温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

编写条件:

昨日阴线今日涨停反包的选股公式。

编写方法:

XG:REF(C=ZTPRICE(REF(C,1),0.1);

其他写法:

以下是一个适用于通达信软件的选股公式,用于筛选昨日收阴线、今日涨停且反包昨日最高价的股票。公式已排除ST/*ST股票,并自动识别主板(10%涨停)、创业板/科创板(20%涨停):

{ 昨日阴线今日涨停反包选股公式 }

ST过滤: NOT(NAMELIKE('ST')) AND NOT(NAMELIKE('*ST')); { 排除ST股 }

昨日阴线: REF(CLOSE < OPEN, 1); { 昨日收阴线 }

涨停幅度:=IF(CODELIKE('688') OR CODELIKE('30'), 0.2, 0.1); { 688科创板/30创业板=20%,其他10% }

涨停价:=ZTPRICE(REF(CLOSE,1), 涨停幅度); { 计算动态涨停价 }

今日涨停:=C >= 涨停价; { 今日达到涨停价 }

反包条件:=C > REF(H, 1); { 今日收盘价超过昨日最高价 }

选股条件: ST过滤 AND 昨日阴线 AND 今日涨停 AND 反包条件;### 公式说明:

1. **ST过滤**:排除名称含”ST”或”*ST”的股票

2. **昨日阴线**:昨日收盘价低于开盘价

3. **涨停识别**:

