温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

一、大小非解禁概念解析

1. 基本定义

- 小非:指股权分置改革后,占比较小的限售流通股(占总股本5%以下),股改一年后可流通

- 大非:指股权分置改革后,占比较大的限售流通股(占总股本5%以上),股改两年后方可流通

- 解禁:即解除禁止,允许限售股票上市流通

2. 市场影响

- 抛售压力:限售股上市流通意味着大量持股人可能抛售股票,增加市场空方力量

- 股价波动:原持有股票可能因供给增加而贬值,投资者需警惕

- 信息不对称:持股5%以下的”小非”股东可无需公告套现,普通投资者难以获知具体情况

二、股权分置改革(股改)全面解读

1. 股改背景

- 历史原因:上世纪八九十年代为防止国企控制权流失,人为将股票分为非流通股和流通股

- 主要弊端:

- 同股不同价、同股不同权

- 流通股占比低(约1/3),易被操纵

- 流通股与非流通股利益不统一

- 与国际市场规则不符

2. 股改核心内容

- 改革目标:消除流通股与非流通股的隔膜,实现股份全流通

- 对价机制:非流通股股东为取得流通权,向流通股股东支付补偿

- 主要补偿方式:

- 扩股:无偿送股(如”十送0.3股”)

- 缩股:非流通股按比例缩小

- 现金股利:向流通股股东支付现金

三、大小非与市场关系

1. 市场角色

- 最大”庄家”:以低成本获得非流通股的大小股东(大非、小非)

- 信息优势:控股大股东最了解企业经营状况

- 行为影响:大股东增持或减持行为能反映公司投资价值

2. 投资注意事项

- 重点关注限售股持股比例低、股东分散、有较多”小非”的上市公司

- 密切跟踪大股东持股变动情况

- 解禁前后需特别关注市场流动性变化

四、股改对价操作实务

1. 对价获取条件

- 必须在股权登记日收盘前持有股票

- 登记日前卖出股票则无法获得对价

- 对价股票自动计入投资者账户(如”10送3股”)

