温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

编写条件:

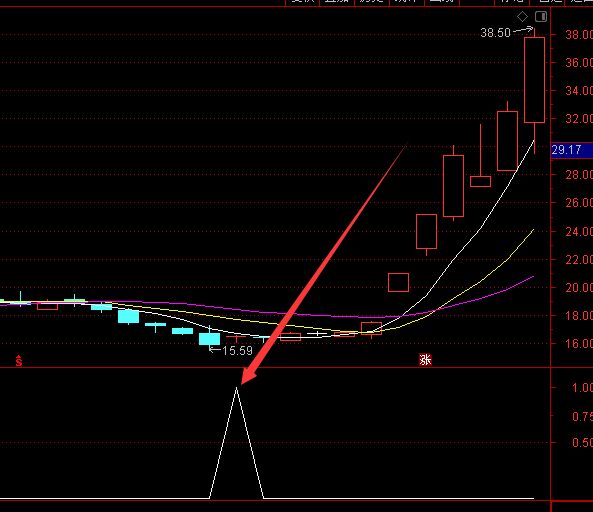

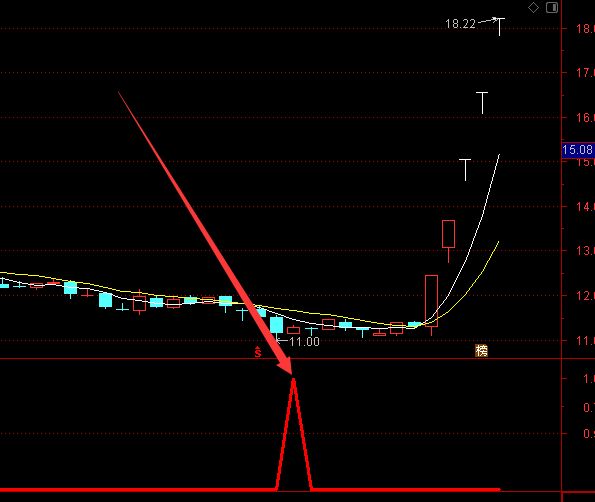

昨日收幅度5%以上长上影线的选股公式。

编写方法:

XG:C>O AND H-C>REF(C,1)*0.05 AND O-L<REF(C,1)*0.01;

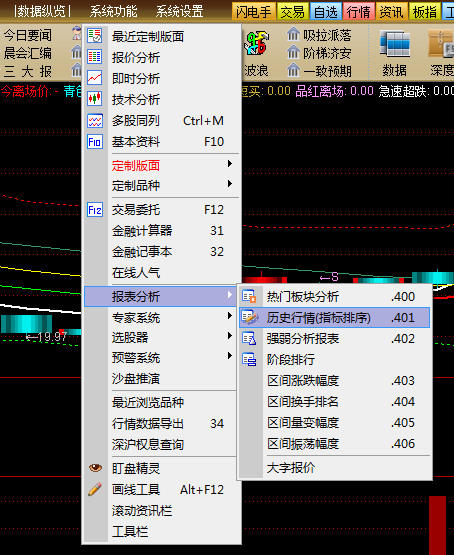

以下是适用于通达信/同花顺的昨日收盘涨幅超5%且带长上影线的完整选股公式代码:

//基础条件

涨幅条件 := (REF(C,1)-REF(C,2))/REF(C,2)*100 > 5;

上影线条件 := (REF(H,1)-REF(MAX(C,O),1)) > 2*ABS(REF(C,1)-REF(O,1));

//增强过滤(可选)

成交量条件 := REF(V,1) > REF(MA(V,5),1)*1.5; //昨日放量

均线条件 := REF(C,1) > MA(REF(C,2),20); //20日均线上方

非ST条件 := NOT(NAMELIKE('ST')); //排除ST股

//最终选股(基础版)

XG: 涨幅条件 AND 上影线条件;

//增强版选股

XG2: 涨幅条件 AND 上影线条件 AND 成交量条件 AND 均线条件 AND 非ST条件;该公式通过REF函数引用昨日数据,核心判断标准为:

1)昨日收盘较前日涨幅超5%;

2)上影线长度超过实体2倍。

增强版额外要求放量且处于均线多头排列。

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0YnV5bVRzcDF0YnVxaHNCRElKRFF6OTJQc0JmWDlyUGp5RW5JVndKOGROcjNOWjEzei9rNFNacU42dm1tNWg5UGFSYjlRZG1wUFFGOVNQb0ZKYmVab0ZpRHVvbkxtVVhWajFJMVlqUyt4K3hjQUVaek5UZHpIZlZBcTZWYlU5ZFR4VDl4TDNmSytaNGh2REJ4ajZRSFpCTDMzSzFDTUx0QW5CVGZ1OTFBNjFMSTBYckp6UHFYeEp6WWxZcHBMYlRMM1QyVm04UXp0bEhrc3pFN1duUmxFeitBbWpxS0ZMeFlmQkRNZEdCblhpV2dtVnJ4ZmhLbUlOb3llWmRKNnNUVDQvVDIvSkhYY2hjYXJJdktBZ2taU21HQjdSZjBRTkxMZDNMeGNJRjY2c2YzZ0ZTck5Wb0VkSmVLNUduQlRkMUE5QW16SzdOSGxxZVQzYlNGcG94ZEJuMm1hRzYveWdVTWFqTVlmeVNlN212RFVzdGQ2cm1kNTRBWE5PbEhOOVpHZU9udXNLY21MZXNPQmc5Z3Q0aEVBMkhEQThtTmx2ZDNqVEZwa1hqUjZLY1RKMXVhdU5rN1Z0MkcxZHFkbU9MOW9RNjdYKzhETWhlMytGZ3pkbkhaaVdFeEo4dUNGZE54TWt6SURmcmRCdmtmcHhnSEpNUkpWNkJ6Mm43d1ZIYVpnQlBKVmx0ak9QTFNpNFNydEVKQUozeHY1djdrODdTdHNnalFkdGJDTU1OY0dsSndROVdCY2JHYTlDNjJKOGQydEIvc1poMnNVMjNMUlRPMU1ObXovRXhobnBqN2xzT1hEbGxhdmpxMytaZTdVd3YwcG1LMGVYbTQrTGFpcGxmVXQ3bWt0MHYzRW1YYWh0QkFLUW1ObklMM3dXNUVYckV3U0FobHdCNzh4RGdJUE13OTlwYUNxVHQwQ0dtajZ5aU1hSDh5TWpVQXgxTTJsVUlTWUxmSjlPOWNnNUx4RlVFUUJJWi9XSEVmMStJTzQ3LzhkVlZaczlVSHB0cGVvclJyeVI3RnBRZjRkWm10N2tmeUxGMmFlei9nOHAzVVpZN3lLYXB6RlR2NkJxQjRSazlWd3p6ZGVudHlvcjB4TmxVTEo2VmNERkJhZ3c3MHhjKzkyei8xNXBibElaMHBUOUN0NHNCYzZjN2JNUXhOc1Q4aFF5NGhwbFpkdSsyUnhDOXh3S0htWWNUUTNxYUJka2cwMlJ2TS9nM2I1OVF3MXAwNWVlSmFEL2tzd2VpT3BteDl0L0Ficy9QOFNsZjFJR2QrcGhjVDliR2F0N3N4cEpSa3dJTTVYUm9ISXhJbVRzYmtvd2dvamdLYzN6b0xuV3FqUHNjM1l1YlV6d2JvNFo1NlV2TzJqL3BLaUVMdEpuVmR3ZG1ZeC9BeWJhWFpqMTFMcExaTGI2NEwvaHRyNTlUdlFFMlVRMWVYSzl4OEVScVJ0aGdJaVRRK2dBL0NXcHBrNm1FRGNEVXhkZ0U5L1NlQXRSdU02STNPYjJlRHJpVXRneThLVGhwUlc0cVRmMGdKbW1LSndXTTdOK3ZPd0tyWkNjdlJmdlhEQU5EZTBJT3BzTkZpMEhEQ3FxdHhxV1E1aXJlbUJnM1pEYVB6ZXFuMlFsOGQxWW1MY0pBWUY0R1JtYUZDeUFOeVYzeGhtQmEybWJoV2lSL2phcW9iS1ZjaldsNEFOZStvZDl5QkY3RG9mcTJpZVpVa2orNVRJZTFkRTVNNXRUYzlkVDJFcHJ2TDBVMkZnUDdGL0dTTFpCWTF0KyszZTd0VS8zT05hb3ovMm41bU5wTVBweHkwUUhuSDVFRGI1YzdGVDFNUVN5SGl6ZW5xalQ3R1VIRUxUZGdLMnRCSnR6S0RBWHZXTWZ5b3dvek1wRUJLbDJxYWNGUVdaWGJhcEdmQTRBaU8ybzloN1hoTUo4NWRmQVpSTXc5bjNPV0lIMHhEejkzWkEyNHFFZmtKanZVTXNqdE5tWTYzOWt4RWRCeG1MSGRHeGhmZ2xhYlZOdElHU1dmRlBCOWFLR3E1T0JKdW4zaGJCc0JkWW1xYzNiUFc5ejA2U2w4MysyNFFsRWNoY3RqNUJTQWxMTjJrOTFMMjZpUWVKUnE5WlkvaXlpQjhNVWFCNVptaHhsL1JrMkhtTkh1b2lHSTI2MGY0UEhWMHNhNGpORlhGWTkwOGVHdXo3bnZxYmc3L3dRRmJRWXA0RS9HNjBMK2RndDZtTzkvdHJZaWJiSUV2dUIxVEFIM0Y5YWZqOFZNRFpWMURSbnVDRkFzY2l3czVxbVhkeU5YZlllUFNZbzFXTjZxUWFHOTRhbUdlaFV2bld3Z0JnTlFCSmtZQXFkNEVPM2lIWlBtWmxyOUtaTjllNXdBd2hpOUg0RGZQRHYzRkFiVEw5VjFWaTRhdnNxLzk3ZmF2T2dtWFJrSTR0YzZTeGxkMFBROHFrTjNEcEQ1T2Z5MVhqZVZnbzBieS8zNDg4RWJrY05laUZTQTRXQ0lUOWVTWElnaW02SEI4YkNtMHlmR0UxS3VPSWtzZVlCQmZvTXc2NFR0ZmxOamFLbms2UUkrb01BMWVtUG5MM085YjZMeFpjak1sV0hJejkwQVYreEdTYlFIWWJ4WkpNaFRzUitjRCtvNkJ5TWRXK3hGdTZSZEJQcDJjMkU4VEZ1anBGT3V2TXBFZFM3UlQ2L1JncnduTytqM1dMNWwzRS94d1Uwb1cxS0ViRDUrd0htMS9kb3gwZWhqTFQrZ2paQ3ZzWWJlN1MyWlJXRHEwSTFDekpzQWUwOFBmYXBPWDl6OVh3SmxWYTVvVFRPdVM3WXA1M1AwZDRiS0VhaU5NbG8xUTc2eE5yZGVnNXJoa3NibzArZi9JS1JhS0NxTVFUaThtSXoxeGNGak9MVkVJRTJNSnhxRzJlQUhOVnNDbFp0ZXl0RkZwV3ZkMmczRVZxbm14REc3Qkx1WDlTeTZIelBVczNyd01TVFdjbnZmUDEvTVRxQkxneU5Ia2hjR3R1ck85WTZQQWhUNWVDVWwxMlV1R0g4cGkxVzJUcGc1VC93c0NzS2ZZS3ZFNDFpeHc5MEFRQVZUMUN1Vk92VXRzQXptY0taNGdMUmJQek8zYlJEZm5EOXFWTXdvMHFDYURYcnRqNGx3ZmRwVHpHQlVkdVhaQXc9PQ==