– 科创板(688开头)/创业板(30开头):20%涨停

– 其他股票:10%涨停

4. **反包条件**:今日收盘价突破昨日最高价

### 使用提示:

1. 在通达信中新建条件选股公式,复制粘贴全部代码

2. 建议盘中或盘后执行选股

3. 可搭配量能或均线系统进一步优化

> 注意:该公式仅识别价格行为,实际交易中建议结合成交量、市场环境等因素综合判断。创业板/科创板因波动较大需特别注意风险控制。

如果需要加入成交量放大条件(例如今日成交量大于昨日),可在代码末行前添加:`AND V > REF(V,1)`

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0Y0FKbUQ5V1Bsd3I2dnZkYUFud2ZSTGo2QnFFRUFLS29JbWI3YlRJdnBST2RSNGU3L3ZqeENRWXJGWDhUQjc4dXdjTGlQaEF4Nnh1VFZ5YXBoaTRweDhQUCtOSk52YlNTTHhpLytGaENhY2tZNG9RTDh6eDZ6RjNtQi9HTW9wSkpyYlIvWlh2bnhBN0pSQXUvSkpkYWYzZVRKN0ZFQXh2aGdHdUYzWHlTS2ZZWkpwUFBqSVExR1V1VkZZdDFXMXo5UjFCVUJYcUZKeUZ3R2VmcW5iVUJTSjZlZTdvQ3dRc3NnYkpOOWpYMnJNVU9QL3hKRU9LK1BzbVRYV2F5ZzJUZTl1ZkhkelcrdnhKVTFKeEVBZ1FKaEZlZWIzM2xKcG96Y2lZc2ZRTHExOEZUWDZmZjVDOS9NRWdCbDJoTDVNSXUrNjdqMlZWR2ZBOXB2L0dvQlFtdmZtRk9IY1dOSnluN09IK1EyREZDNVF6OWQ4enVTcHpVVytvY3BCTkM3dWRldjN2S3oyR0FuVzJ4aUlGQm1ZYjk4TDJUMENlbWovRDBkQUk2Z2ZMNks0RXlEaFVLK0NpeHA1ZnVGSTVUd3FWYTZkM3A5blA3KzJaSzhwdXVmSURYUWJXWTl6MTZzT0N0bFFacUY3OXQwdjc4c0Y5V3VyTlIvN254UklKMnZHMWxqRk8vb3lkVFRib3A5QVV1RTFzaU5hVTlKemJ6QWU5Q1YzMWMreGpvbVNtTzRxWlczaHlzRDMyaFBKcFk2ZG44aWJSNkFXNUh4SE9QNjkvT0xSWmFDN0FjTkxGbnQ3UE9lTit4cDZGTzVhM05UZ2htMS9POTBZMHh5Q0I0VzVITEFiYjRJRnBQYUk0VGdwWTViL3MwblZ0TVFTOVFveXdyc1dzYjkwdmJGcERESEF3N2FTR2pBU2hueGZoREpaR0sxNlZsd2ZQendkeUhubmViWTRlUmpMK3lMVjNHc25IZkpiMk9sKzk2ekJpV0dKa1dwMGFUZ3dnaWd1RmZDZ0phaFozbmRvSVFwNTlPMm9xVFV5d0o3aUJKUXEwQTVuYzJoZlVMQUU5RlpkZG9OVkVqTFhEZGRMRGJhS0pVYTZaTHAra2dRNk9Vak03emdpdStIbE90SGcyc3djbjZGenZpcUZ6OHBEdEwyai9hNmFDalBwTWhta21haWx4YXNZSmV5aGM1bm1INEZ5UEFwS2ROWWpkU1RMZnNodnA5SkdCN2Q5a1pzbTJOOGFqcjcxWENEb3RrOVl4VGxldEhIM0d0R2h4NC9GNWtYdWtva0NlQ3dhRHlGU0tsV25hQ0t1Q010UXRzbGJBM0pKcU4yRnZRV2UwWE9GRmhEL3dYR01SWnZET0FwQnpNWDQxODgrZGJzOTF4b25OcEI4bTErMHMxb2dYcTBhWVdYY1ZPVWxvTTNTUUZtaGlueUtPR2o5Lzh5TFMvWEM2VkNRMEdZTnZNQ01VVVhDZEtWcDBDazZ6Y0RLTG1SWjNONTVnclB6dG11WDdBdTVPRFg0dE11SDdYRDE4UG1hVWFyUnpxbzhBdGxyMlYrd0kwaHZLNkJwb1M1c0wvRTBIb2kwSGduNlc2V05Ja1JxaitNd1I3K0paUHNBQTVRSlM5SEkydlhuUHVWaERwTmZ3SlIyb3hBTHZjT0Mrc0l4TmJsSXlTZ3c4NnlCOVFlT3pmR2djRHFRWTV2Q3pGeFhCS0ZXZHoxUXk3RmREUlRLZGgyMVJaNTVjU0NmVHBUMDZsZDVwcmxBMVIrcTF0V0kvT2ZmTERnelFrdWJFQ1d4L2NMYjFDcFF4WkIvcElXc2pZZ2I4YlNiZFZ0NFVxdWJ0S3dsTXlQU3R0ekp1TmIwNFFFQThoaE43QmprVThqRzR1eVZuelhiZkltY1ovaUsrWjZuUkxaQ2J1MU01Q0VpSXRnSGpJTFlrZ0wxTjRaRmdUY1RVZHZsTnRMZStsVkZ5cXU3TkNlYTFOTnVxcUc3RGloTnpRZVRRY1hnR2RmRkxjdkR0RVY0WEp1d0FpYzhwTW1YYy9ZNElxbDE5YlZITDdQOU9rbnF2TzVWVUNYN1AyNHVzSmNtSTgvSTlMSTRkYWRZNEVhWC9ZU1VJTVRyRGlybUJldzc3eWErSWdHM1oxcUlTd3R0SnRkZW4vSFI5cHhhenoyUjA3bkRIeXNKdVcyWU0xakYrRXFUekRsRms5aGFpVG51Y2c3Tm1aRU5zWWFNT2c3RGc2VDBDVW5HZmZEdXc4VjdINnZSZzVVcTJkN0RYVzVTUmw2ZXpQTUNxQkNlQmpaNlJWbEplZnk5VU1PNWsvOEE1MHQyc3Fwcm1DVThQem9FNVRjUUJFY002QndCQTlxaWU0TGRlbnAyVVJETUtLcmNLanRaUGZyS215b3gyRGordld6OFZkVS9oRm83c3ZWVUFlTHJuSkhxTnh2UFhnLzM1TzhoM3dZVUpIQThRdTFpNHZpR1ZrdUlEZlJvVG42K0lQdWgvLzV1WDRmSk5EZTRyMURmRVZ3bEFjVkZHOXkvOTJWSlhQRXgxL2V3NlNITFlKK2t3dlNjM1lLMHRnOHBKNDhqUklQVkFMdGNXdXJlMU1ranU3TXFzUUQ5WTBqcU5RaDRWclZselI2YlJnazNsaHdlZVhJbnZUdWZkY1ZIZDNzbDdxRkVnNGVQM1Z2NDhGMnUxcW0raFhBdjNPNm1UOFgvb3M3c0xRNVJNTVNTVXhPLzZjN2xxTUtyNHVLTllLdFVFMlk4TEp1VzNobFdQQUhWL1E4VDFzek1RV3psSXFQdEErSHl1T0ptMVc4V2lNWEd1ZkR0VFhDY3VCbmVDSm1mZkhJOFYzdTh2V3E3RGduaXNSWVZUN0Y3aWhOL3cvWnNaWFM5cHRNdDRwc3IvSXp3cU5DQVg0K2pNL2NWVlUvaWdhODVxVmJ6U1ZVNW1sbExmWmpCQTZFcXNrcmNUaWRtL3pJaTBBSHZmcDQ1MnJOQXdnY3hGZWZkcFk1ekF2ZWhPbHJxMkdQMTEwVU5UY0UvVkJNV2FIdkpORnBsdEpSeDVaM3R3aW9md0llKzN6ZDVBSzZFNTJjUThNcVlZS0UwVGIrVXdiWnAvb3RCNjFvUXdnY3RnbWtab3pGVnhHVzY2TWRueVQrZk1KcW5RMDByYmpNdlV2dmNFNnp1ZGk5SmFHQ2dEQ2x6TENKNTlxVWlzRHlHdm00MFJOc0hSNG94UFcwcE1DU1VBR3NkVlhkeXdCZkpuM0NxN2dlcmJJeUJkbGZoTXdaaTVmSGVpZk9IdmMvNzlBVEZBVmU3S3FGMTc4SHBzZTlkS3lETWpDdmRPcVM3TU1JMEJrZC96c1lsZVlYWUdFbkd4RlJpdGdCeStmU3c4Ti94cStPYVpHSUdVcldNYU5kRFBwdklPbUFzcy82anhtYVZpaW00UGRCd2xZNDczaFdIYzFCSnRpL01XMjQrUjdPWU5jY2pYUElWeHpPY1k4eWw2U25GTGYra3ZWMExtMHpNL1lhbEhkTkt6NmZKODJrdU9xNGZDcDFScjk1azJXRE00N2NVNTY5cW1MUmZXZnFWaUFJVUNYa3lTa3d4WjNlODVnMUU2K1NtT09ha25RV29yc1RkeE5vY0QrN0ZUaEdZdG05dnVvL0IvbGNscklKZUlHMEwxQ2lreE1sSjg3bHFLYUc2amNVWW42bkVzVHZobEMya29CM0VPNmxpdXVzbTczS0piV05wcjNCK3NGaDBqRGJxQ2paQ3RrRzMvVEN2NVROaVNkUGVXbWVpYUJSTHVKYjA2a2szOXVvYmZFM0RzV1V0Yitxem5nRFFlTk50b1o3Ti9wUUZpOEV2RVpUZnNkZ0llOFRKRkppVng4WDQ2Q2Z3RnlLOTQ1L0lDeWVHMFp4TlgzK0pVU001TzBGTWJycXBrUEtHcUl5ZTFKOTkrNE4yVlZWTi94MDVxejd6ams2Szc1aEJOOVREWllpY1U1VFhOOTJzOEcwMUhsREFqZ1RPOUtLL3dwYXdrbVRidmswdStIWnVtZk1wVXNoVjNVOE4rUVJPdGpTMndHZ3lWQUsvU2l3d2tVblV3M3RMK1pEZUxFQitveXRtUlpUdnpIUGZ5NkQ4aGJIS05NTmpWWGRuSmhFSW0xell0aTVTNTAyYjk4SEFML3oxVDNuNEM3TFQvbTFYY2lVU2MvQ3lYbW94dTFaUFNrUi92OVN2eGlZNVc5VGE4SUl2VVV5WEtHQVJTWmw4N3hHZ21TVlFnYktWeFNHOHVpbXM5OXlRcG1CdDdqaHJXOFpXVDZVd2hYdjduOTM2YVNPMVJSMWtYUU5ycWNobE5CSUdad1cyMkZmMTYxVVN4YlBNS00wSjVjZ01lZXNRbmdoYnU2Vk5sQjVjTU1CNEcxb0VqNitvS1dSOEFSTU5idkpKU0FQOGRFT1Q3emRCd0JQWWZiSGUvQUEwUkQvbkN6Rk8rRlFaU3cwdTRPK2Era1ZQd3VvUnI=