2. 对价形式选择

- 不同公司采用不同对价方案

- 常见组合:送股+现金、纯送股、缩股等

- 流通股股东可通过股东大会表决选择方案

五、专业投资建议

- 解禁前分析:评估公司基本面和解禁股东结构

- 流动性管理:解禁期前后注意仓位控制

- 价值判断:关注大股东行为背后的公司价值信号

- 长期跟踪:持续关注限售股解禁进程和市场消化情况

- 风险防范:特别警惕”小非”占比较高且分散的公司

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0WmVOQzBWeDYzOUxuOW4zNzVpSktRTVFyM0lBc2FzOUoySSs3bGFLUFNnRThYMFl0YkhlRlNwK3NDVkUwTHlhS1R4ZkI0WjliblRNc0N1VUk2a3pQNnJMZllmNlBSMkZhbTFDZHM5YTdET3hsdVVGT05yNllXRVd6ck1zRkV2Vm1oM29zUjF4bVA4ejdLWWo5R0hPeTQxaGhMcXFUZzhFdEhKUjBHc2xpaXJVTXNpbHZwNUN3VVpxZkFLVUdCQWpKK0tVcHZQV29md28wTFBFdUxLRURSdk5NbUJlRXhwM0xRMW1URW1Nd1QxOWZ5RkJkZTFEWFQzdzVsOVl4NC9Sbld1aXFEQU1DbHA1WlR1Tld1cTN4U28vaFNrT0JMZ2o4ZVJnZWtLYi84MmpiVG1aZ1Jydzk1TCszYkNyMDYvL2dJWW1JVU5SWFc2MnhRRW5kZnZveDNWdEFqZm1LUUtxbE90UHI5Smd2S1JIMThmVUFhQWE5WDJrSXpTQ3h1QlNJZDhObCswTnRnN3FnNWFoWnEvQ3Y1ODFTUGZPZWUvUzJTNEdId2JWdkFNcFlJUDZwUGFPeXJnUzN5WjhPaDMvY0tnM3EwR2kyVndnNHlEaWllaG42V2dXZFJ0ZC93NTd3MU10eHovZytrVnFtd0kyRXJYMG1KcnhvbzBZZXQ4NVJsUzNYRllHMGhLRmswWUZGUitBbUNwZ2hjMEdvMEpPaisrUmhIVU9YVVcvM0tyTVc3MXJFTDd5NGdqQkloamV4MEZwUDV5WTFkbUpVeVdOS3NDKzlZSkNjMVdvZ3VMK0ZjNGVJdHBpZi83L3g0SERZMW4rR05LMGxWTlArU1VVTlBjOGRBSjZRb1VZd0M3Y045UE01Tm5QZW41QWNHNEhHcVhlRDNndjFtbXFMcUZVY1k3OUtkcmJnaTVqZ3hLVFVGMGxoYU5QeWxWVkN6QmhaeXV5SllxTEV2YWh3YlQ1MlBZNlJ1eWFlMHFoS3cvYjIrNk16R1NvYzI5N1JYSDlDQzdaU25KZ1ExbHE1MUxNSFBoSEFJWE02RFQyYlo0bk5YdURuaHdTRHlSOGgwcHFsbzZpcXByVVZtNXhzMVJXelovK3RFR1NpWW9oeFc1OWswTEI2UnlGYTlHY05LMWNJdSs5bmdyOU5LNzQxcmk5K0d3elA2ZU0wcWV1aWlibm5VQzZwUThybkZ5STg2UG5wVFJ6cG84ZlJHMmo0QitJcjEwVTB3NFFDV2VMRTdJdEdKUXFHMHhtT2FNb05XbnloeWJ6MTYwenp6UGtVVGMrcmFPbHlqNUM2ZjcrYmZSVC95Zk4za05QWkNNREpLMXo3bStlUVJBc1hHZktxU0ZUWnEwaEtVOSs1YldpazNlVm5KQ0cyNXkyY3Q2RzlGZHdueHJrUTBXcXpvSmxCUHllUjFsNEZCZ2FwanpGMnlYcDlPaXNKejQ1c2hMT0U0RlZhbTdhN1FXN1UrL3ZpY1JpVGxSTHE5bG5JQmNxZ3hGckF2bXl3MzFFYjV6ZnJSck4rc3lEaFFKa1BObUR2Tk1XQ3RseUY1b1hLd05FNURWMDd1UGd6a1g0clVPejhQbkdhREo3UDhUQ3plcERiL1dta0tJd0k4ZllCd1pnT3BPcUtwRjZUaEU0a20wRkR4eVprUnlNUnNxZ3hqbGVaN0NldEp0alBDMDFEMjRjM3dKTS9xeEwxT3lDQXpESmx5RkFVYnFIRFdqZVhBNUZ3c3dYbUtFTEJKTFdubjR5d3dYUWVjWkZ5dDZVRXM0UE5NWG9zQURPdExZK0I3NElMT0JuUXJlN3NBblltelViSko1OTdtY3VjV1FvUUFZempBTkdwQjBEZzBTK2c1SFhjYlAyV0sxcVozcko3TE9wZ3pxRGVMOWhHcExNRGxaeFE4aTYxNzN0YnRBM2lCOHBpaTZkc3ZQd2tWT2Y5T3YrUDVaakNrVnF0MUNKRDliSGhsc1E5ZFBseE5NaUNrSGtTWnpTU1hFTDAyRkZKTDFtME1xMXB2QmR3dmRRMm5sRi9GRHp3V01sd1JFcWliMnNKY1loMjR3c3JPWEtLUXErRnFndHRNRmFnS0ZneTVlOHRsNFZTYlZkTVBYa1doVE5ycmZJQ0U1MVhJbGU4OGRmbHFWb2ZzRVcwR0JJSHJqbzdYTStQRGJWY2lBZy9qVEt3TDZlVWIvVE8yQk5rdEZod3VpV2NrK3l0UmxwMTloaHE5SXNiemt4eFBUZzN5MGlWODNINE85ajZPT0hQc1VUbm1JRjNISmFlM1BUekJoTVkzL09Od0FMVHU1TnhDYWxmMWdGeXV1bEtUNEUrbjA4cHJkd1VlZjhGMlB5MG84WGpHNFNVdjNhUFZ1RWdhNTlTSk5OVk9ZRUtqUDJmUmlrM2VKV3lkYmY2OVE1RC9tZjJSWk5kVXNEZUxBRnNkbWNTdU9ETk5wYVVPNU1MT25hWVUxUWk0b1hnV0FzWjl3Y0lXMGgxNG5FTUlRcW15dTNXTU55Nkc2ektwZ2k2TkVwSTU4QkR5T0NOSHJpaUFMSUJ4MTNmWjdPOVlIYVBFTWc0Y0t1bkFWc2swM2NxNUV3VnZRSDRXUmJ4K1VqaVkvbEVoanA5U001azhLcDBUUGVMM1loaWtva2dzSjRVVXlpclBXeGxTc3NaanR4UGhCTnhEQU9sUDlTYytiMTJZOVFwdXlxNGEvQ01FTU9YR3J4MDIxU2lhaUMxeHg5em9IbS9CSHhlT2JoT3FsYWpGOENSUmJFNHVJMFMxbHlQQmhZVkl6KzVJbmZ2bXdvWEJMbGxNSVNxaGorZkZJcWs2Mmp1VEhFNmpvc0tLQzh2OElFcStoanhNcWRXMFBHNk5uWk1aYTNjZlpOQW1HZFd0RXYzbDhIbHhnWUk4b21CbXkyWkd1NTFsamszaDlhMlo2bkhxYVlMbDZLNHJJcm02dHJsZmxnejJmdjBnR1BpMTRmdlhIOXdib1h3azZjVE1GVGc5MzRZeGhobjBjcjVKR0U0MUh5VDdtUXFHWWVUSHNlSEc3R2VyaTNiSEFoSGlQQVF0Z3RxYlR3RW45bkQvRm5NVm5NZEY2UGRBTE5SVzdDY3hVcmhjWmZPMElJQXJuMVVQQWV4QVFwb1RXYWlnbUhIM2VTdmEvL1pjRGNHU25jdkIvUEg1Rzd6VnZZMExIWDFlNlRnNlhSUjVhYm96Vi9DRU5pY1ZUZ0FCZDhUeXgzTzZzQ2ZnditFWmx0TXN5dFJlakwxQmRkemMvT2I0c3RGc2hEaW4vWThVdFE4RDZndjVrclVWYXNNb1pneGsyRnFpOGh5SGQvWEljTkJpWjFZYjBEU1ZqK2dzYlhhT2ZCbTlCbSttbkNleURzTE9RTWN3Zy9zVUJzWEtwSVdYbFFwT1pVRWZ2L0EyUmhUS29yTXRhRFBXcldlK09pYXRIRE9VdkR6dExKc2ZIRWVraXpPalpWOE1VdW5OY05VZ0paR0M0VWM1OWR5a0RWZFVhRjFWYzJ6bmhnOEdKTXJ3VThWVVFWWTBtSzgyUTZxNi9ab01OZE85VXJTWWlrVUQ5SnJzQVFqbEkzcGdYTlB1QXpRenNFa25RSmhwMUdkRTRsS0xyaVN5L1ZxZVF0akl1aUFjRFlUSzlqaFM5blgzdEdFTmJZSEFZY3NxRm9lMFVudW1IY2JHdjBuK1dpY2pyZUErOUhXWE41SUMraHdVZzVlRjNjeTM4NG8vbVByVHE1b3BJSUpkOVVoS0xuWG1jOGFMS0taRFhSQXhMeG1tajJwRVVZeVFyc1FNczZIa3BXejZ4UmIzbDl2UGxyTmw0R3ErUEl5OHFCNHg5R0xQRWR2UmhEZlFWd1dyS2didjFTNlJqWE1ZUkRpZGlsYVYzTmh1RGxQQkhwbGpBVkxBa21BRTkwTUdJSFZoR3FzRll0eFJ4TnpHYU0wZ2YxVmlYbnY4RUlCZ1o3TjRxcjFISFdreWpjdUNuMkNha2dxcHIwSmpyRkZEMWtJYURISmtoWm9zUkJFd1ZVYmJ3bU13dERUeDQ0MWxhUTRadk50MlN4ZENBSXhmQ0lnOFhwblRmZkxOWmsxSlpvK3N3N25qK0oySGNVUGlIRDZzUk9rRytIRTZhUzdvVmVQUFc2ekUxWStyUzQrVW5HakliYVNXV2hJOEUwUW4zeDRmZXc2R0JESUw0aDFrOHltdzZpYjNHSUpsM2hCZCtJVkxFNjFUM1FGcURxTnZWcWx4RmxzY0hsYUV1M2RzR0lEaDI4SUN3Wk4yVG9NUUV0UERjSkN1cXZFRTB4RFkwKzNqWjlGWEUzcVRteDQ5TzJydWZSOTNvNC9MdDZHcE84SnVua0paa2ptQ1l0ZCs2aVRlcFlEK3V5NlB4Qndla1F5ejhqUUJqc1FNOE1yYnc3OVprQzFIQXRuUGROQkV5OGV0d2VJcDVWd2xGTjNLanhEOG1WUEZhVG5zWmFnNWpNbmxjZDdDZFpBYk9vNDFkS2lKcUo5YmNzdmlFbGpORnRZNkVpNlcyKzBtT21jWjgyNldWK2hLRERJTExmaUl0eWUybi9OTitDRTF1eFpObERLa1N5Yjc4SFdlYVY5ZWJ1ZEJsNW9yaFY4QUV2MzRhUExJbGVkZWV5RWxZdzZaOUpjSm1wMFl0OTI2Z3NpaTNjR3BzbHgwSTI1Nk05RG5mZTkwNW40SGFHZU84eUFEZnloZ2kybkJ1YVZleWRMdTlKRGxiU0tjNWV1ZDVreUNnM1hBWmxYbVA5N1BzRjViNXZ4ZkgxbVlXemNxZFNPTlZRaDdsWUV6eE1YcE43Q0pMU0xnWlFXbW5RMTI4SThJSHZoYkxXbm9Kd3E1VFZoY0ZDcjNCZFBENGh2YmhDdXNLREhqcTR3ZDNtV0YwRmJmQnhTSTRNSENmdGVhY0dRV01ZRG9Ba3RaeFVWOVMyODR3QW8zVCtrcXJlRFd6RFpIQmpOaWNkbjFhTnM1REZxTVU2R0kxVUU2MGxIVk9pVVVMeWl5YzQ5eGhNK2hRcmtBTUc3SkRYUDNISVZ6K08yQ2JaYVgyVUVzMjcxakZGU1lyNXhYTEJoVUtJLzhHd1FlUElnZlRhaDhrOWJrYVgxOWNmcFcvbnhRci9LQ24xZ2NTZDFEaGxSWExPT1k5MDFCQ0c5bE95VXVSUXhnN2pZN3UvaEZDL3B2VllTK0QyYVFZU0NjMld2QjFmcW9HQldyYWIyQ2N4aGFsMVJXajBucUo0TlBmWWF1d2k5Q0lyZ3dpd2ZTRlFCSitYc0JpZnFDWjd6MTBpNmxxVmRiV3ZzQXhzZThqclI2RHFscndoM0tYME40ME8vR2ZQQmF6MGlpNngxYUF1ZEJzcFJMR2Npejc0TEZUZjhzeFJJTXJFU1l5NCs1dEhiVVFlODFlSzhqN2JUYTdXODdMaGFaQ1RYM2pmZkVHRzI2d0IvbERkRzBFMlZmQS9tS3M3QndUUk91aWdxV3Q3QUVGZ2YyMGFNNlhSTW1rOGlCSi9QNVRZVEx0NXlRRS9nblR0TWNaR0VMMDd4S1ZBMWFxY1BuRHFMV2NEMExBTXRHMWNkbmUxYTBKb3JsVjdwUERtWU5uYnFYN25ydjJVSDZpR0d2enZ5UVVOSUFJdHlrQTV4NkZVNkVUNldBYlVIdVlpN2VZS2lQWE1XdWc5QkZoTzVQMXZKZ0Rvek9Hc0QrbVh5V1lQUnBKai90SU5kUTRyRWxxQXNJWEVIUjJTVWMvR045bEFjVGU0cmQwZlgzWHU1MGF6OHBQdDd4SWs3b3JqdGhQamd0dTdsTVFYblRHOG1WcEdsYjAvcjkzQWdTS05DVFBJRGlXSTJWd1E1Z2loRUdPZVF2MlFNbjZOa2c4VGgwSElNNFJKS3BGT3lENmtLcXNEWmFZVXBWWHV5OU8rWncvSWRMYzF1Q1hMUGNNQVVILytwS1dVRXUzakM2RUFPSy92NHNpVVZSTWZzSWU5ZXIvMUlWdU90VGgzeFFNTmVrWEJ6WGFOSmpQWFVqVXRSSnpzVTFDL01uVTFCRHZsZHlyaXh6NlVmSG9qdlpxa3hEZndWdExWU2NPUlVZRTIwc00xaGdoTzVHenhBSElDTXRqVWhXTGNkMDJFa0ZJa21ESjJmZFpqYTlGbm8rT1Mwc0RlRFhuYnpUUnJzSjNtN1hLd1dOdXJFT0Z6eGsxYVJmTzBOWEZpNmhyQkM2M0ZNYStzNG1aTjhOeE1TNm9pVjZYVnNuQUxOTUQ4WVR5eVpmMlBBVmt4VkZpaWo2dzdybHoxY0duenUwaGE4RVhwSGoyNGYrTDZ5QnV5dno3NlNHZlM2OE5FN2t0TWlyL2VHWjRIMk9PdHN0U0x3ellybjBVcUcwYmMxajU0dGxld25yR042bEd3RkxldkJMZ3pqY1JKK0hLeEpMYm9SQUlaTGNnRSttUmVCWUxNUXA5eUtuTmlKVVZhV0ZNZFB1OVQ1NTRsMUpCTHRZdWNKRmMvVUVYOXZuYWdSeFNIZnlycGdFOVZnZmltNWltcnZaRjdGS1BLMFFiK1BOMzJEc0hwS1ZZemNhc0RHdTZyN0Z0L0lSQitXUWtTSGR1T0kyZkhYcnlBMzA1aVAycllWQWpCVXZyQm9FWUNWdEFPaG1uTWJpN3prRWU2R0FBU0pxWTdyZDU5OHZtQlZJREhUNVJ6bUVSRTVJdWdFTnRXSkxGMkdPWmZwRklTK1RNNzFEQjZFRjJ3cHNqdEhBU3YwdXFNTHlmKzc3aFpwcEE9

