温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

涨停板是证券市场中交易当天股价的最高限度,当股价上涨至该限度时称为涨停板价。这一制度是我国证券市场特有的价格稳定机制,具有以下核心特征:

基本规则

-

涨跌幅限制:

- 主板普通股票:10%

- 科创板/创业板:20%

- ST股票:5%

- 新股首日:44%

-

交易状态:

- 达到涨停价后仍可交易(非停牌),但无法以更高价格成交

- 封单量(涨停价未成交买单)反映资金强度34

市场案例观察

- 近期连板股:如2025年7月24日西藏天路、保利联合等13只股票达成4连板

- 风险案例:浙富控股在四连板后次日”炸板”,导致涨停价追入资金单日浮亏13%

主力行为识别

| 涨停类型 | 特征 | 主力意图 |

|---|---|---|

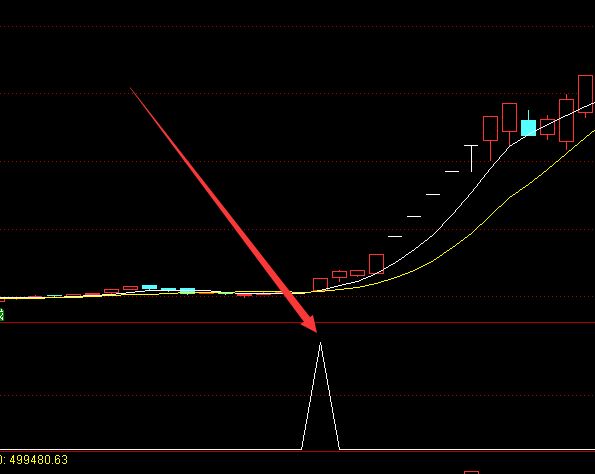

| 金坑板 | 前期超跌30%+,成交量突增3倍 | 洗盘后暴力反弹 |

| 反转板 | 突破20日均线,尾盘偷袭涨停 | 测试市场反应 |

| 阴阳板 | 尾盘封单不足1万手,换手率20%+ | 诱多出货 |

制度设计特点

- 实施时间:1996年12月16日

- 国际差异:区别于熔断机制,允许限价内持续交易

- 特殊情形:权证交易无涨跌幅限制

该制度通过限制单日波动抑制过度投机,但投资者需警惕”一字涨停”后的流动性风险及游资操纵可能。对于涨停股的分析应结合封板时间、成交量变化及基本面综合判断。

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0WmNNbll5VjcxSFI2emRwdXdORlJVODFNb1UwRVBEZks1YytQWFBCS3MxeGM2SFQ1M1phejQzTFRBcW95c0IvWm9HcW1pVjJac29jVW1QeW1PK3BMZ3hZbTYrRGovN3F5QlVQWGtGRGhuSUxwS3ZWNTFIR21UQUlrNlg3bHFiOFBLRkxVenNWbjJicGZOcXc5ei9WSDU3RHlEc2dmTjNnRXViV0R1MnZPWXJYUUVFTWR3QVBmMWFHMXMybmw1MGJrakI2djNkbVY3eng1Q3Eycm1ZMldrNzdneEthSXVxczFhZTRtMWdYWTgxV2hSYnpVOENDbWhpbEp3ZTNrdGdOZXEvN1hxWk1IVGZHWUphT3ROcjhWdmZBRXlQRTBOOUZjeU0wMFhvZEk4b3lKVUdXZ2pkenZZa250NUE4S1NGSWhkZHNoTU5IVWVIWG9yOWFCcm1xUFN3T2EyZ0luWDVrQXpsamR6OEtaTjJvMkNYWXVkRFVyZzgvMzdYbFM4cXB4T2t1TUdiU3lpeHFyTndHd1BtUjlvekxmSDNOR3U1S2IzUXB3ZmFFOFB2Tis3UVdZeTZwTjhLREFFNkVtMlBqdDZEeXdTU3UvbTJuWGtlb2I4QlpBL2x5RHVvalo2bWpUTkN1V3prVVd2bVlKN292YXZmMkJHR2loZzIxYmF5dU43bkdEUHUvVUVNcE4xNzFPQXlhWDZqcWRuVUpXcVl3TzdDemlnL2V5SzlpOHE5WDlRT0Z4ME96eWo4aDBoM3dkNVZtai9EZEwvbGlvMDJrVlNFUzJZZmdMbVZBRVcrdThoelY5cXpMUlVwbXBDOTJOei9TeFc5M0UvTWxFQ2VBMmVBT3IwSW1NUGZGYWNJc24rQlVvdW1QSjlQYitBUGZYNmYzSmhuVjNraGltSXZ0YjkrUGhQZ0lWNitza0hXYnMxNi93aVkvTlVRUDNtZ0ZWR