RVdTOUtDenh1c1RzcTJZc216SUM0Y0FKbUQ5V1Bsd3I2dnZkYUFud2ZSTGo2QnFFRUFLS29JbWI3YlRJdnBST2RSNGU3L3ZqeENRWXJGWDhUQjc4dXdjTGlQaEF4Nnh1VFZ5YXBoaTRweDhQUCtOSk52YlNTTHhpLytGaENhY2tZNG9RTDh6eDZ6RjNtQi9HTW9wSkpyYlIvWlh2bnhBN0pSQXUvSkpkYWYzZVRKN0ZFQXh2aGdHdUYzWHlTS2ZZWkpwUFBqSVExR1V1VkZZdDFXMXo5UjFCVUJYcUZKeUZ3R2VmcW5iVUJTSjZlZTdvQ3dRc3NnYkpOOWpYMnJNVU9QL3hKRU9LK1BzbVRYV2F5ZzJUZTl1ZkhkelcrdnhKVTFKeEVBZ1FKaEZlZWIzM2xKcG96Y2lZc2ZRTHExOEZUWDZmZjVDOS9NRWdCbDJoTDVNSXUrNjdqMlZWR2ZBOXB2L0dvQlFtdmZtRk9IY1dOSnluN09IK1EyREZDNVF6OWQ4enVTcHpVVytvY3BCTkM3dWRldjN2S3oyR0FuVzJ4aUlGQm1ZYjk4TDJUMENlbWovRDBkQUk2Z2ZMNks0RXlEaFVLK0NpeHA1ZnVGSTVUd3FWYTZkM3A5blA3KzJaSzhwdXVmSURYUWJXWTl6MTZzT0N0bFFacUY3OXQwdjc4c0Y5V3VyTlIvN254UklKMnZHMWxqRk8vb3lkVFRib3A5QVV1RTFzaU5hVTlKemJ6QWU5Q1YzMWMreGpvbVNtTzRxWlczaHlzRDMyaFBKcFk2ZG44aWJSNkFXNUh4SE9QNjkvT0xSWmFDN0FjTkxGbnQ3UE9lTit4cDZGTzVhM05UZ2htMS9POTBZMHh5Q0I0VzVITEFiYjRJRnBQYUk0VGdwWTViL3MwblZ0TVFTOVFveXdyc1dzYjkwdmJGcERESEF3N2FTR2pBU2hueGZoREpaR0sxNlZsd2ZQendkeUhubmViWTRlUmpMK3lMVjNHc25IZkpiMk9sKzk2ekJpV0dKa1dwMGFUZ3dnaWd1RmZDZ0phaFozbmRvSVFwNTlPMm9xVFV5d0o3aUJKUXEwQTVuYzJoZlVMQUU5RlpkZG9OVkVqTFhEZGRMRGJhS0pVYTZaTHAra2dRNk9Vak03emdpdStIbE90SGcyc3djbjZGenZpcUZ6OHBEdEwyai9hNmFDalBwTWhta21haWx4YXNZSmV5aGM1bm1INEZ5UEFwS2ROWWpkU1RMZnNodnA5SkdCN2Q5a1pzbTJOOGFqcjcxWENEb3RrOVl4VGxldEhIM0d0R2h4NC9GNWtYdWtva0NlQ3dhRHlGU0tsV25hQ0t1Q010UXRzbGJBM0pKcU4yRnZRV2UwWE9GRmhEL3dYR01SWnZET0FwQnpNWDQxODgrZGJzOTF4b25OcEI4bTErMHMxb2dYcTBhWVdYY1ZPVWxvTTNTUUZtaGlueUtPR2o5Lzh5TFMvWEM2VkNRMEdZTnZNQ01VVVhDZEtWcDBDazZ6Y0RLTG1SWjNONTVnclB6dG11WDdBdTVPRFg0dE11SDdYRDE4UG1hVWFyUnpxbzhBdGxyMlYrd0kwaHZLNkJwb1M1c0wvRTBIb2kwSGduNlc2V05Ja1JxaitNd1I3K0paUHNBQTVRSlM5SEkydlhuUHVWaERwTmZ3SlIyb3hBTHZjT0Mrc0l4TmJsSXlTZ3c4NnlCOVFlT3pmR2djRHFRWTV2Q3pGeFhCS0ZXZHoxUXk3RmREUlRLZGgyMVJaNTVjU0NmVHBUMDZsZDVwcmxBMVIrcTF0V0kvT2ZmTERnelFrdWJFQ1d4L2NMYjFDcFF4WkIvcElXc2pZZ2I4YlNiZFZ0NFVxdWJ0S3dsTXlQU3R0ekp1TmIwNFFFQThoaE43QmprVThqRzR1eVZuelhiZkltY1ovaUsrWjZuUkxaQ2J1MU01Q0VpSXRnSGpJTFlrZ0wxTjRaRmdUY1RVZHZsTnRMZStsVkZ5cXU3TkNlYTFOTnVxcUc3RGloTnpRZVRRY1hnR2RmRkxjdkR0RVY0WEp1d0FpYzhwTW1YYy9ZNElxbDE5YlZITDdQOU9rbnF2TzVWVUNYN1AyNHVzSmNtSTgvSTlMSTRkYWRZNEVhWC9ZU1VJTVRyRGlybUJldzc3eWErSWdHM1oxcUlTd3R0SnRkZW4vSFI5cHhhenoyUjA3bkRIeXNKdVcyWU0xakYrRXFUekRsRms5aGFpVG51Y2c3Tm1aRU5zWWFNT2c