RVdTOUtDenh1c1RzcTJZc216SUM0WmVOQzBWeDYzOUxuOW4zNzVpSktRTVFyM0lBc2FzOUoySSs3bGFLUFNnRThYMFl0YkhlRlNwK3NDVkUwTHlhS1R4ZkI0WjliblRNc0N1VUk2a3pQNnJMZllmNlBSMkZhbTFDZHM5YTdET3hsdVVGT05yNllXRVd6ck1zRkV2Vm1oM29zUjF4bVA4ejdLWWo5R0hPeTQxaGhMcXFUZzhFdEhKUjBHc2xpaXJVTXNpbHZwNUN3VVpxZkFLVUdCQWpKK0tVcHZQV29md28wTFBFdUxLRURSdk5NbUJlRXhwM0xRMW1URW1Nd1QxOWZ5RkJkZTFEWFQzdzVsOVl4NC9Sbld1aXFEQU1DbHA1WlR1Tld1cTN4U28vaFNrT0JMZ2o4ZVJnZWtLYi84MmpiVG1aZ1Jydzk1TCszYkNyMDYvL2dJWW1JVU5SWFc2MnhRRW5kZnZveDNWdEFqZm1LUUtxbE90UHI5Smd2S1JIMThmVUFhQWE5WDJrSXpTQ3h1QlNJZDhObCswTnRnN3FnNWFoWnEvQ3Y1ODFTUGZPZWUvUzJTNEdId2JWdkFNcFlJUDZwUGFPeXJnUzN5WjhPaDMvY0tnM3EwR2kyVndnNHlEaWllaG42V2dXZFJ0ZC93NTd3MU10eHovZytrVnFtd0kyRXJYMG1KcnhvbzBZZXQ4NVJsUzNYRllHMGhLRmswWUZGUitBbUNwZ2hjMEdvMEpPaisrUmhIVU9YVVcvM0tyTVc3MXJFTDd5NGdqQkloamV4MEZwUDV5WTFkbUpVeVdOS3NDKzlZSkNjMVdvZ3VMK0ZjNGVJdHBpZi83L3g0SERZMW4rR05LMGxWTlArU1VVTlBjOGRBSjZRb1VZd0M3Y045UE01Tm5QZW41QWNHNEhHcVhlRDNndjFtbXFMcUZVY1k3OUtkcmJnaTVqZ3hLVFVGMGxoYU5QeWxWVkN6QmhaeXV5SllxTEV2YWh3YlQ1MlBZNlJ1eWFlMHFoS3cvYjIrNk16R1NvYzI5N1JYSDlDQzdaU25KZ1ExbHE1MUxNSFBoSEFJWE02RFQyYlo0bk5YdURuaHdTRHlSOGgwcHFsbzZpcXByVVZtNXhzMVJXelovK3RFR1NpWW9oeFc1OWswTEI2UnlGYTlHY05LMWNJdSs5bmdyOU5LNzQxcmk5K0d3elA2ZU0wcWV1aWlibm5VQzZwUThybkZ5STg2UG5wVFJ6cG84ZlJHMmo0QitJcjEwVTB3NFFDV2VMRTdJdEdKUXFHMHhtT2FNb05XbnloeWJ6MTYwenp6UGtVVGMrcmFPbHlqNUM2ZjcrYmZSVC95Zk4za05QWkNNREpLMXo3bStlUVJBc1hHZktxU0ZUWnEwaEtVOSs1YldpazNlVm5KQ0cyNXkyY3Q2RzlGZHdueHJrUTBXcXpvSmxCUHllUjFsNEZCZ2FwanpGMnlYcDlPaXNKejQ1c2hMT0U0RlZhbTdhN1FXN1UrL3ZpY1JpVGxSTHE5bG5JQmNxZ3hGckF2bXl3MzFFYjV6ZnJSck4rc3lEaFFKa1BObUR2Tk1XQ3RseUY1b1hLd05FNURWMDd1UGd6a1g0clVPejhQbkdhREo3UDhUQ3plcERiL1dta0tJd0k4ZllCd1pnT3BPcUtwRjZUaEU0a20wRkR4eVprUnlNUnNxZ3hqbGVaN0NldEp0alBDMDFEMjRjM3dKTS9xeEwxT3lDQXpESmx5RkFVYnFIRFdqZVhBNUZ3c3dYbUtFTEJKTFdubjR5d3dYUWVjWkZ5dDZVRXM0UE5NWG9zQURPdExZK0I3NElMT0JuUXJlN3NBblltelViSko1OTdtY3VjV1FvUUFZempBTkdwQjBEZzBTK2c1SFhjYlAyV0sxcVozcko3TE9wZ3pxRGVMOWhHcExNRGxaeFE4aTYxNzN0YnRBM2lCOHBpaTZkc3ZQd2tWT2Y5T3YrUDVaakNrVnF0MUNKRDliSGhsc1E5ZFBseE5NaUNrSGtTWnpTU1hFTDAyRkZKTDFtME1xMXB2QmR3dmRRMm5sRi9GRHp3V01sd1JFcWliMnNKY1loMjR3c3JPWEtLUXErRnFndHRNRmFnS0ZneTVlOHRsNFZTYlZkTVBYa1doVE5ycmZJQ0U1MVhJbGU4OGRmbHFWb2ZzRVcwR0JJSHJqbzdYTStQRGJWY2lBZy9qVEt3TDZlVWIvVE8yQk5rdEZod3VpV2NrK3l0UmxwMTloaHE5SXNiemt4eFBUZzN5MGlWODNINE85ajZPT0hQc1VUbm1JRjNISmFlM1BUekJoTVkzL09Od0FMVHU1TnhDYWxmMWdGeXV1bEtUNEUrbjA4cHJkd1VlZjhGMlB5MG84WGpHNFNVdjNhUFZ1RWdhNTlTSk5OVk9ZRUtqUDJmUmlrM2VKV3lkYmY2OVE1RC9tZjJSWk5kVXNEZUxBRnNkbWNTdU9ETk5wYVVPNU1MT25hWVUxUWk0b1hnV0FzWjl3Y0lXMGgxNG5FTUlRcW15dTNXTU55Nkc2ektwZ2k2TkVwSTU4QkR5T0NOSHJpaUFMSUJ4MTNmWjdPOVlIYVBFTWc0Y0t1bkFWc2swM2NxNUV3VnZRSDRXUmJ4K1VqaVkvbEVoanA5U001azhLcDBUUGVMM1loaWtva2dzSjRVVXlpclBXeGxTc3NaanR4UGhCTnhEQU9sUDlTYytiMTJZOVFwdXlxNGEvQ01FTU9YR3J4MDIxU2lhaUMxeHg5em9IbS9CSHhlT2JoT3FsYWpGOENSUmJFNHVJMFMxbHlQQmhZVkl6KzVJbmZ2bXdvWEJMbGxNSVNxaGorZkZJcWs2Mmp1VEhFNmpvc0tLQzh2OElFcStoanhNcWRXMFBHNk5uWk1aYTNjZlpOQW1HZFd0RXYzbDhIbHhnWUk4b21CbXkyWkd1NTFsamszaDlhMlo2bkhxYVlMbDZLNHJJcm02dHJsZmxnejJmdjBnR1BpMTRmdlhIOXdib1h3azZjVE1GVGc5MzRZeGhobjBjcjVKR0U0MUh5VDdtUXFHWWVUSHNlSEc3R2VyaTNiSEFoSGlQQVF0Z3RxYlR3RW45bkQvRm5NVm5NZEY2UGRBTE5SVzdDY3hVcmhjWmZPMElJQXJuMVVQQWV4QVFwb1RXYWlnbUhIM2VTdmEvL1pjRGNHU25jdkIvUEg1Rzd6VnZZMExIWDFlNlRnNlhSUjVhYm96Vi9DRU5pY1ZUZ0FCZDhUeXgzTzZzQ2ZnditFWmx0TXN5dFJlakwxQmRkemMvT2I0c3RGc2hEaW4vWThVdFE4RDZndjVrclVWYXNNb1pneGsyRnFpOGh5SGQvWEljTkJpWjFZYjBEU1ZqK2dzYlhhT2ZCbTlCbSttbkNleURzTE9RTWN3Zy9zVUJzWEtwSVdYbFFwT1pVRWZ2L0EyUmhUS29yTXRhRFBXcldlK09pYXRIRE9VdkR6dExKc2ZIRWVraXpPalpWOE1VdW5OY05VZ0paR0M0VWM1OWR5a0RWZFVhRjFWYzJ6bmhnOEdKTXJ3VThWVVFWWTBtSzgyUTZxNi9ab01OZE85VXJTWWlrVUQ5SnJzQVFqbEkzcGdYTlB1QXpRenNFa25RSmhwMUdkRTRsS0xyaVN5L1ZxZVF0akl1aUFjRFlUSzlqaFM5blgzdEdFTmJZSEFZY3NxRm9lMFVudW1IY2JHdjBuK1dpY2pyZUErOUhXWE41SUMraHdVZzVlRjNjeTM4NG8vbVByVHE1b3BJSUpkOVVoS0xuWG1jOGFMS0taRFhSQXhMeG1tajJwRVVZeVFyc1FNczZIa3BXejZ4UmIzbDl2UGxyTmw0R3ErUEl5OHFCNHg5R0xQRWR2UmhEZlFWd1dyS2didjFTNlJqWE1ZUkRpZGlsYVYzTmh1RGxQQkhwbGpBVkxBa21BRTkwTUdJSFZoR3FzRll0eFJ4TnpHYU0wZ2YxVmlYbnY4RUlCZ1o3TjRxcjFISFdreWpjdUNuMkNha2dxcHIwSmpyRkZEMWtJYURISmtoWm9zUkJFd1ZVYmJ3bU13dERUeDQ0MWxhUTRadk50MlN4ZENBSXhmQ0lnOFhwblRmZkxOWmsxSlpvK3N3N25qK0oySGNVUGlIRDZzUk9rRytIRTZhUzdvVmVQUFc2ekUxWStyUzQrVW5HakliYVNXV2hJOEUwUW4zeDRmZXc2R0JESUw0aDFrOHltdzZpYjNHSUpsM2hCZCtJVkxFNjFUM1FGcURxTnZWcWx4RmxzY0hsYUV1M2RzR0lEaDI4SUN3Wk4yVG9NUUV0UERjSkN1cXZFRTB4RFkwKzNqWjlGWEUzcVRteDQ5TzJydWZSOTNvNC9MdDZHcE84SnVua0paa2ptQ1l0ZCs2aVRlcFlEK3V5NlB4Qndla1F5ejhqUUJqc1FNOE1yYnc3OVprQzFIQXRuUGROQkV5OGV0d2VJcDVWd2xGTjNLanhEOG1WUEZhVG5zWmFnNWpNbmxjZDdDZFpBYk9vNDFkS2lKcUo5YmNzdmlFbGpORnRZNkVpNlcyKzBtT21jWjgyNldWK2hLRERJTExmaUl0eWUybi9OTitDRTF1eFpObERLa1N5Yjc4SFdlYVY5ZWJ1ZEJsNW9yaFY4QUV2MzRhUExJbGVkZWV5RWxZdzZaOUpjSm1wMFl0OTI2Z3NpaTNjR3BzbHgwSTI1Nk05RG5mZTkwNW40SGFHZU84eUFEZnloZ2kybkJ1YVZleWRMdTlKRGxiU0tjNWV1ZDVreUNnM1hBWmxYbVA5N1BzRjViNXZ4ZkgxbVlXemNxZFNPTlZRaDdsWUV6eE1YcE43Q0pMU0xnWlFXbW5RMTI4SThJSHZoYkxXbm9Kd3E1VFZoY0ZDcjNCZFBENGh2YmhDdXNLREhqcTR3ZDNtV0YwRmJmQnhTSTRNSENmdGVhY0dRV01ZRG9Ba3RaeFVWOVMyODR3QW8zVCtrcXJlRFd6RFpIQmpOaWNkbjFhTnM1REZxTVU2R0kxVUU2MGxIVk9pVVVMeWl5YzQ5eGhNK2hRcmtBTUc3SkRYUDNISVZ6K08yQ2JaYVgyVUVzMjcxakZGU1lyNXhYTEJoVUtJLzhHd1FlUElnZlRhaDhrOWJrYVgxOWNmcFcvbnhRci9LQ24xZ2NTZDFEaGxSWExPT1k5MDFCQ0c5bE95VXVSUXhnN2pZN3UvaEZDL3B2VllTK0QyYVFZU0NjMld2QjFmcW9HQldyYWIyQ2N4aGFsMVJXajBucUo0TlBmWWF1d2k5Q0lyZ3dpd2ZTRlFCSitYc0JpZnFDWjd6MTBpNmxxVmRiV3ZzQXhzZThqclI2RHFscndoM0tYME40ME8vR2ZQQmF6MGlpNngxYUF1ZEJzcFJMR2Npejc0TEZUZjhzeFJJTXJFU1l5NCs1dEhiVVFlODFlSzhqN2JUYTdXODdMaGFaQ1RYM2pmZkVHRzI2d0IvbERkRzBFMlZmQS9tS3M3QndUUk91aWdxV3Q3QUVGZ2YyMGFNNlhSTW1rOGlCSi9QNVRZVEx0NXlRRS9nblR0TWNaR0VMMDd4S1ZBMWFxY1BuRHFMV2NEMExBTXRHMWNkbmUxYTBKb3JsVjdwUERtWU5uYnFYN25ydjJVSDZpR0d2enZ5UVVOSUFJdHlrQTV4NkZVNkVUNldBYlVIdVlpN2VZS2lQWE1XdWc5QkZoTzVQMXZKZ0Rvek9Hc0QrbVh5V1lQUnBKai90SU5kUTRyRWxxQXNJWEVIUjJTVWMvR045bEFjVGU0cmQwZlgzWHU1MGF6OHBQdDd4SWs3b3JqdGhQamd0dTdsTVFYblRHOG1WcEdsYjAvcjkzQWdTS05DVFBJRGlXSTJWd1E1Z2loRUdPZVF2MlFNbjZOa2c4VGgwSElNNFJKS3BGT3lENmtLcXNEWmFZVXBWWHV5OU8rWncvSWRMYzF1Q1hMUGNNQVVILytwS1dVRXUzakM2RUFPSy92NHNpVVZSTWZzSWU5ZXIvMUlWdU90VGgzeFFNTmVrWEJ6WGFOSmpQWFVqVXRSSnpzVTFDL01uVTFCRHZsZHlyaXh6NlVmSG9qdlpxa3hEZndWdExWU2NPUlVZRTIwc00xaGdoTzVHenhBSElDTXRqVWhXTGNkMDJFa0ZJa21ESjJmZFpqYTlGbm8rT1Mwc0RlRFhuYnpUUnJzSjNtN1hLd1dOdXJFT0Z6eGsxYVJmTzBOWEZpNmhyQkM2M0ZNYStzNG1aTjhOeE1TNm9pVjZYVnNuQUxOTUQ4WVR5eVpmMlBBVmt4VkZpaWo2dzdybHoxY0duenUwaGE4RVhwSGoyNGYrTDZ5QnV5dno3NlNHZlM2OE5FN2t0TWlyL2VHWjRIMk9PdHN0U0x3ellybjBVcUcwYmMxajU0dGxld25yR042bEd3RkxldkJMZ3pqY1JKK0hLeEpMYm9SQUlaTGNnRSttUmVCWUxNUXA5eUtuTmlKVVZhV0ZNZFB1OVQ1NTRsMUpCTHRZdWNKRmMvVUVYOXZuYWdSeFNIZnlycGdFOVZnZmltNWltcnZaRjdGS1BLMFFiK1BOMzJEc0hwS1ZZemNhc0RHdTZyN0Z0L0lSQitXUWtTSGR1T0kyZkhYcnlBMzA1aVAycllWQWpCVXZyQm9FWUNWdEFPaG1uTWJpN3prRWU2R0FBU0pxWTdyZDU5OHZtQlZJREhUNVJ6bUVSRTVJdWdFTnRXSkxGMkdPWmZwRklTK1RNNzFEQjZFRjJ3cHNqdEhBU3YwdXFNTHlmKzc3aFpwcEE9