RVdTOUtDenh1c1RzcTJZc216SUM0YnV5bVRzcDF0YnVxaHNCRElKRFF6OTJQc0JmWDlyUGp5RW5JVndKOGROcjNOWjEzei9rNFNacU42dm1tNWg5UGFSYjlRZG1wUFFGOVNQb0ZKYmVab0ZpRHVvbkxtVVhWajFJMVlqUyt4K3hjQUVaek5UZHpIZlZBcTZWYlU5ZFR4VDl4TDNmSytaNGh2REJ4ajZRSFpCTDMzSzFDTUx0QW5CVGZ1OTFBNjFMSTBYckp6UHFYeEp6WWxZcHBMYlRMM1QyVm04UXp0bEhrc3pFN1duUmxFeitBbWpxS0ZMeFlmQkRNZEdCblhpV2dtVnJ4ZmhLbUlOb3llWmRKNnNUVDQvVDIvSkhYY2hjYXJJdktBZ2taU21HQjdSZjBRTkxMZDNMeGNJRjY2c2YzZ0ZTck5Wb0VkSmVLNUduQlRkMUE5QW16SzdOSGxxZVQzYlNGcG94ZEJuMm1hRzYveWdVTWFqTVlmeVNlN212RFVzdGQ2cm1kNTRBWE5PbEhOOVpHZU9udXNLY21MZXNPQmc5Z3Q0aEVBMkhEQThtTmx2ZDNqVEZwa1hqUjZLY1RKMXVhdU5rN1Z0MkcxZHFkbU9MOW9RNjdYKzhETWhlMytGZ3pkbkhaaVdFeEo4dUNGZE54TWt6SURmcmRCdmtmcHhnSEpNUkpWNkJ6Mm43d1ZIYVpnQlBKVmx0ak9QTFNpNFNydEVKQUozeHY1djdrODdTdHNnalFkdGJDTU1OY0dsSndROVdCY2JHYTlDNjJKOGQydEIvc1poMnNVMjNMUlRPMU1ObXovRXhobnBqN2xzT1hEbGxhdmpxMytaZTdVd3YwcG1LMGVYbTQrTGFpcGxmVXQ3bWt0MHYzRW1YYWh0QkFLUW1ObklMM3dXNUVYckV3U0FobHdCNzh4RGdJUE13OTlwYUNxVHQwQ0dtajZ5aU1hSDh5TWpVQXgxTTJsVUlTWUxmSjlPOWNnNUx4RlVFUUJJWi9XSEVmMStJTzQ3LzhkVlZaczlVSHB0cGVvclJyeVI3RnBRZjRkWm10N2tmeUxGMmFlei9nOHAzVVpZN3lLYXB6RlR2NkJxQjRSazlWd3p6ZGVudHlvcjB4TmxVTEo2VmNERkJhZ3c3MHhjKzkyei8xNXBibElaMHBUOUN0NHNCYzZjN2JNUXhOc1Q4aFF5NGhwbFpkdSsyUnhDOXh3S0htWWNUUTNxYUJka2cwMlJ2TS9nM2I1OVF3MXAwNWVlSmFEL2tzd2VpT3BteDl0L0Ficy9QOFNsZjFJR2QrcGhjVDliR2F0N3N4cEpSa3dJTTVYUm9ISXhJbVRzYmtvd2dvamdLYzN6b0xuV3FqUHNjM1l1YlV6d2JvNFo1NlV2TzJqL3BLaUVMdEpuVmR3ZG1ZeC9BeWJhWFpqMTFMcExaTGI2NEwvaHRyNTlUdlFFMlVRMWVYSzl4OEVScVJ0aGdJaVRRK2dBL0NXcHBrNm1FRGNEVXhkZ0U5L1NlQXRSdU02STNPYjJlRHJpVXRneThLVGhwUlc0cVRmMGdKbW1LSndXTTdOK3ZPd0tyWkNjdlJmdlhEQU5EZTBJT3BzTkZpMEhEQ3FxdHhxV1E1aXJlbUJnM1pEYVB6ZXFuMlFsOGQxWW1MY0pBWUY0R1JtYUZDeUFOeVYzeGhtQmEybWJoV2lSL2phcW9iS1ZjaldsNEFOZStvZDl5QkY3RG9mcTJpZVpVa2orNVRJZTFkRTVNNXRUYzlkVDJFcHJ2TDBVMkZnUDdGL0dTTFpCWTF0KyszZTd0VS8zT05hb3ovMm41bU5wTVBweHkwUUhuSDVFRGI1YzdGVDFNUVN5SGl6ZW5xalQ3R1VIRUxUZGdLMnRCSnR6S0RBWHZXTWZ5b3dvek1wRUJLbDJxYWNGUVdaWGJhcEdmQTRBaU8ybzloN1hoTUo4NWRmQVpSTXc5bjNPV0lIMHhEejkzWkEyNHFFZmtKanZVTXNqdE5tWTYzOWt4RWRCeG1MSGRHeGhmZ2xhYlZOdElHU1dmRlBCOWFLR3E1T0JKdW4zaGJCc0JkWW1xYzNiUFc5ejA2U2w4MysyNFFsRWNoY3RqNUJTQWxMTjJrOTFMMjZpUWVKUnE5WlkvaXlpQjhNVWFCNVptaHhsL1JrMkhtTkh1b2lHSTI2MGY0UEhWMHNhNGpORlhGWTkwOGVHdXo3bnZxYmc3L3dRRmJRWXA0RS9HNjBMK2RndDZtTzkvdHJZaWJiSUV2dUIxVEFIM0Y5YWZqOFZNRFpWMURSbnVDRkFzY2l3czVxbVhkeU5YZlllUFNZbzFXTjZxUWFHOTRhbUdlaFV2bld3Z0JnTlFCSmtZQXFkNEVPM2lIWlBtWmxyOUtaTjllNXdBd2hpOUg0RGZQRHYzRkFiVEw5VjFWaTRhdnNxLzk3ZmF2T2dtWFJrSTR0YzZTeGxkMFBROHFrTjNEcEQ1T2Z5MVhqZVZnbzBieS8zNDg4RWJrY05laUZTQTRXQ0lUOWVTWElnaW02SEI4YkNtMHlmR0UxS3VPSWtzZVlCQmZvTXc2NFR0ZmxOamFLbms2UUkrb01BMWVtUG5MM085YjZMeFpjak1sV0hJejkwQVYreEdTYlFIWWJ4WkpNaFRzUitjRCtvNkJ5TWRXK3hGdTZSZEJQcDJjMkU4VEZ1anBGT3V2TXBFZFM3UlQ2L1JncnduTytqM1dMNWwzRS94d1Uwb1cxS0ViRDUrd0htMS9kb3gwZWhqTFQrZ2paQ3ZzWWJlN1MyWlJXRHEwSTFDekpzQWUwOFBmYXBPWDl6OVh3SmxWYTVvVFRPdVM3WXA1M1AwZDRiS0VhaU5NbG8xUTc2eE5yZGVnNXJoa3NibzArZi9JS1JhS0NxTVFUaThtSXoxeGNGak9MVkVJRTJNSnhxRzJlQUhOVnNDbFp0ZXl0RkZwV3ZkMmczRVZxbm14REc3Qkx1WDlTeTZIelBVczNyd01TVFdjbnZmUDEvTVRxQkxneU5Ia2hjR3R1ck85WTZQQWhUNWVDVWwxMlV1R0g4cGkxVzJUcGc1VC93c0NzS2ZZS3ZFNDFpeHc5MEFRQVZUMUN1Vk92VXRzQXptY0taNGdMUmJQek8zYlJEZm5EOXFWTXdvMHFDYURYcnRqNGx3ZmRwVHpHQlVkdVhaQXc9PQ==

