温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

编写要求:

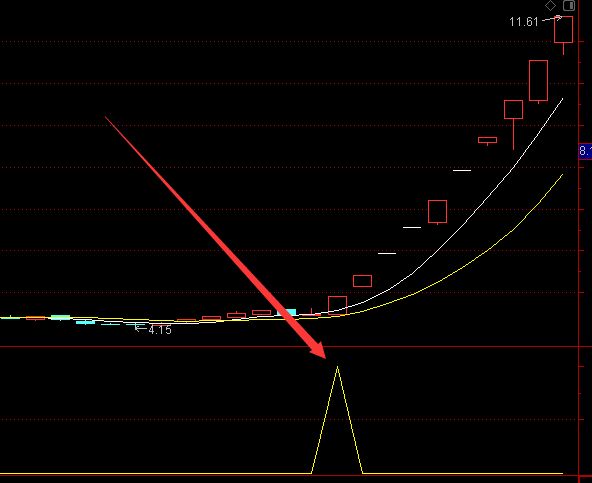

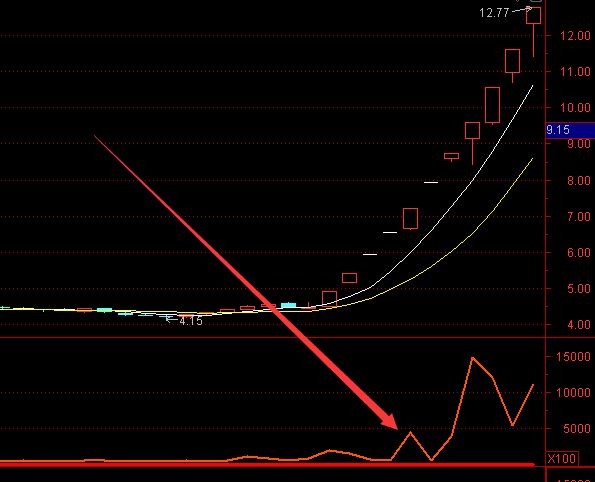

10日前到10日前的30日内价格一直存在下跌,最近10日内有1-2个涨停,涨停不超过5个的公式。

公式网解答:

ZT:=C/REF(C,1)>1.095 AND C=H;

REF(DOWNNDAY(CLOSE,30),10) AND COUNT(ZT,10)<5;其他写法:

// 参数设置

N1:=30; // 前期观察周期

N2:=10; // 近期观察周期

// 前期30日持续下跌判断(10日前到40日前)

DOWN_TREND := EVERY(C<REF(C,1),N1);

// 最近10日涨停统计(1-2个涨停)

ZT_COUNT := COUNT(C/REF(C,1)>1.095 AND C=H,N2);

ZT_COND := ZT_COUNT>=1 AND ZT_COUNT<=2;

// 历史涨停不超过5个(防新股爆炒)

HIST_ZT := COUNT(C/REF(C,1)>1.095 AND C=H,60)<=5;

// 最终选股条件

XG: DOWN_TREND AND ZT_COND AND HIST_ZT

AND NOT(NAMELIKE('ST'))

AND DYNAINFO(4)>0;该公式实现30日下跌趋势+10日内1-2个涨停的选股逻辑,包含ST股过滤和涨停次数限制。适用于通达信/同花顺软件,可调整N1/N2参数优化周期。

