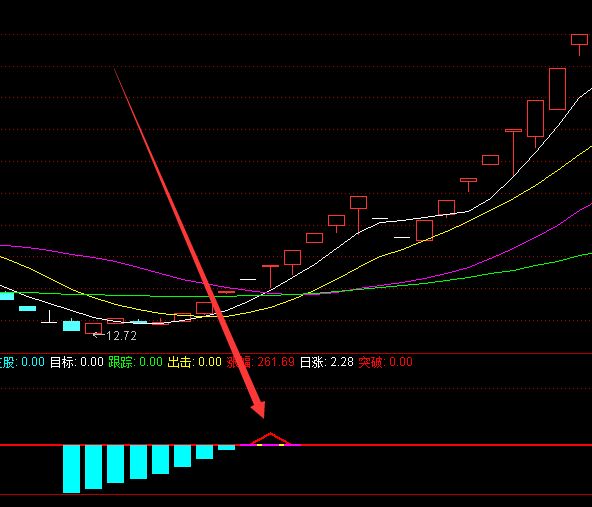

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容