3lpS1NGaWVsTCtvaDhad0pKbUczYXYrRERYSzB2OEM0TUpDcWlaWkY0NkM2UlFIcGFqRHUxbDZ3YzBhWHJmZHdJQnNTYmhqMFlJUGdyVUk3UDRkNTFzYUpLMWNieXZoZUloQ2gxeFFSNjk1WklOZFJ0UDYzNVQ3U0xvT2ZvcjJSbm4xUGRPV3hyODlkbFVENHF5YVJoOEhCK29HY1l3YWRTWG5ROTJoK2JXQXQrOHM2dThrd0FzenVtWEJFMTIwRWRaY1dwWC9ZMng3c0V3eHpnZi9EQmoxMndxMTFGaTFDRGh0WU1ONUdDanBQNnZRclNQSVBkemdxZlg4Wnd4R1I1VU1rR0JzMk12T1Z5U2swOXlEVGxvNjg3aW1TdnJMREtnNzRnWGgyc2ZQNjhlb3JrdzdpbGZpWEJwcVdjTFpIM3VQOGVzOXcyZHI1SjJaajVrdC94OEY2dC9pNTdwUk90NjJSZE1WM2hhUXVsaWd5aHk1TGJwL2JRbGdkUU1SMkFxZHRQRnlwTnE3SGJyOXVkRUFUQ2RSWUp0WEZkN0N6QnBBN1NMNm1GWHA2S0ZHR1djSTJQeDc4NGtuQlZpcjNIVHBjcVVEWjF3OHJreVJlTkx6eWE4TFMrWFdobkEwZ1lLRWhyZ25uLy9USFNucXNrSDg2Q0hERzNMay85SGNucjRyYTBHNldCazRGdlFhdVdaR0xVM2I1em5kMUpaWi9DOTdlT2dJaEhpdWxMbHRtNXNOd3A1QWlJSEJRbFMwRUNiZkQ3TE1nNW1WN1JrRnJRK3J5eUk1c3ZwanZzZlhra0cwQ2ZqN29mL3c0MVlXcFZaSVBRYWxJajk5emFZNUVPQjZJb3I3bHd2TUIzQ2NGOWJEVXZCZVFOeXBCYitvSEx1QWY1a1QwNWxybXovcnd5TGJEWjBzM2NDeUIzMVlQTlhJN0ltMXpxSVNrcmR0OTEzdll6d0FFM2lWZkFhNWxjanU3T1BXVFZkMjZHd1QyR3owNnJmaU5ORkN2cVh1Y1B5bUowQ09MdVFMZ3hnVGcwRmVLMkxnQ0pPclI4Zkl6RTN0dXpHTTFqbEYwV25PQ3JIT2JINFFiMERRSE1uMDNKYXBSUkMzUzU5d1FhbDlZeE9BYU5Gc1hqTzJqQ2V1a1Z3ZXo0dUJBKyswY2Y0WXFPR1B1ZUlQbXVBaCtCVGJiQ0ZYaEI3dnpzNDlpczlLem9IaVp3MXJmNTJvYlQ3YU1qdmlucElCS0xBY2tpbGN1RFRnZklheDJYMFFyVDNBVFRHakI3YXhycEQ5YklXQ3l2SERNb2JKem5QbGw2eWFVQVJ4TWFjQWhiR2ZZVWtVL0hqNThDY1dJUS9ITlJNTU5OWFZKR0ZCbytEeWRNQUF0cUQ4YW01N2J2RkJDS1NLcEZLQjJpbW5xSHFRMkJNTzJPMkxrR0dKUFBUNnZOWUVOZWRWa1hEQ0RENTVmb2FDaVhyU3pVR3AxRnBsNDRNVnFsZi9jY0NiVHd2YmZYWlFPbXNreHpETUZGNkxXYUpiQVZaaFM5SkxWZDNqL2dWcG9oNXJoNXJVc3pSS2s2N3pLQVY4L0FVa1hxT2locjg4L04wOWx5RVd6WTZvc2FYaTlYaHVFWXc5bjVLTjBGZGtha3JPampyVCtvQ1MrYmFMK3lyMzZVc1UxbllRVVgwenBocFNUWk5xbGsydjZuRWtFUktQRVpIek5XMDVLdTN2N1AyNGFPRjltVFA0bW1HVGIycFJWeGd4UGFLOGVlTTAyK2NVZGVLYW0vOE9jY1dlQlU3bndoSWluWXp2YmFzNUZxaFlmYVhqelVxNHN1OGU2cm5kS1BsUGxaSVpNVXMzVDdiSkF2azBnSEpiaEtTaDg3RG5KWTl5TDZQVTRVZldURjJjZmdMYUNabjVLV0VlZ3ErQ2RhaVV5MCtOY0pURVVMR2hySWQrZnU1Nm42THR3SzFGYW8wdHZybTk5YXkrNHk0M1d2RjN2SlA1Q1JxK2R3Q3NJZHJKMnczK2t5c0Q4K3hjUU53QVRKWUFFS1NuMzN3eXJYVUg3Uit1d1JLWFdwU0E4RktKaDRDMm42YWxvUUVJcFdSeHgrUmozV3c2UHFURGROa0F0a0JQZk1EMVFvTHlMbGx5bUFQZ3hTZE9SRGw2dW1xWkkvd29QUXF0cVJzY081Z2hJV0c0cDV2T2hYaTNxUHVzcVRFWkxnc3hRNjRKd0o5NzRZYmJsNmdhMGxJek5nanJadUlFY0ZaeUlOVEtrZ2pJS2dFc3VtdDFNVXdUQi8rM05weS9mbUtKcWlSbENYUjd0Wm9IZzNoMEs4cy9HMlBOSjZLT3U2Yjd4SlM2QXRGL1BLckFvYmNYOUpvM0xjV21vY2NvT0RlamZ4bHp3ZDd4VHh1UXIxOTFPNC9rczNudXVDc3IzR2VVQnlqUHdRMElacnkvY0RoWW8ySUFBUnByM1RwcUdPNXVUOUlDSXJBVnJ6Qkl0WStCbWZsbGVQQzEzU0NMMmRoZzRjSEVZVmxSSExEdEFYYTgyWGFFWGlwVFpnYVVxazNlRm9CQTJwL3IvTlljRWtsbUhlWEhhSStkU0QrdVlvUzVGQTYwSUtqcWFENVZrOTk0d042ZytOWXRZeGxLUlp2Q0JqY05ZZFNITUEvT0k0NHQ0MEpMNTF4RE1LT2N0a3FWYVJEeDVNNCttN2dpcTk2cEt2QmppWDhsVy9WeVdhSU9SNUJzMUNRMGpSR1VXUWFqcm1PR2t2aHBkbVRpVnhRNnNtRzJJMlFGTGlLYUI2YjdXTUgyWFA4MzNLdHhSNjNNdVVIYnFna2xYSFNkSTd5VHBBUXNrZlJQb1Z3SSs5d0NrTVFweko0WWtrTElhcXY0OC93MjEvQW5oVUM3Q0xBMksxNitBQWkrN1czazZjb1dSMURRQnJ1YWQrMVk0WXM1aHNDazN1bExoZEFMWmUxV1Z1Ulo5TFhMOElaUDMrV1JEME5DMDVPM1VHeVBBVGNuLy8vVmt6QUdMdDlNMytFMWpRUkxRdmNGaEhmNjFNS0ZVOUY1QmF3bG9XRlVwSnBhcmJ0aEdXVjBJR3JEeFZiWi9BNDNkb1NycTIvUHVQY2hMdkFGRXBlNFpNcXcrOWFlSFJNaHJkb0ZsMG9UTzlqb2VyamhleVc2L3cycklFbGFGbmQ0dzFKdG1MZHp4OENkdjB4YTduY1FqQ010S2RHVlRuZE9YTFFqbm5qK3lFOUl4OHhZK2J3c2FRVDBXYWtiemY5OFdLVG1uUkpibUUyOGkxTzErTnh6YzhXVHpBMmNpTnJYblRwbE9lUEVXd3dRSzN2R2loSWpGNmFhWFJPUnlnTmRjS0VBRSsxcGdRUkxCSTk2c2VUTHpGRU1HR1dMaWdHR3JGRlgxWTI0ajBDbDNkRFlRdz0=

