温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

一、ST股票基本概念

ST是英文”Special Treatment”的缩写,意为”特别处理”。该制度自1998年4月22日起实施,针对出现财务状况或其他状况异常的上市公司股票进行特别标识。

二、ST股票认定标准

财务状况异常情形

- 连续亏损:最近两个会计年度审计净利润为负值

- 净资产不足:最近一个会计年度股东权益低于注册资本

- 审计问题:注册会计师出具无法表示意见或否定意见的审计报告

- 调整后亏损:财务报告调整导致连续两年亏损

- 监管认定:被交易所或证监会认定为财务状况异常

其他状况异常情形

- 自然灾害、重大事故导致生产经营基本中止

- 涉及赔偿金额超过公司净资产的诉讼

三、ST股票交易规则

- 涨跌幅限制:5%(普通股票为10%)

- 特别提示:ST标识并非处罚,而是风险提示机制

四、暂停上市与恢复上市

暂停上市条件

- 公司不再具备上市条件

- 财务披露违规或虚假记载

- 重大违法行为

- 最近三年连续亏损

恢复上市条件

- 前三项情形:依据证监会决定恢复

- 连续亏损情形:需在暂停期间披露盈利的半年度报告

五、终止上市(退市)情形

- 未按期披露半年度报告

- 披露盈利但未及时申请恢复上市

- 恢复上市申请未被受理或核准

- 恢复上市后再次出现亏损

六、ST制度与退市制度的区别

- ST制度:风险警示机制,针对连续两年亏损公司

- 退市制度:市场退出机制,针对严重违规或长期亏损公司

- 关系:ST制度是退市机制的前置环节和有机组成部分

七、投资注意事项

- ST股票风险较高,需谨慎评估

- 关注公司基本面改善情况

- 了解相关交易规则和特殊风险

- 理性分析公司摘帽可能性

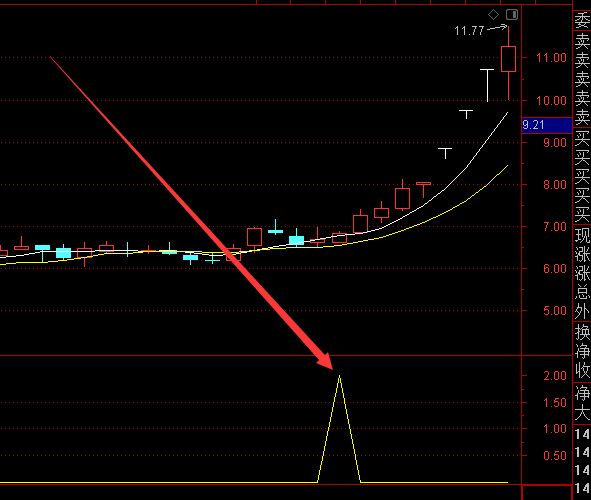

如需获取更多股票分析工具和指标公式,可参考专业平台提供的历史数据回测、未来函数检测等功能,辅助投资决策。

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0UUYwZkZ3WmNta1BjeCtZWk1iMjFmcVNrVlRIaWxWR3oweEsrV3M2bTM4eUovQXYzK1ZSdS9MSGZ3UUNmbXFpaVIwNGFQUXN1SjhRWWtkM3hZZ3RkcXh4eFhZcFEwNUZEekhxaFM2bit0ZTNBdFBCM2h5YlhZekQyUmJLNnZkQW9pWFpEUHhBQWdmTXhDZEp1UjI4cmVYUktuU0lsekh0cXdsNGc3K25FUCtkVnQ0Tm1nclNHcCtMaFF6L1prYmhSV1o2SSs5TXFWODM3UFBMVElGb05FbUNyUHpWaG9LM2I1d1kxM0RGWERaOE10YW1La0piaUJiRXRJWC8yRlVYSk82VXpHeHkxZG9Zd21wUjBuWlcwcVozMWtMWFJ2K3JNa2lJSWExTkk4ZWdjYjdrQlhxM0hZaDlxblA2ajN6SkhEdnEwbEo1NVkyazVoYWV1Q2dNQ0RFd2hFZUduRTlEMTNVUWdaVnZITXkxWEdIdnZiVVVaQ3dmSGIyOFFZZjh4RkNJSFF1ZVRTL1BZeUJVZjh1cTYrS1h6UEdOZFV6ZVNCUzdoWDBWdk93bzZ2T0QzNGVvVDM5SlpzdlRtbUcxTFM3Y01iUmk1Rm1zbGJHZ3Byenp1V1hkNDdQZFVKMy9ZcWVTT2NxblVIc2paQ0pHSTlxUjFFRzhPTVpUcHpXMGVidFc3eHhMN2d3NHBuakJ6MDZobVU0dlA4QnY1Z052ZC9TVGhRdmZtT0doKzhQOTVFVnZPV1JFV3RRYUsrWEp5dTFFMjNMQk85cVNqclVKTTdJVE13TmE4Q1I1eFEwMmRzVVZ5Um0veXVKOWNCWUJ6VlR3b0xMUDUycDYrUnZ2dzduNExUQWF4dzZLQ2Z0bjhpdUVXVUhieEZVR3FwTzNhYlZQS3k2cEpSZFRheVBoNUEwNGZLQm5MdnloWFN6ZUk0RU8zRC9saVRGMWVlK1J2dHlQbVh3dFd1UE42RmRkQUpHNDYvNTR2enVVS2lOcDJjMWR6RTg4MmdNY0xSSklONW0zOTZNbXJhSFMyNnNlT0lIcTN6dTJTRFFieVRMWi95RHdkT3dwdVh0NnZia0MxdnBya2RUMFlGR0FsR21zbExETGRNSVFRNTl2RTN4eEtoN1ZlMmJzTU5mMFBvNCttem9MZ3ZQTjlMekVXMlM5clZLL0hYWU5aVVRIeXNhRTl0ckNjMzRCLzNHQlVvb3JKZ0pjbnhYc0ZTVHpiUFRmNzFNV0VIRHVYSk1jTmwrVE41QVdYbm9uTmQ4cGdmU3RPcFpGbXRxcFBUK09UTTBBS1dvSllxT2dqN3FERE1NTHF2d2pZYUVVSzgyTVJGVEpFR2w0c013SVJHZzZwRkZmZFB6NGdLeXFLZVA2SGNaSW5PUCtsWE0raUR0YWpGR21lL0lsenpmZUQyMStZOGg1VnJGbGM0RzZHVWlOZ2hXTHJ0T2xWQUZoY0tRcnZia1ExU3NSUnJKTThjOXRqZXZ0KzZ1UGVTenRlaCsveHlNU0pzYVppenNia0VzMnRYZzFFSS9vMWRpN2xyL1Nxdml1V1gvemx3VXJHU1BmOFU0RFFDN1ZDbHVpZStlcXRrZ3QveTVRaHBsejZhUUJJcCszeHI4RHVyYWdHb2t0VzA4T3VKSDQycWEzbURYbXZBcFE4Qk4yWUdBR28rNWUxQWkvOGVBblpLUlpBLzJmNWZIQ3NOSk81cWhKNXU4UHNiNjF3NU45VzZzZnNicE1MTkc1bk9Kems2eFFBSjJ0eUJVV1hkWFJVRzg5MUVkRWowaGp0WUw0cmN3a3JJNzNXYWM0ZVlJdW9Pa3E0anJ3V3ZFbzBoQzZtckFtWFV6Y1FTaUtYQWdQeUQ4NVJVNmQrdDYzR0lvOVhRaFZYWnpOdmxqUGFyY2wwMk10dUwvbWVXOGgxdWpVbXJvczdHYzloby9qOXM4bXdMTERTL3FtNlhyYTdDa204OXB5ci9ZZlhqZDdnQ3F4WTNFeXJ6d1JNdENVZEZDa1cwaTdlODVCSm1KRTZ6c2VwazMyeUp0OHJNRDVscG1IcWErVmlEMS9lNW1yMUF0dmZaS0pwNTJ3L3VIVHIxWUNuZGtWN1FvS0dnRi9HdWpSRC9mQTFGSmhVUzJ1OVlOSnkwR1VhN2p6UTlZZFBkd3RITzl2TVlIRDNEUHh4aEVuZDFBaVZYbkU3ZkRINHh6WlNSSEY2V3dUdU5JMVFER01yS1h0bjBnbUdaTWxCWHpNYUtxSVlBV3pmY1FmUUFxTWhvb1UzZllDemJEMUJMTjhjeVNtRXlsdlRPSldmM1F6WUo5VHdZN1ZhYzFWdlFjam1adFRCRDFvdHU4c044R0ttMWhjU29YM2todU1kRVNRNFpHY1NIRG9SQUY2NXBjUU5KTVM3akJkU3lJR2NtUlAxYlhxWUJjZHlDTFdqNUpKN0grZWl6M1VIQVlyUWV5S1ovYU5KaEpRYitvcWJ1NnAwVjFzUHhxbHFXVFR4N3lBNmlJZGdPWUF1MFZHaDVIdTgwT09wbFNaQ2FCNGdpaENLWnZyTjM1bzVWbC9mK25aa2FIWXRJSzMxeDVlK1NoZUN5dVFaVzJ5V3FDOHhTSmpCWjVhNVJyenFUUDYxWXgrelA0RGI4bXdUNTJXU251amdmMDZkeUw1TWF0aW1oZEpUNWxONW5ZSXVjWVlxTTg4SXJDU3Y4My96S1FISUNaemJPaWtiYm95aUhYZXI3dXdkOTZNSW8vZWcyM3crdHhmSndEUW8zT0I5TDdwNlVEQVoyZGlEakF3S2ExNk1aM2xWUFRWZEtjNTZjMTNoMzNUUU4raGdkaGdoZDRtTjBpa013NXhEZ2R4aXc5UUhCM3RTcEhReDhWUDBZTzY5ZlVTZUxha096QmV5RU8wWitVNHJPRGx2VllCc0ovQ3FobWc3NlE2clFqU1VNaStYUUJoK2UrS0xhR1NBeXRCbWFhcHg3bXJkTHcrL2NYTHZNR3BMcjIxcktMb05uaVZaQXRKZ01XYVZmZmNxcGxHdHhFZjdTNUVtZkUxUDB5OHpRdEFPaE9OMzVldmdSMFhiay80ZkdhUlNURXpYQUpQdDIwbnI2MVdBbmRJaFMvTW1YN2NuNmZqdUJCZCtURURMZ29hbnVKNGpCZnZQa2htdlRseG03ako3RGY1MndWVjZwbTNQRnJQZHpyNExFeC9RZ0dYcWVrRysxZG5IaFRKSmdxcGdxTzVjeEtkWGpFdnNlazB0NnJRM0pVRGJLYkdCVWFjUDRoOFMrZkx0TE5EbE5LcWhCY1JwWHN2ZFJ6WmdDUXovL1dkVUpZR3FXSmREUnVrcnE4SkxmTHRSN1JvNkNNY1FyOFg3c1NDdjFUQWx5NTRMVjZ2QmZUSUZmZXNScXNBaHFXZXJtaG5zRDlsVHZiVllTSFNvMnIyMHQ5WjFoT1VIQmRuZWNjL3RFOHh3SDZIU1BaSStTdlVJaE1WR25IRFd4WE93TG5DQWhMQkNpeWdTaTI2VHowM2FPYXp1K1RqTElOVUN4cm4vTEVyU2FsUTNGTzUxSDdDWGlXNzlyODNFc1hldlBiZmRqNCtBNGVKUC9VdUhQZlUvVURaM3NXRTlYaGNPbjBpZDJEcVg1SHhRN2NnSHE4RURZaW5uZWhLendacjZIUFRGcnp6ZkV4