3RGc2VDBDVW5HZmZEdXc4VjdINnZSZzVVcTJkN0RYVzVTUmw2ZXpQTUNxQkNlQmpaNlJWbEplZnk5VU1PNWsvOEE1MHQyc3Fwcm1DVThQem9FNVRjUUJFY002QndCQTlxaWU0TGRlbnAyVVJETUtLcmNLanRaUGZyS215b3gyRGordld6OFZkVS9oRm83c3ZWVUFlTHJuSkhxTnh2UFhnLzM1TzhoM3dZVUpIQThRdTFpNHZpR1ZrdUlEZlJvVG42K0lQdWgvLzV1WDRmSk5EZTRyMURmRVZ3bEFjVkZHOXkvOTJWSlhQRXgxL2V3NlNITFlKK2t3dlNjM1lLMHRnOHBKNDhqUklQVkFMdGNXdXJlMU1ranU3TXFzUUQ5WTBqcU5RaDRWclZselI2YlJnazNsaHdlZVhJbnZUdWZkY1ZIZDNzbDdxRkVnNGVQM1Z2NDhGMnUxcW0raFhBdjNPNm1UOFgvb3M3c0xRNVJNTVNTVXhPLzZjN2xxTUtyNHVLTllLdFVFMlk4TEp1VzNobFdQQUhWL1E4VDFzek1RV3psSXFQdEErSHl1T0ptMVc4V2lNWEd1ZkR0VFhDY3VCbmVDSm1mZkhJOFYzdTh2V3E3RGduaXNSWVZUN0Y3aWhOL3cvWnNaWFM5cHRNdDRwc3IvSXp3cU5DQVg0K2pNL2NWVlUvaWdhODVxVmJ6U1ZVNW1sbExmWmpCQTZFcXNrcmNUaWRtL3pJaTBBSHZmcDQ1MnJOQXdnY3hGZWZkcFk1ekF2ZWhPbHJxMkdQMTEwVU5UY0UvVkJNV2FIdkpORnBsdEpSeDVaM3R3aW9md0llKzN6ZDVBSzZFNTJjUThNcVlZS0UwVGIrVXdiWnAvb3RCNjFvUXdnY3RnbWtab3pGVnhHVzY2TWRueVQrZk1KcW5RMDByYmpNdlV2dmNFNnp1ZGk5SmFHQ2dEQ2x6TENKNTlxVWlzRHlHdm00MFJOc0hSNG94UFcwcE1DU1VBR3NkVlhkeXdCZkpuM0NxN2dlcmJJeUJkbGZoTXdaaTVmSGVpZk9IdmMvNzlBVEZBVmU3S3FGMTc4SHBzZTlkS3lETWpDdmRPcVM3TU1JMEJrZC96c1lsZVlYWUdFbkd4RlJpdGdCeStmU3c4Ti94cStPYVpHSUdVcldNYU5kRFBwdklPbUFzcy82anhtYVZpaW00UGRCd2xZNDczaFdIYzFCSnRpL01XMjQrUjdPWU5jY2pYUElWeHpPY1k4eWw2U25GTGYra3ZWMExtMHpNL1lhbEhkTkt6NmZKODJrdU9xNGZDcDFScjk1azJXRE00N2NVNTY5cW1MUmZXZnFWaUFJVUNYa3lTa3d4WjNlODVnMUU2K1NtT09ha25RV29yc1RkeE5vY0QrN0ZUaEdZdG05dnVvL0IvbGNscklKZUlHMEwxQ2lreE1sSjg3bHFLYUc2amNVWW42bkVzVHZobEMya29CM0VPNmxpdXVzbTczS0piV05wcjNCK3NGaDBqRGJxQ2paQ3RrRzMvVEN2NVROaVNkUGVXbWVpYUJSTHVKYjA2a2szOXVvYmZFM0RzV1V0Yitxem5nRFFlTk50b1o3Ti9wUUZpOEV2RVpUZnNkZ0llOFRKRkppVng4WDQ2Q2Z3RnlLOTQ1L0lDeWVHMFp4TlgzK0pVU001TzBGTWJycXBrUEtHcUl5ZTFKOTkrNE4yVlZWTi94MDVxejd6ams2Szc1aEJOOVREWllpY1U1VFhOOTJzOEcwMUhsREFqZ1RPOUtLL3dwYXdrbVRidmswdStIWnVtZk1wVXNoVjNVOE4rUVJPdGpTMndHZ3lWQUsvU2l3d2tVblV3M3RMK1pEZUxFQitveXRtUlpUdnpIUGZ5NkQ4aGJIS05NTmpWWGRuSmhFSW0xell0aTVTNTAyYjk4SEFML3oxVDNuNEM3TFQvbTFYY2lVU2MvQ3lYbW94dTFaUFNrUi92OVN2eGlZNVc5VGE4SUl2VVV5WEtHQVJTWmw4N3hHZ21TVlFnYktWeFNHOHVpbXM5OXlRcG1CdDdqaHJXOFpXVDZVd2hYdjduOTM2YVNPMVJSMWtYUU5ycWNobE5CSUdad1cyMkZmMTYxVVN4YlBNS00wSjVjZ01lZXNRbmdoYnU2Vk5sQjVjTU1CNEcxb0VqNitvS1dSOEFSTU5idkpKU0FQOGRFT1Q3emRCd0JQWWZiSGUvQUEwUkQvbkN6Rk8rRlFaU3cwdTRPK2Era1ZQd3VvUnI=

