RAY_L动量 爬动的毛毛虫(个股指标)

前辈说过,仿造与创造这一字之差何止万里!没有真品仿制者将一筹莫展,再好的赝品不如残缺的原本!创造力是最大的财富!

我不介意别人仿造我的指标,仿造的好那也是一种自我提升,我非常高兴!

欢迎各位前辈参与交流!

Ray_L参量本来只是无聊编出来玩玩而已,但在实践中却发现有其独特的价值,特发放出来给大家在实际中检验.

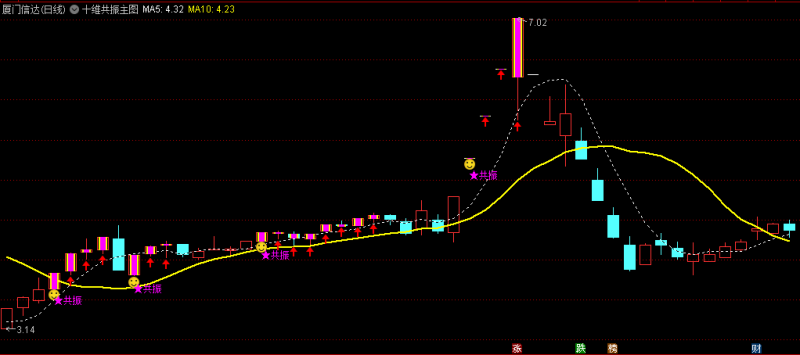

本指标(Ray_L参量)主要通过换手的变化情况来观测市场的,可以设定三个不同的换手区间,其中100为100%换手的意思,也就是流通盘全换手.三个参数可以随意调整,不分先后,系统自适应.其中,区间数值代表累计满足换手率距今周期,图上标{通达信公式网www.haoyundada.com}出相应的日期,方便江恩的玩家们.

使用方法总结如下:

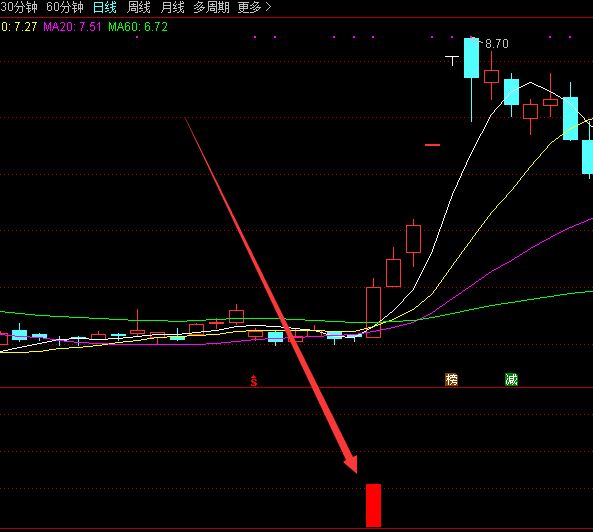

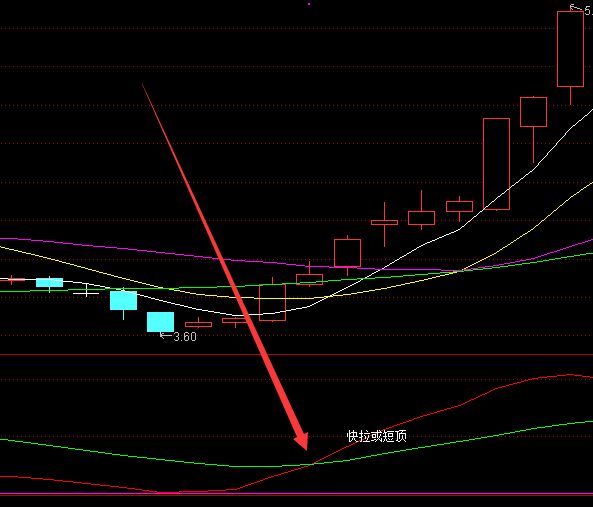

远区被压缩,近区不断扩张,说明庄家出货完毕,为散户们的自由行情,突然有一天近区开始压缩,远区没有大改变,很有可能是庄家开始进货了;

相反,近区被压缩,远区不断扩张,说明庄家开始拉升出货,突然有一天近区开始扩张,有可能庄家出货完毕,也有可能是庄家洗盘,这就要看中{公式网www.haoyundada.com}远区的表现了;

区域压缩的越小,表明动力越强,爆发力也越长.