N3dJejhmdFRoMTh6M1p6VE5yRHh5STBkdG1UVG15dVF2YURtNGFlR2lQWHFLTWhoUkZETGZ5aTVCa0RsdTVYRThNTmhjd0ttQXVvcmJuQXVML2Fkb1QrUzJhS3FsdDQwZ3FydnhzbTArcXZXdllzejZRYnFUcElKSTJ3Z2krM0tDUUNKOUhYWkFnMlo2Rm00SnBVZEd5SmJndkN6WFExRmVPQWtHVDJYcHZWRE9MVG9teEN3WHFGb2NyK25jUXUzTTdIOCt5RjlqeEZBNlB0U3cvcWxqSU85MHBEZEYya3ovSVc0c0U1dkNzejNHZWZmZ3puK3R6ZUhHOHVuOHY5TVl5VHFFQ25lbFJDdEd2QXg4dCtjU3dEeFhWQ0hIVXh4c3JzcjByd3RqZFR0WjB6SDFXTm9JN2VCVkd5a2x0emYydnBQOHo4YWxtZHpIK2hOQUFZOE9KZENCdEg3SkNqZ1c4d0R0dlhCTXRhbDVBTWV6Z3B2VE1zTDY2NTVxU0U3bXphRnpCRWhVR0JzaFVXeTV0Z0FZRVMxUCtiRXNQN3crczVWQUJ2TXRJL2Q0bE9RLzlRa3dBZFlUWkVibHRmWXprQTVJbjJ4NW92NXBYSUxQWTl2bCtQaXJ0eHJPM0Q3U0JaZUkzWnpVU2tOcFgyd3RPd1VocmpSNjdIb1ZHbzBKTUdnTEh0OEUxanhwTHpkVFdHS1BIU2NqTjJMN3NHK1dWMEVONmsvMGd5UnFTQXNoWmJHRU1xUEFTaXFTMi9OWTFrYjJmQ3FPdXdkVU1aTnE3YmtpUnJiaXd5ZHBpZDVqU0R6dm01YVJlbnRmYWRQY09IQ1AxdnQ0clNQdFlkOFlyaVJ2b3E3SGRmTTZHdzROaENwZU93YUx6SXFidjM3NngzcXJjbDJXbGJaYStzcmVqYjB2eTNld1IzTTFFSkN1RENMZEs2T2lEUEc0dkF6OVBhYlpmcC8zQ3JWWTdkaGMxVGVnbDRqL0VjSEZybW9BdkZZeHJySXdEUXNqRVlYOTJmd0E3U0NFMmQrc0prczJYQUlhMTJLa2cwSnZKNS9ncmRMUkNGQVFOczlnZDY1RmQzRWFELzFoRVFmZmduT29iNHZrdGpyeU5vZC9YYzRxMzBXNTV4YjZLT2xRTDFkTitWZUR2azV3ejkxVUxJYjJuUzZDamQ3VGN0M3U0SzljU3huZ3ZwdFg3TFQ5bjhBMk84TUMwL3Y4b2ROWE02QVd6Z3liRERETFZiNFM3OHFqc2Jna3NJdVZMZnFEa3VWYldPMGNWR2Y0am5KN3lvWDR6c0VKd2pkVE9YczBSZkRWZ1h5eUlQY1NwNUlRSUNJeUtNcXF1dGtVNUdMQ3c0d0NJMnNuK05ZellyN29jaldnNGhKSldDNWJIcGgxSXN0Ukl0NVdPVEtRbk9xVWhobUQrZVd3VFhtOGt5bFJFL25TK1dQSVVuS2dJdzkwWDQ5akJuek1taDBubm1EZ0RjWUdFRHY2ajc1MEFzTWEyaXJKSjVrM2NGNmJvU0tJYkE9PQ==

