温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

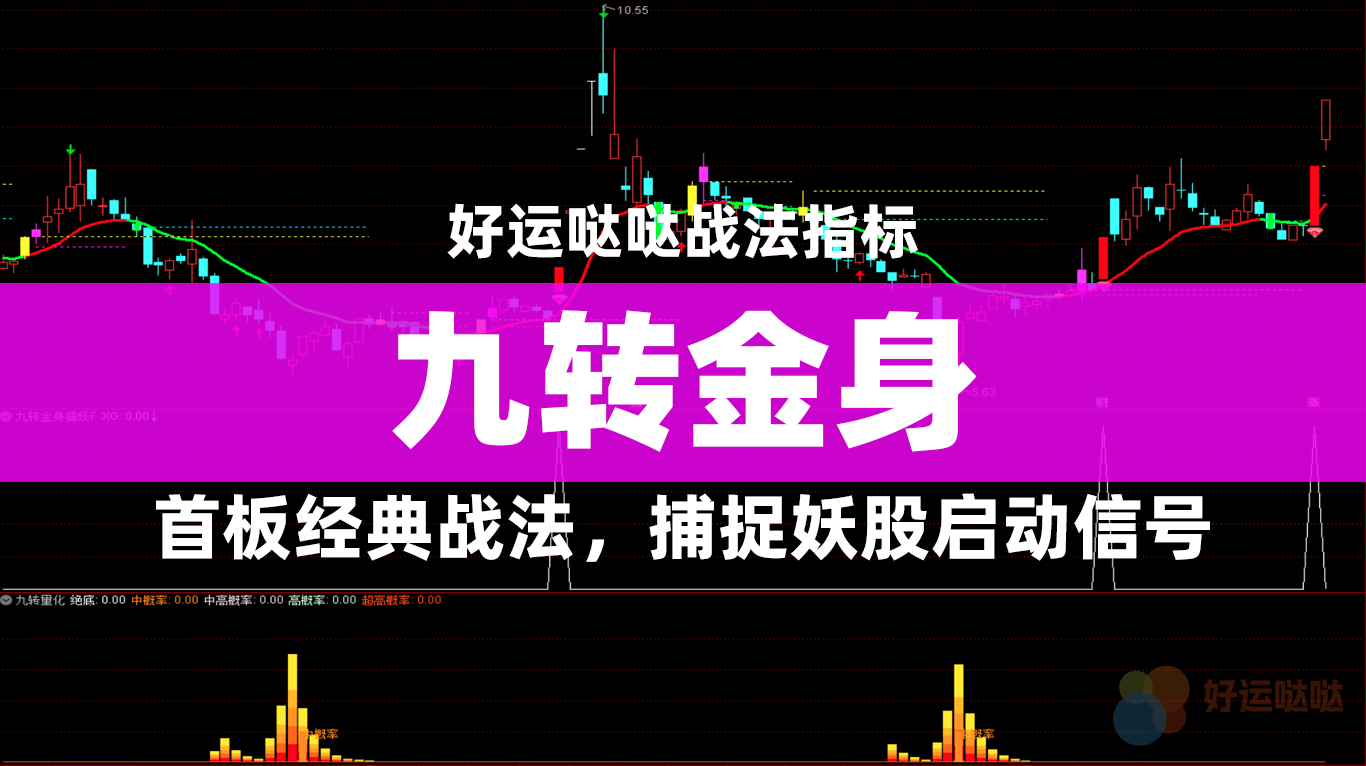

通达信最实战的指标60副图源码

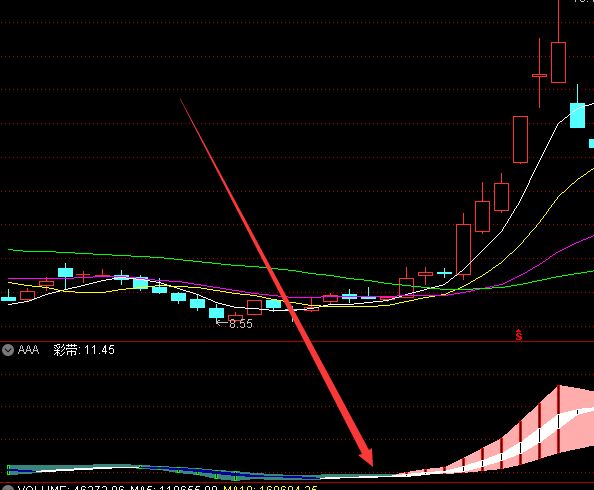

住图:

CYC34:CYC(34),LINETHICK2;

CYC81:CYC(80),LINETHICK2,COLORRED;

