温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

编写要求:

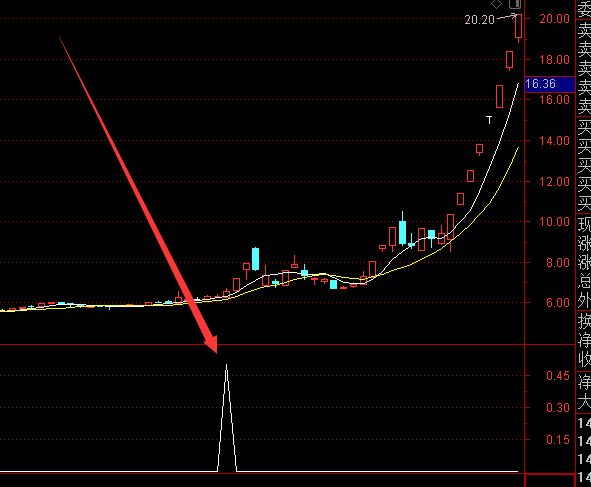

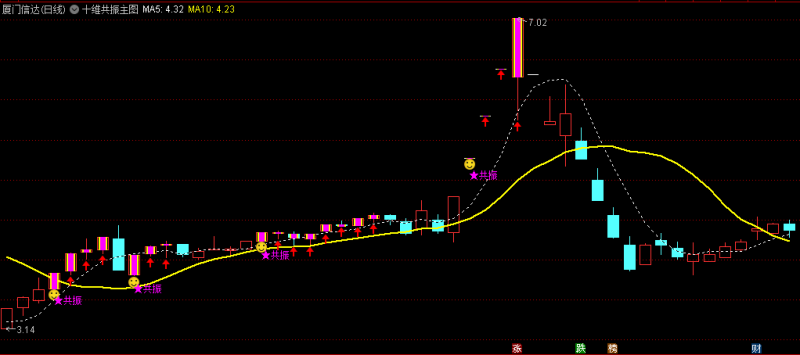

5日均线首次上穿30线后,缩量回调,然后在30日均线上的5日10日首次金叉!

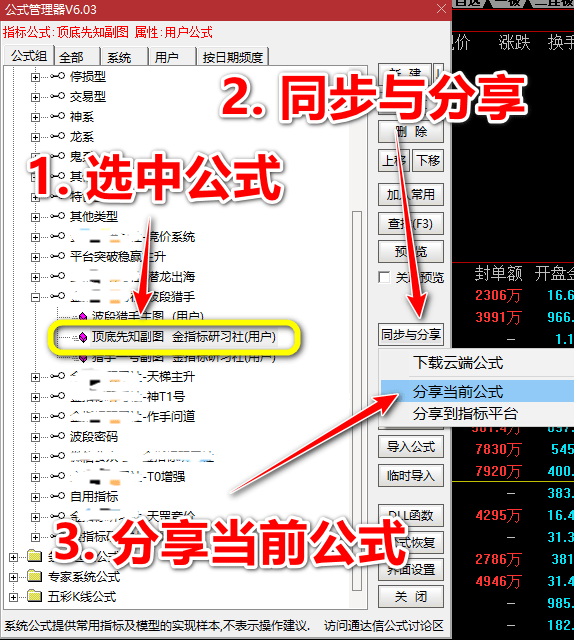

公式在线网解答:

M5:=MA(C,5);

M10:=MA(C,10);

M30:=MA(C,30);

T:=BARSLAST(CROSS(M5,M30));

TJ:=M5>=M30;

TJ1:=CROSS(M5,M10);

TJ2:=IF(C>O,V,-999);

XG:COUNT(TJ1,T)=1 AND TJ1 AND EVERY(TJ,T) AND EVERY(TJ2<REF(V,T),T);

其他写法:

以下是通达信指标公式代码,实现5日均线首次上穿30线后缩量回调,并在30日均线上方出现5日10日金叉的选股条件:

MA5:=MA(CLOSE,5);

MA10:=MA(CLOSE,10);