RVdTOUtDenh1c1RzcTJZc216SUM0UUYwZkZ3WmNta1BjeCtZWk1iMjFmcVNrVlRIaWxWR3oweEsrV3M2bTM4eUovQXYzK1ZSdS9MSGZ3UUNmbXFpaVIwNGFQUXN1SjhRWWtkM3hZZ3RkcXh4eFhZcFEwNUZEekhxaFM2bit0ZTNBdFBCM2h5YlhZekQyUmJLNnZkQW9pWFpEUHhBQWdmTXhDZEp1UjI4cmVYUktuU0lsekh0cXdsNGc3K25FUCtkVnQ0Tm1nclNHcCtMaFF6L1prYmhSV1o2SSs5TXFWODM3UFBMVElGb05FbUNyUHpWaG9LM2I1d1kxM0RGWERaOE10YW1La0piaUJiRXRJWC8yRlVYSk82VXpHeHkxZG9Zd21wUjBuWlcwcVozMWtMWFJ2K3JNa2lJSWExTkk4ZWdjYjdrQlhxM0hZaDlxblA2ajN6SkhEdnEwbEo1NVkyazVoYWV1Q2dNQ0RFd2hFZUduRTlEMTNVUWdaVnZITXkxWEdIdnZiVVVaQ3dmSGIyOFFZZjh4RkNJSFF1ZVRTL1BZeUJVZjh1cTYrS1h6UEdOZFV6ZVNCUzdoWDBWdk93bzZ2T0QzNGVvVDM5SlpzdlRtbUcxTFM3Y01iUmk1Rm1zbGJHZ3Byenp1V1hkNDdQZFVKMy9ZcWVTT2NxblVIc2paQ0pHSTlxUjFFRzhPTVpUcHpXMGVidFc3eHhMN2d3NHBuakJ6MDZobVU0dlA4QnY1Z052ZC9TVGhRdmZtT0doKzhQOTVFVnZPV1JFV3RRYUsrWEp5dTFFMjNMQk85cVNqclVKTTdJVE13TmE4Q1I1eFEwMmRzVVZ5Um0veXVKOWNCWUJ6VlR3b0xMUDUycDYrUnZ2dzduNExUQWF4dzZLQ2Z0bjhpdUVXVUhieEZVR3FwTzNhYlZQS3k2cEpSZFRheVBoNUEwNGZLQm5MdnloWFN6ZUk0RU8zRC9saVRGMWVlK1J2dHlQbVh3dFd1UE42RmRkQUpHNDYvNTR2enVVS2lOcDJjMWR6RTg4MmdNY0xSSklONW0zOTZNbXJhSFMyNnNlT0lIcTN6dTJTRFFieVRMWi95RHdkT3dwdVh0NnZia0MxdnBya2RUMFlGR0FsR21zbExETGRNSVFRNTl2RTN4eEtoN1ZlMmJzTU5mMFBvNCttem9MZ3ZQTjlMekVXMlM5clZLL0hYWU5aVVRIeXNhRTl0ckNjMzRCLzNHQlVvb3JKZ0pjbnhYc0ZTVHpiUFRmNzFNV0VIRHVYSk1jTmwrVE41QVdYbm9uTmQ4cGdmU3RPcFpGbXRxcFBUK09UTTBBS1dvSllxT2dqN3FERE1NTHF2d2pZYUVVSzgyTVJGVEpFR2w0c013SVJHZzZwRkZmZFB6NGdLeXFLZVA2SGNaSW5PUCtsWE0raUR0YWpGR21lL0lsenpmZUQyMStZOGg1VnJGbGM0RzZHVWlOZ2hXTHJ0T2xWQUZoY0tRcnZia1ExU3NSUnJKTThjOXRqZXZ0KzZ1UGVTenRlaCsveHlNU0pzYVppenNia0VzMnRYZzFFSS9vMWRpN2xyL1Nxdml1V1gvemx3VXJHU1BmOFU0RFFDN1ZDbHVpZStlcXRrZ3QveTVRaHBsejZhUUJJcCszeHI4RHVyYWdHb2t0VzA4T3VKSDQycWEzbURYbXZBcFE4Qk4yWUdBR28rNWUxQWkvOGVBblpLUlpBLzJmNWZIQ3NOSk81cWhKNXU4UHNiNjF3NU45VzZzZnNicE1MTkc1bk9