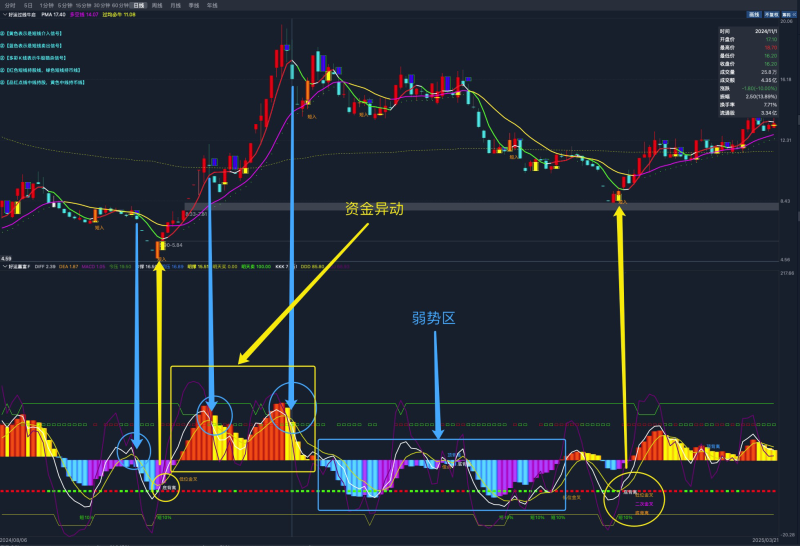

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容