RVdTOUtDenh1c1RzcTJZc216SUM0WmNNbll5VjcxSFI2emRwdXdORlJVODFNb1UwRVBEZks1YytQWFBCS3MxeGM2SFQ1M1phejQzTFRBcW95c0IvWm9HcW1pVjJac29jVW1QeW1PK3BMZ3hZbTYrRGovN3F5QlVQWGtGRGhuSUxwS3ZWNTFIR21UQUlrNlg3bHFiOFBLRkxVenNWbjJicGZOcXc5ei9WSDU3RHlEc2dmTjNnRXViV0R1MnZPWXJYUUVFTWR3QVBmMWFHMXMybmw1MGJrakI2djNkbVY3eng1Q3Eycm1ZMldrNzdneEthSXVxczFhZTRtMWdYWTgxV2hSYnpVOENDbWhpbEp3ZTNrdGdOZXEvN1hxWk1IVGZHWUphT3ROcjhWdmZBRXlQRTBOOUZjeU0wMFhvZEk4b3lKVUdXZ2pkenZZa250NUE4S1NGSWhkZHNoTU5IVWVIWG9yOWFCcm1xUFN3T2EyZ0luWDVrQXpsamR6OEtaTjJvMkNYWXVkRFVyZzgvMzdYbFM4cXB4T2t1TUdiU3lpeHFyTndHd1BtUjlvekxmSDNOR3U1S2IzUXB3ZmFFOFB2Tis3UVdZeTZwTjhLREFFNkVtMlBqdDZEeXdTU3UvbTJuWGtlb2I4QlpBL2x5RHVvalo2bWpUTkN1V3prVVd2bVlKN292YXZmMkJHR2loZzIxYmF5dU43bkdEUHUvVUVNcE4xNzFPQXlhWDZqcWRuVUpXcVl3TzdDemlnL2V5SzlpOHE5WDlRT0Z4ME96eWo4aDBoM3dkNVZtai9EZEwvbGlvMDJrVlNFUzJZZmdMbVZBRVcrdThoelY5cXpMUlVwbXBDOTJOei9TeFc5M0UvTWxFQ2VBMmVBT3IwSW1NUGZGYWNJc24rQlVvdW1QSjlQYitBUGZYNmYzSmhuVjNraGltSXZ0YjkrUGhQZ0lWNitza0hXYnMxNi93aVkvTlVRUDNtZ0ZWR3lpS1NGaWVsTCtvaDhad0pKbUczYXYrRERYSzB2OEM0TUpDcWlaWkY0NkM2UlFIcGFqRHUxbDZ3YzBhWHJmZHdJQnNTYmhqMFlJUGdyVUk3UDRkNTFzYUpLMWNieXZoZUloQ2gxeFFSNjk1WklOZFJ0UDYzNVQ3U0xvT2ZvcjJSbm4xUGRPV3hyODlkbFVENHF5YVJoOEhCK29HY1l3YWRTWG5ROTJoK2JXQXQrOHM2dThrd0FzenVtWEJFMTIwRWRaY1dwWC9ZMng3c0V3eHpnZi9EQmoxMndxMTFGaTFDRGh0WU1ONUdDanBQNnZRclNQSVBkemdxZlg4Wnd4R1I1VU1rR0JzMk12T1Z5U2swOXlEVGxvNjg3aW1TdnJMREtnNzRnWGgyc2ZQNjhlb3JrdzdpbGZpWEJwcVdjTFpIM3VQOGVzOXcyZHI1SjJaajVrdC94OEY2dC9pNTdwUk90NjJSZE1WM2hhUXVsaWd5aHk1TGJwL