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0UUtoeFhLS0d3eGtlUGR1Vk9saWNBM25jL2IwcW5aUVFxNkFJcUtOL3hnSnNJMVBzelFjZkJIeTk0S0tZMWlhR3diTjU3N0VPNFlaQVV1dWR6WUc2QnFvc2x0N1ZQNTVxZ2lDQTF0NEFDcFY2clRaVnRTQWY4Q084bE05Q1dVRmxkUStkNjM1WmZUSTlweTk5amhTVm9yQXo2ZWlZNVFnTFBCdkJpRGhUejNtd2d6eWxQSTJTc2RadUlsZllmamQ4OU9RNGxseUxiaCtmcXlqSlFMSENBSnNaNVp0UnRldzU3NS9ZZHZXWjhhY2VraWR6MExIT1FRWEk0NUJnRzRVTTFWV1ZtdDExbjIrd2s3OXJscXNpQVZuTnVmbXNSTnNmcWIxV0tSM1ZMRyt4Zlk4MEJ4cEpSL1Y1UWZDRjBNZks2MlpXZFhKOTk5WFVsOC9tbUo0Nmg5MTFVV0VLdTJHcmE4S0NMbnpYd2pTb3dzN1BPSHZPSk5mM29xNTZaTTlYSnIwQ29rU0QvdGgyMzdPdmh2ZGRXQmhHaGZMbkYvMHYxNS9ML2tXYk8rMmNnZlB6dXpzYkZBVXkweGtNRG83bmRHM0Rad0YwUzZNc0YyT1pZWllyTWRaSmVQVS9BTURPYlo3MEpFWVhKSlFDU29zbDYyZTNEODRicDIrQ2NlaTNCb2NiRXpzRzNHWkw1WEM2eENuNVViNDhFdUxFU1dwYUpGYnB4R1JKaXNVVUFhY0syOXQxSHRiZC9JYWpHTUNheHhnTk1NODFjR2puSloyV3pMaGUzS1NsaE81VUpwMkxXcDJLUURWRWRQRVJ4c3JYTE13MXpFTHVPLzh3bFU0QkR5b3RVczR2ZWFqeW0wWVgweUZvbVYrbUhqZ21ZWEljYTBJckNIYU1MaEVkQzZlTE14VVYxci9BWnJzMnkzWnJlRVJ6WDVwWVErMjFCdGlDVDZoUzJNVFNnaTlhSDVKTzE5anRKaStaN1lxeW1teS9wVUdLejhwTjdTU1RvUnFaT0VDT2RrMGRTWDZjRG9qYTRDMFNYSVAzcFliOHhtTThkOVFUWmxzMFVGdnkyZUhsT0xaUWUvcU5VekkzQUczNGhKNDZnQTZyWVVzRzRiVHN1MlY0RWxFQ1FJMzZyb2drYURRQkkyRi9ZR3l5VXoxWlc5NVR4Zmw3VXhTelZYNlkvY1BZSGJRbkdzWmJKYTdXcHgydnJEVDcwU3VEZnRITFZSbEhDNHVjcHMzbFlZSFdrelpVK3ZDd1ZhckZGa2NCWnd5SWJ5TGM2TnYzZTdCend1bkFyOGtQMlZ3UDlyUkZuSnluN0NvTnI0bUN6bXArMmNaRGoxUEZEOGtaRktkeWxDclFNV0JUZzZyUnRZK3U3eEdqSUh3c1RBSmlTR3kwdENJVFZ3TngyRWtpUjAwdG1tOUdGbTB1Rjg0RjJKWEo0c052M0FPbzhPTEQydkhGWURZdWREZ3loNkx3elpISHVjL1hudm1kYWw1MGNtb1YyYUl6L1VpekU0TFBxMVhqdUwrUFNOc0JwamFGK0xyMU43UGVIVW56c3g1TjBORE9wNnVQU3JHRytqekMrdXEyaTJDWlVqNlpUVlVjdXJvaWFaQ0x1bFZBVVZMeC83dGhFU3JoTGZNcE50QnBXL1ErRTV2RXYwSFM0YUlEWkkvcWs0ajZ5N0I1b1ZEZGVFSnBsVGNzQUV6R0haa3RsaGQvNEJzMkJTT20yaEtLSGFzSkQ2N0NSOEtnWWc0NWxlWHpFVUs1RG8rR0x0a0o3eGVONHBRUjdQalE0Z3lDNHFuMnVJTFVpZnhmZEdxbzNHR3A4ME14SlFUMHRkTkRHK2RVVzZnRWJWc1VjQjQ2S1N3MmREdWpEbzdZWmt0Unh0UUx4a0tPd0tsVHpMUERwWGtkSDJ1QzBLUkNPc0JVeGt6M3I0M0dDV1crZXVZcTZKUng2WDhYODdwSTc3KzQ2RlRPOFIrSUxqcU5oOCtpWlo3QmtTZmdqeDlzZXQvQmNnVlBGQ3VZaEVvWjgzU2JRNjZ6d05tQ3dpSVF5NlFrRTNzZWErWlhJalBGQWhmeEd3RFlBbmNRTW5lTnpPMWJmWEdBbUNRdWZDSHVndnlYVlJXM3Q5WUxQMGRDaFJ1emk2L0xMcEl6Y2czbUdNRUVGRDR2Wk9IeFYxOGtiKzlFTndKY0ZzdlJIbHpKSkg2WThTYWE4ejYzUFFBaEpyWUtpdVJPVlBHODN5UnYzTmxwR2xPbFJQVmZvOWNHYlQyWGFzckZjSGVBR1M3OXdNL1gyWUVtSU9WVnNBak95VXoxQm1TWkRzSXFvUzJOb0pDR2xyREJJaEYraXdtUVRLWEZKTWlsUW5SWjhZQmkySnIxT2tQMklyMmhGSWp1dGowWjZYTytBbVl4M1ZiS2xhRUhTREJVRlMvZFZzYytwWThFMmltaTdyOGVvWHYvMHlncjNCZ0wraDRabTh4MkJrT21FOS9iV2FnRnRxTklaSmtGSE5xVFdoOFRTT0dWSXplWDFHVjgrZ2VZVTF1VURGQVJmd3ZNYVVRUEZJRFZHOXMxV3Y3SFZObWM1Ny9LS01zNmZDNTRkM2xMYm1HNVpFeTEyV0d0Qnh1N2JFcm5uMmxHSnZQM2ZLNTFlMU11aTlPWWtORUc0b0kxcGEycVoya2FneEgzMmJkMGE4cEs5bjFsZGRiNXdscVRkRzFEcVNnOW4vSEVpMjZsK3VZdUczaDFValBUL0xYVkdFNmlMeStUK28xdGpkVEJVMmpTSHhDd2h1QTJYVnRVVE44WEtsSmUvZGdQVkV4aUF5SmpJSGlUNzJ2amxlQ3JyR3c3WUxiWnFkYW1NWmJTMFRZak5Kb2RIMVE2YjljUElpcjVwNlZKR0ZUcTc4bER0SEVrdjl0b0g1WEkvbnhUT1grYW13TUhQcU02Y0JnS2xuNEtaNGdsQzgzRDYyQWJUdWhLTFYxWktZYURoUDhxTGlFUWhlaGhuYmVNdVRpTlBmZ3JLdDIxOUtYWFl2UzFHVVcwMGZwUGp6Vyt2QWk2aFErU3AvaEhucDYzd0c4OWgwc2M0NTkyQnNVOXBzK0pPVXVTbkVhRHlXaFlQTDdGVUgwTVU5cQ==