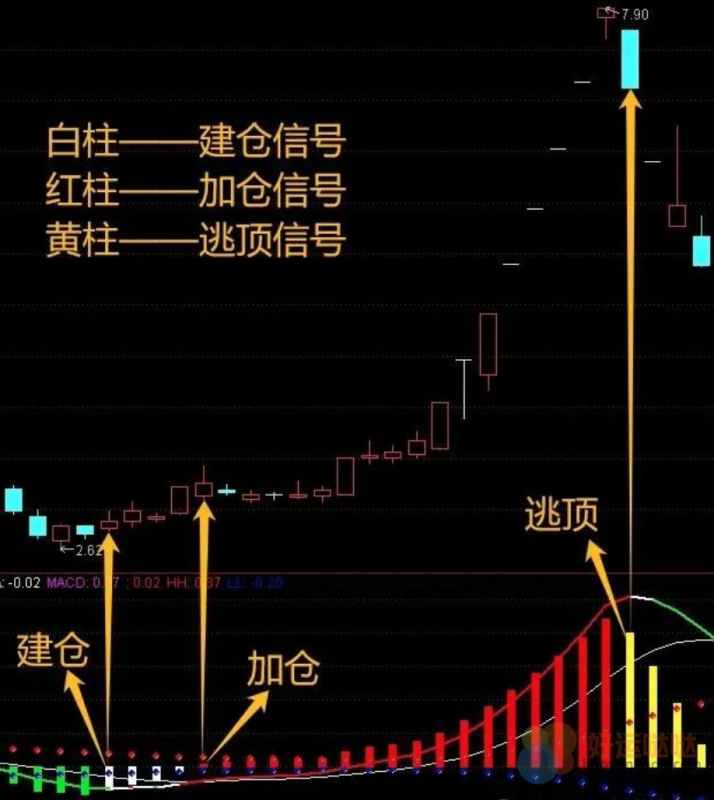

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容