MA30:=MA(CLOSE,30);

VOL_MA5:=MA(VOL,5);

// 条件1:5日均线首次上穿30日均线

FIRST_CROSS:=CROSS(MA5,MA30) AND COUNT(CROSS(MA5,MA30),20)=1;

// 条件2:缩量回调(成交量低于5日均量线的80%)

VOL_RETREAT:=VOL<VOL_MA5*0.8;

// 条件3:在30日均线上方出现5日10日金叉

GOLD_CROSS:=CROSS(MA5,MA10) AND MA5>MA30 AND MA10>MA30;

// 综合条件:首次上穿后出现缩量回调,然后金叉

BUY_SIGNAL:REF(FIRST_CROSS,5) AND COUNT(VOL_RETREAT,BARSLAST(FIRST_CROSS))>=1 AND GOLD_CROSS;这个指标包含三个主要条件:5日均线首次上穿30日均线、缩量回调(成交量低于5日均量线80%)、在30日均线上方出现5日10日金叉。使用时可以调整参数优化信号。

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0V3ozSjJUMWtNMEdnakFFWHhHMk1vMnF2U0NibHYvSEpadlo5dUR3M01RcEgvRFRzL2JVMUthTEtoZHU4eHhPZmxjbmZjYVZhNGs2L25FL1JTalNiSUpTV1lzVFkraU1mUWE3bG8rTDVDR2daYWZJaTlzVnpXbGtmNXIwaVIzQ3hIU0ZOQ1QrTWJTNGcxL3VnRlF3ck1qMVlXWlluUFNQOHNlME13SFcxZ0RoaU1UN3Z4UTl1VGJYL2dnVVFDL1hKeWl5cTRBSnNRVjc1S3dKZzdjS1BrcWdZYkVTd21xRjVRQTJFNjllZGJMWFpRRkZubkFFWjBwbEVUbG5waDhuQUp5MWFNQy9jcUZqU3NVUTBHbEdoc0Fnb3NtY1BxdXQzczl2ZWl4YkVOSjlFNkFBQVlmdlhDWFBPWnMyVDdYb0pHZkhKdlZwN0t3S1lpM2FaYXk5amp1clFxeGRNUkkvT0t1bExiRnBML0MxM3ovU0lBTWd2Q0VjR2xkdk16QmxGbzdPbnRSYk0yQVRpY2lETERBZlc0UllCcDNETktVNUI0UFkzTkhtdHR6ZDJkUDhYdUtZRCszNmpnZG8wUXZIRFR0enZGWkJrenRTRzNBSVBtdHBUWnNKLzkxdlB4WktRUDlqNkttRVhyQ0NaZDkrM2tEWmZiUzhMY3ZvbDJzQXk0RnVqdzJ3STV5Zy9jVTBiVFF4Y2dPWHMya1dCd2pESmZuNnZwSWEvOUZ5ZnFIczRMRnM3TThKNk4xRmJsNmVHU1BoNk0wdnl2SmswbTBQTkVHTWIweGtuY2txa0tWYUVQL2V6Qy9jQWJ0bG55cXZXQjVjdmNFMGNRVGVMNVJITHQzQmRvM0V3eDgwcFRRS2U4bkExM2N4L0VWVHBLSURsMnQvckdZMkNVbEZOeUgySXBuSWJXWlZ4NllZVng3UWU0OGhUZDhYZDVCekdEeDBETnZIVncrTjJYWWdDejgvcm1CWUdMYThFbXlqZDVuMlBmOWNTQXFNTkFCRXIrbGF2QUFMRnQ5TkpVOTBkNGxwTG5NV1pUUjdBZFVMTFZ5UmtUbllWU1BYakF4ZkhIcjNrNFhKc0FWVUpQcUNxSEJiVVI4WFREbjhPKzUzTDRZVlZpNjV4RG8rNjdONm5aaWxCTCtQYjhyNjdpYlU1SWVSTk5UTXBBeDFCYW0reVVQWEorblRpakROMzhJOXI3SWd2UmZSeXg4M3g0d0puNDM2QkZnd0lxYm93ZkVmN1B4YWsvb1JONHkxc0dMczNQRXJJRXZBZzRaZC9XbTZmTUZGV0s5b1hac2hQMFk2ZDhXSzFSYTFlQUhuOEJrNGNmTWI2T3hPZTQzV250c0VCUjkvSmNXWGdHTXdVZlltb1VxaTcwTlVZS00yUjRYcVRiM1laVHpJalBiNEE3UFR6TjhLR3l6QVpvOXE3UXJla3VnRmxRZWtvTnBqa1FYR2o5bjZTZTJKYUZmSGhpRUxwLzBuREpEbVBsSkh0dDRKMnJZQWtUeGd3aklvTThGa1JPZ0wyQ1l4cGcrNmk5c2F5WHRzYzVJNk1DclJnZC9BUnZiOHJGSjBWUm5xMmh0QlJEZ0tUdHZjWFVHdjlXcWp6UlhwTjBzSGwva29mK3A3eTZKcytJWlFsL0h3dUhjSzc1cHo3aFJyN2hNT09CRFZZVS9lVVVKRWcwU3pKUUIrajJFNHFGa25UaEYrK25lNm9rL3JpRXpNbm5QSWRHZy8vcnAycmM0My92R0kwZnFRUmhWMUhVVkVqMnRJTHBkY1NsRk40QlJBd1FlYThjNDBhVkc2aXBycDVPbUpXYzBINHFoUnlPRDhtS1I5TlpndzVGeFJ2dW5RZVRXL1Y4Z2FERHNhUU9xU0VCVVFvWDF3cXgzU28zNG5hT0s4QThPdjZoTGh3bFN2SXFPRVN0djhPbENPNms5VEswdzN1bWVuUkxFaFZnbDQ0a3E3cHBLcE5zaWFyeEY3cWdqVkpOY1ZpY3FPak5EQm5LMVg1TktlYTBJSmxMay9lbWxpQTVoK3ZLMHBQYTFIb01xajM0eUQvRUIxTENkekVWK3lsUmdoeitVY3VXQ3BpbHNoSnRDQ3BKckpZL0RiaDNUZFlaTU9ueEJJSU5xV1RoeCtvMWsyczd1L1JrcEpVcitlYUdRa1lVQ2VEd0ZmUHIxSWU5L1dLaGlyODdLRWtLeXZxUE5Hck82L2EvSjFxNFd3cG9zL2hJUkJDN1I3blNUcVFPV2JzZ0dJVEk5Qnc2SGJLQkExQ1J6a3V1cWlVUE9nUkp4RjVXblVqSkFnSkYycUNjQktxR3R0YXB1Y08xLzY1TndzQjF0eWdxUnVVbUxNL0ErRU51UjFzYWx1Qkd1bnl0TEdKcDZhTG5pa3c3dVdabFVpV2pqU1JvRXJYVjhPRFFwNmJkVkFIUW5HLzlnUWVvaDF4cXN0aTdiTmJNTmR6aWMzWW16azU3WlFHS25Mc0R0azdneFhNK0gwNjVBZHdjNHpVZXlEZU11K01GcmpRaThuVXY2TXNmZkROMTRFVHhPazZva3IyWDFXTDl2SzRBN0xNYzJQQWFpOGc1VTJ6eXZFbHc0RSt3SHZZOVFjVHhlSHdKT3AxR2pwSTJwVUgwTmJENFFSUVJrVnJ4U2k3WlROZ2FvT0t0SmZ3KzZTVm4yRU5abVpuMGxaUzdCdDJMRWNxU09VV2w3MjI5VHZGVUQycmN2MmVqNHBsc3NaOENsSXZrdFEvbkFUWUQ4d045ZS9xdldoMEliaUp1bHp3aUdDL2FxOTAyQUhZUXd0dHJsQ3N5V2ZueTUwckFvbWI2WDB5N05lODRNU1cvSWlIS24rZit5TUk5Y0JvZHZ5cUYyeEx1L01JanBBWnBUVjlPVWwzZjRNWkU2MmR0UVNHWWJqSVpqdUhsYUlPaFBreTRHc3lXbHBjSFJsRVRjQ2pCSEV4V2o3c0phOGVFelRTdUMvWmN3Q2ZTSmh5NzNRVE9MUlViRWgwSzRIenFRS2RQNDFiZHA4YjhLNnVMQ0wwU1BGVnN4enZXSXRBODNmT094VXBrdkFMcHh6M1pmSFNiZEhyNTczSld1ZEF5bE1pM0IzanZSUGNQdTZVWWhRYVdPVkxFcFpZMTlCOXNHanR4NW95SlhGZmY0T3RteXZyYkdJSWllUHlJOWw2M1RRQm90N2FIeHllcE1EY3E4bmg2Z0Y4RW92NXdjQUtkUFJ4dGtiSnNWekhhSUozR1lnb0EvaUdQejZ2QVdXUDUrYnB1YzhVZTl3NHJpUnVWdG82aDNiVHBBbGJ2cG9ZTGM1UnIwdlRoSVRGajJWSGxwMlBNTktmUFdPa2VxdS9nUis0ejRNYXhWRlhaSy82SHpzMmM2RHpicTJRVk9DMlNCMktPUWJhSThsRmtTdmtpTmJmd1N3ZzB4Si9XQjJueHdLK2tGMlBWeUNNWkh2WjlzUXBOWEVUcGhiZ3BETzl6WXpEdDZqZzNXZXFRZjZpeEREN1cwZkhVdGF4czZPd283ZUJZVGdpSG10aS9obHl4WjJLMGczNDN0N0IrZnZBdHY4b21PZTRucTR4amJQblZ4eGE4NGNDYmNuS3ZjcmdrT1h0U0lIeWxxWEpoQTk1ZjV5Rm8wekNuWFIzTjhtSXNxMDljUDlhRGw3cVNlQUxnYUJHTTd0aVVULzVMb013b2FOVUluSHFWTW8xL21NUDhyYkUwaU5nOUVXcTBRbnVCQk9HcmVkaGRWZUtzcThzaDd6N2ZTcGRMQkVob1hHMmZ5dFk1Y3FOL0JybVJJK0FWUFdLSzk4TFdiNFFLRGIvTEI0UmdvNm56YXBIQjQrT3hlWlllQnZEQWtRdGlES1Q3R2pLMDQ3NHVLbC9DVWk2YWhSek94SA==