Kems2eFFBSjJ0eUJVV1hkWFJVRzg5MUVkRWowaGp0WUw0cmN3a3JJNzNXYWM0ZVlJdW9Pa3E0anJ3V3ZFbzBoQzZtckFtWFV6Y1FTaUtYQWdQeUQ4NVJVNmQrdDYzR0lvOVhRaFZYWnpOdmxqUGFyY2wwMk10dUwvbWVXOGgxdWpVbXJvczdHYzloby9qOXM4bXdMTERTL3FtNlhyYTdDa204OXB5ci9ZZlhqZDdnQ3F4WTNFeXJ6d1JNdENVZEZDa1cwaTdlODVCSm1KRTZ6c2VwazMyeUp0OHJNRDVscG1IcWErVmlEMS9lNW1yMUF0dmZaS0pwNTJ3L3VIVHIxWUNuZGtWN1FvS0dnRi9HdWpSRC9mQTFGSmhVUzJ1OVlOSnkwR1VhN2p6UTlZZFBkd3RITzl2TVlIRDNEUHh4aEVuZDFBaVZYbkU3ZkRINHh6WlNSSEY2V3dUdU5JMVFER01yS1h0bjBnbUdaTWxCWHpNYUtxSVlBV3pmY1FmUUFxTWhvb1UzZllDemJEMUJMTjhjeVNtRXlsdlRPSldmM1F6WUo5VHdZN1ZhYzFWdlFjam1adFRCRDFvdHU4c044R0ttMWhjU29YM2todU1kRVNRNFpHY1NIRG9SQUY2NXBjUU5KTVM3akJkU3lJR2NtUlAxYlhxWUJjZHlDTFdqNUpKN0grZWl6M1VIQVlyUWV5S1ovYU5KaEpRYitvcWJ1NnAwVjFzUHhxbHFXVFR4N3lBNmlJZGdPWUF1MFZHaDVIdTgwT09wbFNaQ2FCNGdpaENLWnZyTjM1bzVWbC9mK25aa2FIWXRJSzMxeDVlK1NoZUN5dVFaVzJ5V3FDOHhTSmpCWjVhNVJyenFUUDYxWXgrelA0RGI4bXdUNTJXU251amdmMDZkeUw1TWF0aW1oZEpUNWxONW5ZSXVjWVlxTTg4SXJDU3Y4My96S1FISUNaemJPaWtiYm95aUhYZXI3dXdkOTZNSW8vZWcyM3crdHhmSndEUW8zT0I5TDdwNlVEQVoyZGlEakF3S2ExNk1aM2xWUFRWZEtjNTZjMTNoMzNUUU4raGdkaGdoZDRtTjBpa013NXhEZ2R4aXc5UUhCM3RTcEhReDhWUDBZTzY5ZlVTZUxha096QmV5RU8wWitVNHJPRGx2VllCc0ovQ3FobWc3NlE2clFqU1VNaStYUUJoK2UrS0xhR1NBeXRCbWFhcHg3bXJkTHcrL2NYTHZNR3BMcjIxcktMb05uaVZaQXRKZ01XYVZmZmNxcGxHdHhFZjdTNUVtZkUxUDB5OHpRdEFPaE9OMzVldmdSMFhiay80ZkdhUlNURXpYQUpQdDIwbnI2MVdBbmRJaFMvTW1YN2NuNmZqdUJCZCtURURMZ29hbnVKNGpCZnZQa2htdlRseG03ako3RGY1MndWVjZwbTNQRnJQZHpyNExFeC9RZ0dYcWVrRysxZG5IaFRKSmdxcGdxTzVjeEtkWGpFdnNlazB0NnJRM0pVRGJLYkdCVWFjUDRoOFMrZkx0TE5EbE5LcWhCY1JwWHN2ZFJ6WmdDUXovL1dkVUpZR3FXSmREUnVrcnE4SkxmTHRSN1JvNkNNY1FyOFg3c1NDdjFUQWx5NTRMVjZ2QmZUSUZmZXNScXNBaHFXZXJtaG5zRDlsVHZiVllTSFNvMnIyMHQ5WjFoT1VIQmRuZWNjL3RFOHh3SDZIU1BaSStTdlVJaE1WR25IRFd4WE93TG5DQWhMQkNpeWdTaTI2VHowM2FPYXp1K1RqTElOVUN