============

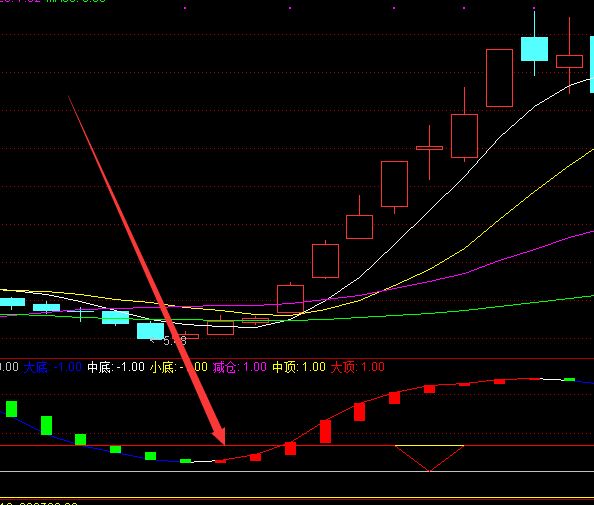

副图:

LC:=REF(CLOSE,1);

RSI1:SMA(MAX(CLOSE-LC,0),3,1)/SMA(ABS(CLOSE-LC),3,1)*100,COLORWHITE,LINETHICK2;

底:25;

75,COLORRED,LINETHICK2;

60分钟回调红绿线附近,RSI最好小于25.特别强调:只适用60分钟。每天挣个千儿八百{指标网www.haoyundada.com}就跑!老指标比资金流向还好!

以上内容为网络收集来的数据,未经过测试整理,请自行研究,待整理完成会重新更新发布!

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0WlVjQm1IOERaWTBadEh2d1o1dGM4V2g1c1BnMmpqOTZZUnBBK0xObTBwM2p1UGliYnpkRCt6Vk1EUkx1VVg4UExOU1Nyd0VydzdPbmU5eldLMXZDM3gxMWh3UXcyS1AveUk0cUhsQzgzMkxYSkxsb3J6S3NyejdtbVA5RXdrOHhIRWtuU0hLRW1JaDhIVld6bElyY0puTFVtbWdnQUYyNi9sZ0tFNEtyQ0lQb2V4bS9NVlp6QlFGbU5jWUxlYmJVQWJTMzh5MUtYY05tcVByV0FTSW92azNiZ3ROVVJSdTFtaUt3ZFN4dEZuVld1WWZ1b1pBUDZjQ083cE9iNUlrOVQvclA2NnJlRy94UnhNWTAwN2tReGMrNEVMMFNaWVo1Wnl3NE9qOHhscHZkSmkyVVFZRkRXMXc2bU1vaDZwenpJaU1lc1A2WWdtQVdUd01ieFRkcVE1UFZKdHBQZ2owb2tZVGRHbHN4K3laaGNNdStlWlU2cithTXM5SjlFRjliaDM3ZHA1ckFzTWVOVkR5bkptZUR4RVdsczYvL3pjaXpQVm55UlVBL0VFMFpwcW5uT1RuMEoyckt2QmJIS1RyZjVpWW4xZHA5dklBVmY0YnJ3bDB4TGFkMGpPRWR3Q0pHRUZMcjBwZXo2Wk04bHpTViswbEd3a0xzZnpaWnRaSFZUOU4vRXF5T1ozM3RPandXV3l4WUw4dk9mK2tBSXpBdTk5bThQQWduVTBwUk5JTDdRM0h2N2doV2g1cGJVdXlYRUFzeWxIbmNXanhYdm13MEdhYjM3TnN1cU0wTHBqc0h2YW00MVBKZGc2c1pqbmk1UmF2cDQwcDJLdG9VVTZCQmhqQXFLNVVORmcyWDVyM0FSVmpJQzlhSkJ2Y2RsbUUwUHErYlRBcFM3Tk4rQnBnTCtsMElXOUJITTNPaXEzU0U4VG1wd0FBaWQ2NnE2WTN6MEo2blFIMm92VmtkYnpvd0RoZ05UTVVNVXJvbTArNkNNTC9ZK0g4WDVXUjhXNTMrQmxpa282cndQcFVoZENOQlJ2aG5KZzVPS1pRTHZmdmV1Z3phdWdYRVJ0UWMyMGZ2aWV1K2pIQVJUR0dZUEhaVENrdmpiMTlBdnAyNXkzSEZwU3pzVSt2NjBMVVhkTlI2RFV4b2M4RnFxTW13b1ZNVHdrTDlIZXRBQXlKV1BlMVZIdmViZ01EWmhXRVpBcnpleEttdjRjNHhLYTgxRExvWkFVUHZ4Yms0WUE5QVorN1lhYXo0TjYvRCtna3FLdDdRVVhLczl5cVZLK1FIclc2VkI0S01NMnlwYjQvclVNYWQ1L1E0S2pHeWxYalNESWczK2Z6bHI5bWd5dWhOb2JiYkVwcStNcDFjUEpOUEp2d0tFcWk2MzVtOXBNLzBuVm1LaXpnWjVTZ3g1ZHAyR3pUbFlKY2ZPdVROdU51V3JCdFF2T0lBZHd0aytkTVg1OG1sWll5amRjSGczQnVmYXl4bS8xdnBYTGhlU0Rl