2JRbGdkUU1SMkFxZHRQRnlwTnE3SGJyOXVkRUFUQ2RSWUp0WEZkN0N6QnBBN1NMNm1GWHA2S0ZHR1djSTJQeDc4NGtuQlZpcjNIVHBjcVVEWjF3OHJreVJlTkx6eWE4TFMrWFdobkEwZ1lLRWhyZ25uLy9USFNucXNrSDg2Q0hERzNMay85SGNucjRyYTBHNldCazRGdlFhdVdaR0xVM2I1em5kMUpaWi9DOTdlT2dJaEhpdWxMbHRtNXNOd3A1QWlJSEJRbFMwRUNiZkQ3TE1nNW1WN1JrRnJRK3J5eUk1c3ZwanZzZlhra0cwQ2ZqN29mL3c0MVlXcFZaSVBRYWxJajk5emFZNUVPQjZJb3I3bHd2TUIzQ2NGOWJEVXZCZVFOeXBCYitvSEx1QWY1a1QwNWxybXovcnd5TGJEWjBzM2NDeUIzMVlQTlhJN0ltMXpxSVNrcmR0OTEzdll6d0FFM2lWZkFhNWxjanU3T1BXVFZkMjZHd1QyR3owNnJmaU5ORkN2cVh1Y1B5bUowQ09MdVFMZ3hnVGcwRmVLMkxnQ0pPclI4Zkl6RTN0dXpHTTFqbEYwV25PQ3JIT2JINFFiMERRSE1uMDNKYXBSUkMzUzU5d1FhbDlZeE9BYU5Gc1hqTzJqQ2V1a1Z3ZXo0dUJBKyswY2Y0WXFPR1B1ZUlQbXVBaCtCVGJiQ0ZYaEI3dnpzNDlpczlLem9IaVp3MXJmNTJvYlQ3YU1qdmlucElCS0xBY2tpbGN1RFRnZklheDJYMFFyVDNBVFRHakI3YXhycEQ5YklXQ3l2SERNb2JKem5QbGw2eWFVQVJ4TWFjQWhiR2ZZVWtVL0hqNThDY1dJUS9ITlJNTU5OWFZKR0ZCbytEeWRNQUF0cUQ4YW01N2J2RkJDS1NLcEZLQjJpbW5xSHFRMkJNTzJPMkxrR0dKUFBUNnZOWUVOZWRWa1hEQ0RENTVmb2FDaVhyU3pVR3AxRnBsNDRNVnFsZi9jY0NiVHd2YmZYWlFPbXNreHpETUZGNkxXYUpiQVZaaFM5SkxWZDNqL2dWcG9oNXJoNXJVc3pSS2s2N3pLQVY4L0FVa1hxT2locjg4L04wOWx5RVd6WTZvc2FYaTlYaHVFWXc5bjVLTjBGZGtha3JPampyVCtvQ1MrYmFMK3lyMzZVc1UxbllRVVgwenBocFNUWk5xbGsydjZuRWtFUktQRVpIek5XMDVLdTN2N1AyNGFPRjltVFA0bW1HVGIycFJWeGd4UGFLOGVlTTAyK2NVZGVLYW0vOE9jY1dlQlU3bndoSWluWXp2YmFzNUZxaFlmYVhqelVxNHN1OGU2cm5kS1BsUGxaSVpNVXMzVDdiSkF2azBnSEpiaEtTaDg3RG5KWTl5TDZQVTRVZldURjJjZmdMYUNabjVLV0VlZ3ErQ2RhaVV5MCtOY0pURVVMR2hySWQrZnU1Nm42THR3SzFGYW8wdHZybTk5YXkrNHk0M1d