4cm4vTEVyU2FsUTNGTzUxSDdDWGlXNzlyODNFc1hldlBiZmRqNCtBNGVKUC9VdUhQZlUvVURaM3NXRTlYaGNPbjBpZDJEcVg1SHhRN2NnSHE4RURZaW5uZWhLendacjZIUFRGcnp6ZkV4N3dJejhmdFRoMTh6M1p6VE5yRHh5STBkdG1UVG15dVF2YURtNGFlR2lQWHFLTWhoUkZETGZ5aTVCa0RsdTVYRThNTmhjd0ttQXVvcmJuQXVML2Fkb1QrUzJhS3FsdDQwZ3FydnhzbTArcXZXdllzejZRYnFUcElKSTJ3Z2krM0tDUUNKOUhYWkFnMlo2Rm00SnBVZEd5SmJndkN6WFExRmVPQWtHVDJYcHZWRE9MVG9teEN3WHFGb2NyK25jUXUzTTdIOCt5RjlqeEZBNlB0U3cvcWxqSU85MHBEZEYya3ovSVc0c0U1dkNzejNHZWZmZ3puK3R6ZUhHOHVuOHY5TVl5VHFFQ25lbFJDdEd2QXg4dCtjU3dEeFhWQ0hIVXh4c3JzcjByd3RqZFR0WjB6SDFXTm9JN2VCVkd5a2x0emYydnBQOHo4YWxtZHpIK2hOQUFZOE9KZENCdEg3SkNqZ1c4d0R0dlhCTXRhbDVBTWV6Z3B2VE1zTDY2NTVxU0U3bXphRnpCRWhVR0JzaFVXeTV0Z0FZRVMxUCtiRXNQN3crczVWQUJ2TXRJL2Q0bE9RLzlRa3dBZFlUWkVibHRmWXprQTVJbjJ4NW92NXBYSUxQWTl2bCtQaXJ0eHJPM0Q3U0JaZUkzWnpVU2tOcFgyd3RPd1VocmpSNjdIb1ZHbzBKTUdnTEh0OEUxanhwTHpkVFdHS1BIU2NqTjJMN3NHK1dWMEVONmsvMGd5UnFTQXNoWmJHRU1xUEFTaXFTMi9OWTFrYjJmQ3FPdXdkVU1aTnE3YmtpUnJiaXd5ZHBpZDVqU0R6dm01YVJlbnRmYWRQY09IQ1AxdnQ0clNQdFlkOFlyaVJ2b3E3SGRmTTZHdzROaENwZU93YUx6SXFidjM3NngzcXJjbDJXbGJaYStzcmVqYjB2eTNld1IzTTFFSkN1RENMZEs2T2lEUEc0dkF6OVBhYlpmcC8zQ3JWWTdkaGMxVGVnbDRqL0VjSEZybW9BdkZZeHJySXdEUXNqRVlYOTJmd0E3U0NFMmQrc0prczJYQUlhMTJLa2cwSnZKNS9ncmRMUkNGQVFOczlnZDY1RmQzRWFELzFoRVFmZmduT29iNHZrdGpyeU5vZC9YYzRxMzBXNTV4YjZLT2xRTDFkTitWZUR2azV3ejkxVUxJYjJuUzZDamQ3VGN0M3U0SzljU3huZ3ZwdFg3TFQ5bjhBMk84TUMwL3Y4b2ROWE02QVd6Z3liRERETFZiNFM3OHFqc2Jna3NJdVZMZnFEa3VWYldPMGNWR2Y0am5KN3lvWDR6c0VKd2pkVE9YczBSZkRWZ1h5eUlQY1NwNUlRSUNJeUtNcXF1dGtVNUdMQ3c0d0NJMnNuK05ZellyN29jaldnNGhKSldDNWJIcGgxSXN0Ukl0NVdPVEtRbk9xVWhobUQrZVd3VFhtOGt5bFJFL25TK1dQSVVuS2dJdzkwWDQ5akJuek1taDBubm1EZ0RjWUdFRHY2ajc1MEFzTWEyaXJKSjVrM2NGNmJvU0tJYkE9PQ==

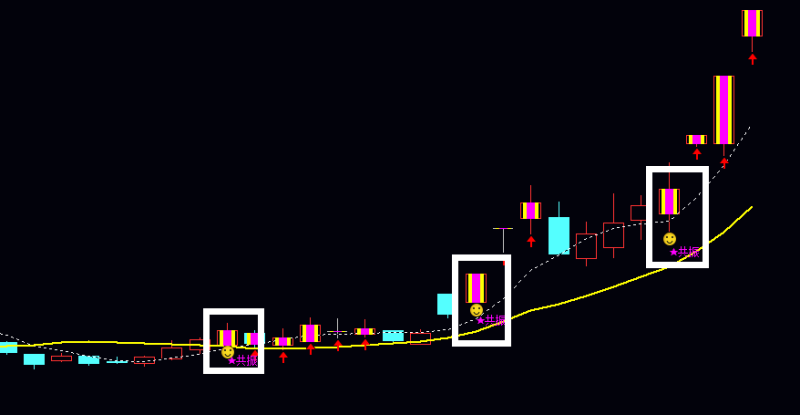

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容