再多的我就不说了,要讲的话一天一夜都讲不完,主要就是和庄家的操盘手法有关,要靠大家自己去总结了.

指标检测含有引起未来数据的函数或引用,但决不影响指标的使用和真实性,各种数值都不会因为时间而发生改变.成本分析虽然含的信息量较大,但使用该指标意义简明直观,而且数值精确.

该{公式网www.haoyundada.com}指标单从量的变化来监测庄家的行为,虽然没有明确的买卖信号,但在实际运用中具有极高的使用价值以及真实性.

还有很多用法请自己体会!

以上内容为采集来的数据,未经过测试整理,请自行研究,待整理完成会重新更新发布!

RVdTOUtDenh1c1RzcTJZc216SUM0UUd5UVB6TDN6MVlsOWtrYW43RUwrK1hSQjFST2lpQjdaYlZUUkJCU1pzQ2wyZElLWXc3dEhjdExHVEtjYlpGK2NMdFdLYStYcU13WGRGK2tVOC9tK01BYWFhRjhreGtQYTN2eFREVnJNT0VCR21wTmNBelNhS0Y3Z0cyU20vNVFkVUJ1MlJGMnA1ZzVZMmRHb0pxWmd4NmN4ZTJrVUg4dHFKSXgzS3o3b3hCRXIzeEhENFNVTDk3TUw4Z2UxbTByOTZhRnNSNWlwRC8vd3FwM3FwVUpzNHoyTW1aVXdSSFhPbkluRWErYVZHRU4yMXpUeWJVWkY2NlY3a0ZiRWxTanZhb2NPNFZHWi9PcmkwdXBhQ0RLSmthR0lvMVZ5WVN2Wmc4YkIwUjJTWGFhajBoU05WRldWTmVOclU5aVFLaWx6QXR4L0xFaWhrK0xQRE5Ia05Fa1AyV2RjM3hLeTNaK0JTODhnNkFQaWlHaHVVTVFzMDFGczhjQmNrRmErY2Fxa3lZQVdpWEcrWFZTMkN5VUNWb1VuY1NIdGVrNVR1UTFiR0xGcEg4TUFHMkNQc2V5ZVlaUllRYmJ0TGE4cVFyNHBHQ1pZQjBQOFUyVURYT0dwWjJVdFBsM2NFdyt3ay9uREpqTFFJelJUaGllSW12dk9FeU9QOGFoR3orUEVwUTRzbDQxK0RPVmJ4Qll6L0ZkRWYrcXJqOHBHZWZiZEd4L2kxclFRZ2tKeTB2eUNlekZXYWtrdGRPUGxTTHdEVDRJRU82MkMrVmFGTjcrejhmcEtoUHFOTG94eHY1UTRsb2JFR3E4Q3MrWVNWRDlhbURobFBVSnk4aHBoS01vK29ySUtCdDMySVZ0VVJ5ZDkzb3l3RytpK3U5bnBqbTB3QUt4MGxpcE1NZjlsSDNuWWNDMGFIS3c2MHBZN3A4NWk5SUhFTlVkQW9xTG9hdzZ3Mk40MkVVcUEzNUFKY09ka0lIelcrWXRzMm5Va3czakw2UERKUEVzTjFSb09SbDZiMC9iRk9aSW1SNFI5UlYzRzJ6ZGpFRk1pdG1zUHVyWVErKytOaWtRdVR2N0dwZktselRQRnFLSENyTFJOeW9CZU8xZU1tVnhvL0lxWGEvZERSYmYyZFVVRjN6NTNYejJ6ZHcvVW94dFdzRmdnekM0K3BsZENTNnd0a0RQWCs2OVdSQkFjSmJZTGZyL0pPZFo3dURkOXNaRlN3UU96M0NWbm1uaUJ6TWFwMGtiR25ldDhjUllJSFEvK0dCOVppRHVUU0lNczgrRzl3MEw0NmIwRmJDZ0d1bWNRbC9mQSsxeWY0ZUIxYXFoT2ZQUWNNMHgxUkh6MVR4WS9VZXB5QzR2eWY1bnhhaXMzd1Q4YTlmNWh2YlNVL3BpbFBGblNyRTdOL2UyM1ZxaDh3TSszazFueTdhb1QzYUZNa2lDdjBwVnQxRGNiWElJV3ZUZUl0Y1hldFBmMDNLejNmUDJkeHI3c3VWM1BMaWJmQkIxUjk1eXp5Q1hrODFnbmFOYWFNVUhPbHdJU3lXU29tOXEwdGpodXNXNHNxTFgrSGluL0JlZ0Q2cGdxZURpczJlUUhXck5TWmxxUTJmV094NXgvTjl5MHNnM0FSdnpqWlgveVVYQUtweGpvRjh6N2Z6UDNJRDh4V2NzWExhMDVzMy82OGNVOGsxcU5laHZYY2tscGd2NXhLUXhjQkt6d0ZQQkdvMzBmMDIwL1lCM0ZyZ2o1N2JnMFVuUy9IVzYrallCdm1sb29JeEJwMG5XMFJJS01HSExtQitucDVRNHVVZGYvTGVSMDJkSkx2U0hCQlo5RmlvMGlBUG1wRC83cG1jbnkzVWEvQ1llNFRIeG5SSFI0aXM3ZjhhRzN5VGJMYUloNHVyQVd5VHFydnFEZlpKZ2NBSjBUWk9XbzBYaHVZN3grOHNuT2ZnK3REQkV1WG1RVWVVbXMzUzlvYlkwbDZCYmJqNERwVWlRTVdGTmY5bHZwaXZNS3JJdHB3MGNzR3Qrb2pKdCtIM1hlVVNoWEtINmxEZmYrSHRsQlJLdmZoZmJSZU4zZzlPSVRRbVBuNHB2VS8xQytKcnk3QlFZampRdkJLYndibWZNL1JlNUtGd3I4N282bzRqbUtrZVFJSTBIQjh2RXA3eG96TkJ4T3JLMHgyNWZzeUY1VDFtaGZYN3AxVWdIaFlkeHI2QklmVGlBT2ZSVnRRRVFBbVN6MkpVcVdPVGc5ZTUxOVBpZTJ4TkNhRER3Z1g3VkJRdURaUGN1MWxqOEtXRld6VndldTFzQlAzd0NlVmFBM2lzd3BycXNsMFU0ZVNsSHl6UnVnYUZsbVZCQ2Y1ZXhTQTdnYkN1N0szaHpyQ0VUM2kxeGRVd0UxeGJ3eERpbE54ODlBaFArS0FZbXRQSC80R2VIaTRLU2QvN3k1TzJmQzdpOVNFTDFWQzV6K0YwMWg2eEYvek50Zmt5UzZKcUNzSEdjTEZPZVp4OWJkVzRVL0g4Um8wWitWaGJMMlA2dE00NWN2S0pYeXNVYWN0VTQyRyt3c3c4Um4vbENoQ012eHVBZ20weHE3bzhldEJhdFA1c2tRUDErTTNqZysxRWZGZ1hybFBQREFtRjQxK01WbnA2bkZYRlgwLys1cUdianhCUEU4RGQ4akJkRFA0WXMxbCtRa3NreTVQTEJtYVRSN1QxSUFTck9jSmU2cjc1RDExcHhxSytabnE3TmxSUGE2Z2lEcVRMS3hxK24zazNBOGNWbXhHMzVzcjE1VkRhb2NpaGhPeWZTZ0R2bWk3aU9CcStKemI5QVUyNER5UjFwUm1VYXl0WmN0TDNjbytKRisvNDFYcmM2d05lVy9FK0VyUTdXMDMzRGF4R1NSRmwrNXZ1QnhNdHFpWE9WWWxETVVvVDJLY3IwWVdmYVp2VXFraU9DOERBZVNFY0JZS3VWTjJMUjlCVEZtZ1BqQXdvTlF5cnlIZXhmYnY1Rk16bHRQNm9iQnRmNW9yZE9FcGVuaHo4UkgyNjkxOVNtcmViTytqSG1ibG1oY2IzQnlWcDJhcWltTzQ0cWF4Mkl2OGNpOW1GQkd0a3pLV1BEbHRwT084OWhQbGNQY3YzSi9ZbHljSWR6SFZISEhMdmo3WkROaEE1dElTKzJ3U2FPa2FodVB5NlBCY0ZtYlRqTTgyeThpOTlZdkV0blptZTQ5aVR1Y0c4dkdFNTVtWEZyb0UxZmxNVFN1aWhIVEZSRkxIbm93NDlxbkMwTXJYVERWWHRIYVNtS2FlOUdscFRCWEx1NUlCU1JCVWkvYVhGSC9oSkNZbTcvdUQwbzRKY1NWN3doa3RFWUV5VzNURnhsSmtNUEdXNG5VOU82Z25rRnY5SytqWWptbzZsSFlGbU1vZVc0RWFOSVBzeVBIOUxmQ3AwV1VJTHhZbldMc2RNamRKQ2VRdlJ3ZWVoSC9LM2NCZnVpSWZ6N3pOMi9vcmFIMDBPSlpOOWovamt4ZHRJczZ6eVBHcHFuREpKQzFMV2hkeFpMNDQ4cC9YdjlrV1o5RlhISzdSVWU1WkVldmduaGdhZG9tMnBJZDJPb2xYNVdxUEZrZUZmVmdiUWhjQTZPSlJoRHpsWWpSdThPTDZ0NEl0U28xMk9SUXRRSk9yOUsvYjhhd0xzR2M1VXpJcG5OM0NqSzFPSzUrSENOMnVSRXlDRlpwZlVZRERvandLcDBNUHA3Njk3OGE2Z2pGWVNDdVFtQXF3MGFPZ0hraFpFNlN2QU0wQm85VlZPYkRXSHdrSnZwU25VTWlqeGRIRGY1WHRrcldOdzZ4NHZIWWUxVVFUVDVUNFY5eWlBY1FQS090cXlsRG5yQlk4V3J1VmFFTTlhL3NqM1Z5MGFHeFhTakozZmlxYnVtNHNqTmxQVlVrU1V0U1VCdVVrV0xyK2JSMkZIQ0U1dmtGMHdEL2J3WGo0UU1CaFFtWHFTL2NpTy9KUHltNGx3MzlsUzFzS0NoMXZ6cmhUQUlQbnpWbXRTeDJJS3lHRWVDTDZRYWVWT2VNSGxybVg0eFEweUpYUUp2blZNc1BNZzdMVHpLKy9vNGl5VTVjMG1HSWtOWk1IK21BZitiaHZkMWgzTnMraFhUTkQrZFlvdDQ3RFNDWHhUM3dRV3dUL2g3SkxrYSsra2NrNGdVeFhDbS9MMG5VQjU4RXBZaEk4Q0p3TGtLVFk3a2FBenNJdmNkYStrZzh0TE9oczNlWVZaYXZLOVV4SDhuSXZmS00raU9CUXJleStzUzJPeXJHMXp2S04rblBwR0QxdUdDMHdpbU5VcTNBMUU2REFRcDR6b25ESWpQQmVDVzdjbTQ1bExJMEtObzZ3Sk51azVJUG4zeUVWVEptZWhjaW12UG1reVRYVT0=

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

暂无评论内容