RVdTOUtDenh1c1RzcTJZc216SUM0WlVjQm1IOERaWTBadEh2d1o1dGM4V2g1c1BnMmpqOTZZUnBBK0xObTBwM2p1UGliYnpkRCt6Vk1EUkx1VVg4UExOU1Nyd0VydzdPbmU5eldLMXZDM3gxMWh3UXcyS1AveUk0cUhsQzgzMkxYSkxsb3J6S3NyejdtbVA5RXdrOHhIRWtuU0hLRW1JaDhIVld6bElyY0puTFVtbWdnQUYyNi9sZ0tFNEtyQ0lQb2V4bS9NVlp6QlFGbU5jWUxlYmJVQWJTMzh5MUtYY05tcVByV0FTSW92azNiZ3ROVVJSdTFtaUt3ZFN4dEZuVld1WWZ1b1pBUDZjQ083cE9iNUlrOVQvclA2NnJlRy94UnhNWTAwN2tReGMrNEVMMFNaWVo1Wnl3NE9qOHhscHZkSmkyVVFZRkRXMXc2bU1vaDZwenpJaU1lc1A2WWdtQVdUd01ieFRkcVE1UFZKdHBQZ2owb2tZVGRHbHN4K3laaGNNdStlWlU2cithTXM5SjlFRjliaDM3ZHA1ckFzTWVOVkR5bkptZUR4RVdsczYvL3pjaXpQVm55UlVBL0VFMFpwcW5uT1RuMEoyckt2QmJIS1RyZjVpWW4xZHA5dklBVmY0YnJ3bDB4TGFkMGpPRWR3Q0pHRUZMcjBwZXo2Wk04bHpTViswbEd3a0xzZnpaWnRaSFZUOU4vRXF5T1ozM3RPandXV3l4WUw4dk9mK2tBSXpBdTk5bThQQWduVTBwUk5JTDdRM0h2N2doV2g1cGJVdXlYRUFzeWxIbmNXanhYdm13MEdhYjM3TnN1cU0wTHBqc0h2YW00MVBKZGc2c1pqbmk1UmF2cDQwcDJLdG9VVTZCQmhqQXFLNVVORmcyWDVyM0FSVmpJQzlhSkJ2Y2RsbUUwUHErYlRBcFM3Tk4rQnBnTCtsMElXOUJITTNPaXEzU0U4VG1wd0FBaWQ2NnE2WTN6MEo2blFIMm92VmtkYnpvd0RoZ05UTVVNVXJvbTArNkNNTC9ZK0g4WDVXUjhXNTMrQmxpa282cndQcFVoZENOQlJ2aG5KZzVPS1pRTHZmdmV1Z3phdWdYRVJ0UWMyMGZ2aWV1K2pIQVJUR0dZUEhaVENrdmpiMTlBdnAyNXkzSEZwU3pzVSt2NjBMVVhkTlI2RFV4b2M4RnFxTW13b1ZNVHdrTDlIZXRBQXlKV1BlMVZIdmViZ01EWmhXRVpBcnpleEttdjRjNHhLYTgxRExvWkFVUHZ4Yms0WUE5QVorN1lhYXo0TjYvRCtna3FLdDdRVVhLczl5cVZLK1FIclc2VkI0S01NMnlwYjQvclVNYWQ1L1E0S2pHeWxYalNESWczK2Z6bHI5bWd5dWhOb2JiYkVwcStNcDFjUEpOUEp2d0tFcWk2MzVtOXBNLzBuVm1LaXpnWjVTZ3g1ZHAyR3pUbFlKY2ZPdVROdU51V3JCdFF2T0lBZHd0aytkTVg1OG1sWll5amRjSGczQnVmYXl4bS8xdnBYTGhlU0Rl

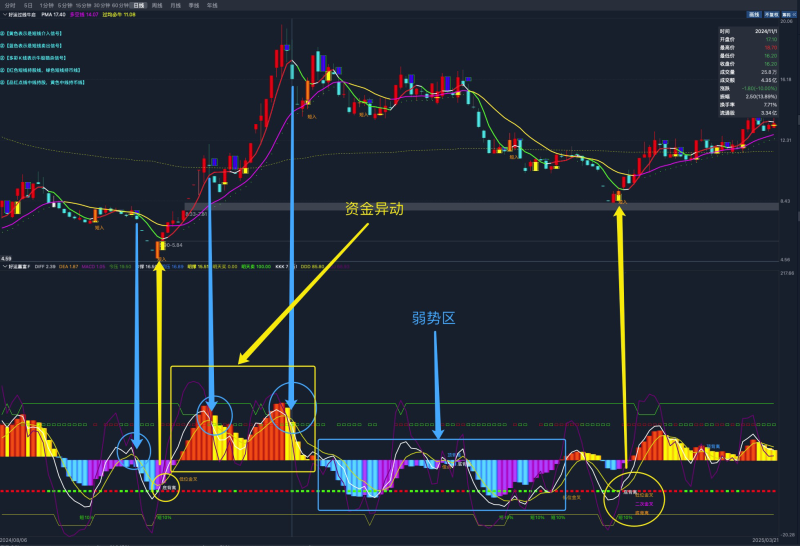

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容