RVdTOUtDenh1c1RzcTJZc216SUM0V3ozSjJUMWtNMEdnakFFWHhHMk1vMnF2U0NibHYvSEpadlo5dUR3M01RcEgvRFRzL2JVMUthTEtoZHU4eHhPZmxjbmZjYVZhNGs2L25FL1JTalNiSUpTV1lzVFkraU1mUWE3bG8rTDVDR2daYWZJaTlzVnpXbGtmNXIwaVIzQ3hIU0ZOQ1QrTWJTNGcxL3VnRlF3ck1qMVlXWlluUFNQOHNlME13SFcxZ0RoaU1UN3Z4UTl1VGJYL2dnVVFDL1hKeWl5cTRBSnNRVjc1S3dKZzdjS1BrcWdZYkVTd21xRjVRQTJFNjllZGJMWFpRRkZubkFFWjBwbEVUbG5waDhuQUp5MWFNQy9jcUZqU3NVUTBHbEdoc0Fnb3NtY1BxdXQzczl2ZWl4YkVOSjlFNkFBQVlmdlhDWFBPWnMyVDdYb0pHZkhKdlZwN0t3S1lpM2FaYXk5amp1clFxeGRNUkkvT0t1bExiRnBML0MxM3ovU0lBTWd2Q0VjR2xkdk16QmxGbzdPbnRSYk0yQVRpY2lETERBZlc0UllCcDNETktVNUI0UFkzTkhtdHR6ZDJkUDhYdUtZRCszNmpnZG8wUXZIRFR0enZGWkJrenRTRzNBSVBtdHBUWnNKLzkxdlB4WktRUDlqNkttRVhyQ0NaZDkrM2tEWmZiUzhMY3ZvbDJzQXk0RnVqdzJ3STV5Zy9jVTBiVFF4Y2dPWHMya1dCd2pESmZuNnZwSWEvOUZ5ZnFIczRMRnM3TThKNk4xRmJsNmVHU1BoNk0wdnl2SmswbTBQTkVHTWIweGtuY2txa0tWYUVQL2V6Qy9jQWJ0bG55cXZXQjVjdmNFMGNRVGVMNVJITHQzQmRvM0V3eDgwcFRRS2U4bkExM2N4L0VWVHBLSURsMnQvckdZMkNVbEZOeUgySXBuSWJXWlZ4NllZVng3UWU0OGhUZDhYZDVCekdEeDBETnZIVncrTjJYWWdDejgvcm1CWUdMYThFbXlqZDVuMlBmOWNTQXFNTkFCRXIrbGF2QUFMRnQ5TkpVOTBkNGxwTG5NV1pUUjdBZFVMTFZ5UmtUbllWU1BYakF4ZkhIcjNrNFhKc0FWVUpQcUNxSEJiVVI4WFREbjhPKzUzTDRZVlZpNjV4RG8rNjdONm5aaWxCTCtQYjhyNjdpYlU1SWVSTk5UTXBBeDFCYW0reVVQWEorblRpakROMzhJOXI3SWd2UmZSeXg4M3g0d0puNDM2QkZnd0lxYm93ZkVmN1B4YWsvb1JONHkxc0dMczNQRXJJRXZBZzRaZC9XbTZmTUZGV0s5b1hac2hQMFk2ZDhXSzFSYTFlQUhuOEJrNGNmTWI2T3hPZTQzV250c0VCUjkvSmNXWGdHTXdVZlltb1VxaTcwTlVZS00yUjRYcVRiM1laVHpJalBiNEE3UFR6TjhLR3l6QVpvOXE3UXJla3VnRmxRZWtvTnBqa1FYR2o5bjZTZTJKYUZmSGhpRUxwLzBuREpEbVBsSkh0dDRKMnJZQWtUeGd3aklvTThGa1JPZ0wyQ1l4cGcrNmk5c2F5WHRzYzVJNk1DclJnZC9BUnZiOHJGSjBWUm5xMmh0QlJEZ0tUdHZjWFVHdjlXcWp6UlhwTjBzSGwva29mK3A3eTZKcytJWlFsL0h3dUhjSzc1cHo3aFJyN2hNT09CRFZZVS9lVVVKRWcwU3pKUUIrajJFNHFGa25UaEYrK25lNm9rL3JpRXpNbm5QSWRHZy8vcnAycmM0My92R0kwZnFRUmhWMUhVVkVqMnRJTHBkY1NsRk40QlJBd1FlYThjNDBhVkc2aXBycDVPbUpXYzBINHFoUnlPRDhtS1I5TlpndzVGeFJ2dW5RZVRXL1Y4Z2FERHNhUU9xU0VCVVFvWDF3cXgzU28zNG5hT0s4QThPdjZoTGh3bFN2SXFPRVN0djhPbENPNms5VEswdzN1bWVuUkxFaFZnbDQ0a3E3cHBLcE5zaWFyeEY3cWdqVkpOY1ZpY3FPak5EQm5LMVg1TktlYTBJSmxMay9lbWxpQTVoK3ZLMHBQYTFIb01xajM0eUQvRUIxTENkekVWK3lsUmdoeitVY3VXQ3BpbHNoSnRDQ3BKckpZL0RiaDNUZFlaTU9ueEJJSU5xV1RoeCtvMWsyczd1L1JrcEpVcitlYUdRa1lVQ2VEd0ZmUHIxSWU5L1dLaGlyODdLRWtLeXZxUE5Hck82L2EvSjFxNFd3cG9zL2hJUkJDN1I3blNUcVFPV2JzZ0dJVEk5Qnc2SGJLQkExQ1J6a3V1cWlVUE9nUkp4RjVXblVqSkFnSkYycUNjQktxR3R0YXB1Y08xLzY1TndzQjF0eWdxUnVVbUxNL0ErRU51UjFzYWx1Qkd1bnl0TEdKcDZhTG5pa3c3dVdabFVpV2pqU1JvRXJYVjhPRFFwNmJkVkFIUW5HLzlnUWVvaDF4cXN0aTdiTmJNTmR6aWMzWW16azU3WlFHS25Mc0R0azdneFhNK0gwNjVBZHdjNHpVZXlEZU11K01GcmpRaThuVXY2TXNmZkROMTRFVHhPazZva3IyWDFXTDl2SzRBN0xNYzJQQWFpOGc1VTJ6eXZFbHc0RSt3SHZZOVFjVHhlSHdKT3AxR2pwSTJwVUgwTmJENFFSUVJrVnJ4U2k3WlROZ2FvT0t0SmZ3KzZTVm4yRU5abVpuMGxaUzdCdDJMRWNxU09VV2w3MjI5VHZGVUQycmN2MmVqNHBsc3NaOENsSXZrdFEvbkFUWUQ4d045ZS9xdldoMEliaUp1bHp3aUdDL2FxOTAyQUhZUXd0dHJsQ3N5V2ZueTUwckFvbWI2WDB5N05lODRNU1cvSWlIS24rZit5TUk5Y0JvZHZ5cUYyeEx1L01JanBBWnBUVjlPVWwzZjRNWkU2MmR0UVNHWWJqSVpqdUhsYUlPaFBreTRHc3lXbHBjSFJsRVRjQ2pCSEV4V2o3c0phOGVFelRTdUMvWmN3Q2ZTSmh5NzNRVE9MUlViRWgwSzRIenFRS2RQNDFiZHA4YjhLNnVMQ0wwU1BGVnN4enZXSXRBODNmT094VXBrdkFMcHh6M1pmSFNiZEhyNTczSld1ZEF5bE1pM0IzanZSUGNQdTZVWWhRYVdPVkxFcFpZMTlCOXNHanR4NW95SlhGZmY0T3RteXZyYkdJSWllUHlJOWw2M1RRQm90N2FIeHllcE1EY3E4bmg2Z0Y4RW92NXdjQUtkUFJ4dGtiSnNWekhhSUozR1lnb0EvaUdQejZ2QVdXUDUrYnB1YzhVZTl3NHJpUnVWdG82aDNiVHBBbGJ2cG9ZTGM1UnIwdlRoSVRGajJWSGxwMlBNTktmUFdPa2VxdS9nUis0ejRNYXhWRlhaSy82SHpzMmM2RHpicTJRVk9DMlNCMktPUWJhSThsRmtTdmtpTmJmd1N3ZzB4Si9XQjJueHdLK2tGMlBWeUNNWkh2WjlzUXBOWEVUcGhiZ3BETzl6WXpEdDZqZzNXZXFRZjZpeEREN1cwZkhVdGF4czZPd283ZUJZVGdpSG10aS9obHl4WjJLMGczNDN0N0IrZnZBdHY4b21PZTRucTR4amJQblZ4eGE4NGNDYmNuS3ZjcmdrT1h0U0lIeWxxWEpoQTk1ZjV5Rm8wekNuWFIzTjhtSXNxMDljUDlhRGw3cVNlQUxnYUJHTTd0aVVULzVMb013b2FOVUluSHFWTW8xL21NUDhyYkUwaU5nOUVXcTBRbnVCQk9HcmVkaGRWZUtzcThzaDd6N2ZTcGRMQkVob1hHMmZ5dFk1Y3FOL0JybVJJK0FWUFdLSzk4TFdiNFFLRGIvTEI0UmdvNm56YXBIQjQrT3hlWlllQnZEQWtRdGlES1Q3R2pLMDQ3NHVLbC9DVWk2YWhSek94SA==

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容