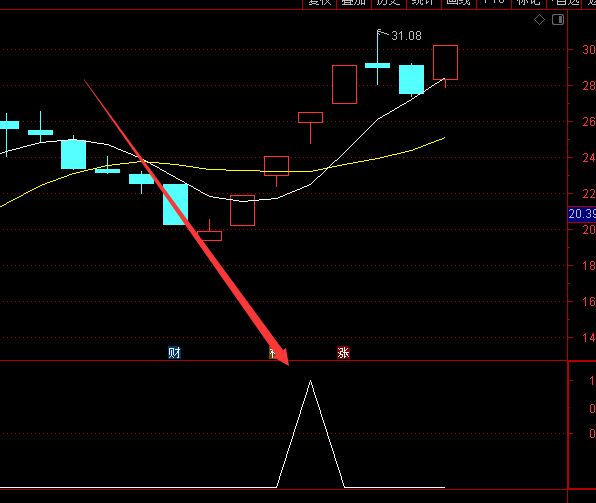

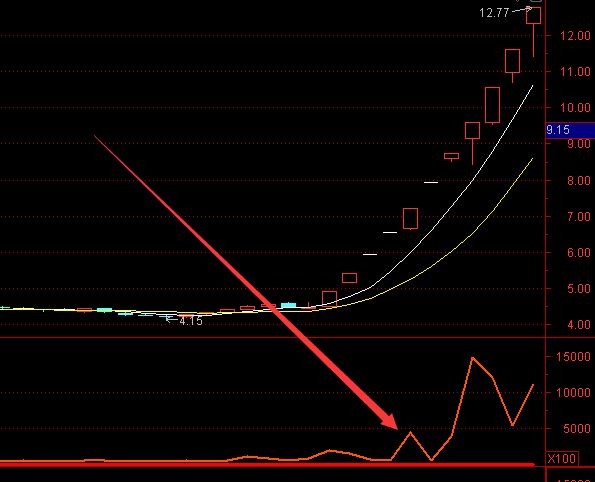

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容