2RjN2SlA1Q1JxK2R3Q3NJZHJKMnczK2t5c0Q4K3hjUU53QVRKWUFFS1NuMzN3eXJYVUg3Uit1d1JLWFdwU0E4RktKaDRDMm42YWxvUUVJcFdSeHgrUmozV3c2UHFURGROa0F0a0JQZk1EMVFvTHlMbGx5bUFQZ3hTZE9SRGw2dW1xWkkvd29QUXF0cVJzY081Z2hJV0c0cDV2T2hYaTNxUHVzcVRFWkxnc3hRNjRKd0o5NzRZYmJsNmdhMGxJek5nanJadUlFY0ZaeUlOVEtrZ2pJS2dFc3VtdDFNVXdUQi8rM05weS9mbUtKcWlSbENYUjd0Wm9IZzNoMEs4cy9HMlBOSjZLT3U2Yjd4SlM2QXRGL1BLckFvYmNYOUpvM0xjV21vY2NvT0RlamZ4bHp3ZDd4VHh1UXIxOTFPNC9rczNudXVDc3IzR2VVQnlqUHdRMElacnkvY0RoWW8ySUFBUnByM1RwcUdPNXVUOUlDSXJBVnJ6Qkl0WStCbWZsbGVQQzEzU0NMMmRoZzRjSEVZVmxSSExEdEFYYTgyWGFFWGlwVFpnYVVxazNlRm9CQTJwL3IvTlljRWtsbUhlWEhhSStkU0QrdVlvUzVGQTYwSUtqcWFENVZrOTk0d042ZytOWXRZeGxLUlp2Q0JqY05ZZFNITUEvT0k0NHQ0MEpMNTF4RE1LT2N0a3FWYVJEeDVNNCttN2dpcTk2cEt2QmppWDhsVy9WeVdhSU9SNUJzMUNRMGpSR1VXUWFqcm1PR2t2aHBkbVRpVnhRNnNtRzJJMlFGTGlLYUI2YjdXTUgyWFA4MzNLdHhSNjNNdVVIYnFna2xYSFNkSTd5VHBBUXNrZlJQb1Z3SSs5d0NrTVFweko0WWtrTElhcXY0OC93MjEvQW5oVUM3Q0xBMksxNitBQWkrN1czazZjb1dSMURRQnJ1YWQrMVk0WXM1aHNDazN1bExoZEFMWmUxV1Z1Ulo5TFhMOElaUDMrV1JEME5DMDVPM1VHeVBBVGNuLy8vVmt6QUdMdDlNMytFMWpRUkxRdmNGaEhmNjFNS0ZVOUY1QmF3bG9XRlVwSnBhcmJ0aEdXVjBJR3JEeFZiWi9BNDNkb1NycTIvUHVQY2hMdkFGRXBlNFpNcXcrOWFlSFJNaHJkb0ZsMG9UTzlqb2VyamhleVc2L3cycklFbGFGbmQ0dzFKdG1MZHp4OENkdjB4YTduY1FqQ010S2RHVlRuZE9YTFFqbm5qK3lFOUl4OHhZK2J3c2FRVDBXYWtiemY5OFdLVG1uUkpibUUyOGkxTzErTnh6YzhXVHpBMmNpTnJYblRwbE9lUEVXd3dRSzN2R2loSWpGNmFhWFJPUnlnTmRjS0VBRSsxcGdRUkxCSTk2c2VUTHpGRU1HR1dMaWdHR3JGRlgxWTI0ajBDbDNkRFlRdz0=

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容