RVdTOUtDenh1c1RzcTJZc216SUM0UUtoeFhLS0d3eGtlUGR1Vk9saWNBM25jL2IwcW5aUVFxNkFJcUtOL3hnSnNJMVBzelFjZkJIeTk0S0tZMWlhR3diTjU3N0VPNFlaQVV1dWR6WUc2QnFvc2x0N1ZQNTVxZ2lDQTF0NEFDcFY2clRaVnRTQWY4Q084bE05Q1dVRmxkUStkNjM1WmZUSTlweTk5amhTVm9yQXo2ZWlZNVFnTFBCdkJpRGhUejNtd2d6eWxQSTJTc2RadUlsZllmamQ4OU9RNGxseUxiaCtmcXlqSlFMSENBSnNaNVp0UnRldzU3NS9ZZHZXWjhhY2VraWR6MExIT1FRWEk0NUJnRzRVTTFWV1ZtdDExbjIrd2s3OXJscXNpQVZuTnVmbXNSTnNmcWIxV0tSM1ZMRyt4Zlk4MEJ4cEpSL1Y1UWZDRjBNZks2MlpXZFhKOTk5WFVsOC9tbUo0Nmg5MTFVV0VLdTJHcmE4S0NMbnpYd2pTb3dzN1BPSHZPSk5mM29xNTZaTTlYSnIwQ29rU0QvdGgyMzdPdmh2ZGRXQmhHaGZMbkYvMHYxNS9ML2tXYk8rMmNnZlB6dXpzYkZBVXkweGtNRG83bmRHM0Rad0YwUzZNc0YyT1pZWllyTWRaSmVQVS9BTURPYlo3MEpFWVhKSlFDU29zbDYyZTNEODRicDIrQ2NlaTNCb2NiRXpzRzNHWkw1WEM2eENuNVViNDhFdUxFU1dwYUpGYnB4R1JKaXNVVUFhY0syOXQxSHRiZC9JYWpHTUNheHhnTk1NODFjR2puSloyV3pMaGUzS1NsaE81VUpwMkxXcDJLUURWRWRQRVJ4c3JYTE13MXpFTHVPLzh3bFU0QkR5b3RVczR2ZWFqeW0wWVgweUZvbVYrbUhqZ21ZWEljYTBJckNIYU1MaEVkQzZlTE14VVYxci9BWnJzMnkzWnJlRVJ6WDVwWVErMjFCdGlDVDZoUzJNVFNnaTlhSDVKTzE5anRKaStaN1lxeW1teS9wVUdLejhwTjdTU1RvUnFaT0VDT2RrMGRTWDZjRG9qYTRDMFNYSVAzcFliOHhtTThkOVFUWmxzMFVGdnkyZUhsT0xaUWUvcU5VekkzQUczNGhKNDZnQTZyWVVzRzRiVHN1MlY0RWxFQ1FJMzZyb2drYURRQkkyRi9ZR3l5VXoxWlc5NVR4Zmw3VXhTelZYNlkvY1BZSGJRbkdzWmJKYTdXcHgydnJEVDcwU3VEZnRITFZSbEhDNHVjcHMzbFlZSFdrelpVK3ZDd1ZhckZGa2NCWnd5SWJ5TGM2TnYzZTdCend1bkFyOGtQMlZ3UDlyUkZuSnluN0NvTnI0bUN6bXArMmNaRGoxUEZEOGtaRktkeWxDclFNV0JUZzZyUnRZK3U3eEdqSUh3c1RBSmlTR3kwdENJVFZ3TngyRWtpUjAwdG1tOUdGbTB1Rjg0RjJKWEo0c052M0FPbzhPTEQydkhGWURZdWREZ3loNkx3elpISHVjL1hudm1kYWw1MGNtb1YyYUl6L1VpekU0TFBxMVhqdUwrUFNOc0JwamFGK0xyMU43UGVIVW56c3g1TjBORE9wNnVQU3JHRytqekMrdXEyaTJDWlVqNlpUVlVjdXJvaWFaQ0x1bFZBVVZMeC83dGhFU3JoTGZNcE50QnBXL1ErRTV2RXYwSFM0YUlEWkkvcWs0ajZ5N0I1b1ZEZGVFSnBsVGNzQUV6R0haa3RsaGQvNEJzMkJTT20yaEtLSGFzSkQ2N0NSOEtnWWc0NWxlWHpFVUs1RG8rR0x0a0o3eGVONHBRUjdQalE0Z3lDNHFuMnVJTFVpZnhmZEdxbzNHR3A4ME14SlFUMHRkTkRHK2RVVzZnRWJWc1VjQjQ2S1N3MmREdWpEbzdZWmt0Unh0UUx4a0tPd0tsVHpMUERwWGtkSDJ1QzBLUkNPc0JVeGt6M3I0M0dDV1crZXVZcTZKUng2WDhYODdwSTc3KzQ2RlRPOFIrSUxqcU5oOCtpWlo3QmtTZmdqeDlzZXQvQmNnVlBGQ3VZaEVvWjgzU2JRNjZ6d05tQ3dpSVF5NlFrRTNzZWErWlhJalBGQWhmeEd3RFlBbmNRTW5lTnpPMWJmWEdBbUNRdWZDSHVndnlYVlJXM3Q5WUxQMGRDaFJ1emk2L0xMcEl6Y2czbUdNRUVGRDR2Wk9IeFYxOGtiKzlFTndKY0ZzdlJIbHpKSkg2WThTYWE4ejYzUFFBaEpyWUtpdVJPVlBHODN5UnYzTmxwR2xPbFJQVmZvOWNHYlQyWGFzckZjSGVBR1M3OXdNL1gyWUVtSU9WVnNBak95VXoxQm1TWkRzSXFvUzJOb0pDR2xyREJJaEYraXdtUVRLWEZKTWlsUW5SWjhZQmkySnIxT2tQMklyMmhGSWp1dGowWjZYTytBbVl4M1ZiS2xhRUhTREJVRlMvZFZzYytwWThFMmltaTdyOGVvWHYvMHlncjNCZ0wraDRabTh4MkJrT21FOS9iV2FnRnRxTklaSmtGSE5xVFdoOFRTT0dWSXplWDFHVjgrZ2VZVTF1VURGQVJmd3ZNYVVRUEZJRFZHOXMxV3Y3SFZObWM1Ny9LS01zNmZDNTRkM2xMYm1HNVpFeTEyV0d0Qnh1N2JFcm5uMmxHSnZQM2ZLNTFlMU11aTlPWWtORUc0b0kxcGEycVoya2FneEgzMmJkMGE4cEs5bjFsZGRiNXdscVRkRzFEcVNnOW4vSEVpMjZsK3VZdUczaDFValBUL0xYVkdFNmlMeStUK28xdGpkVEJVMmpTSHhDd2h1QTJYVnRVVE44WEtsSmUvZGdQVkV4aUF5SmpJSGlUNzJ2amxlQ3JyR3c3WUxiWnFkYW1NWmJTMFRZak5Kb2RIMVE2YjljUElpcjVwNlZKR0ZUcTc4bER0SEVrdjl0b0g1WEkvbnhUT1grYW13TUhQcU02Y0JnS2xuNEtaNGdsQzgzRDYyQWJUdWhLTFYxWktZYURoUDhxTGlFUWhlaGhuYmVNdVRpTlBmZ3JLdDIxOUtYWFl2UzFHVVcwMGZwUGp6Vyt2QWk2aFErU3AvaEhucDYzd0c4OWgwc2M0NTkyQnNVOXBzK0pPVXVTbkVhRHlXaFlQTDdGVUgwTVU5cQ==

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容