温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

编写条件:

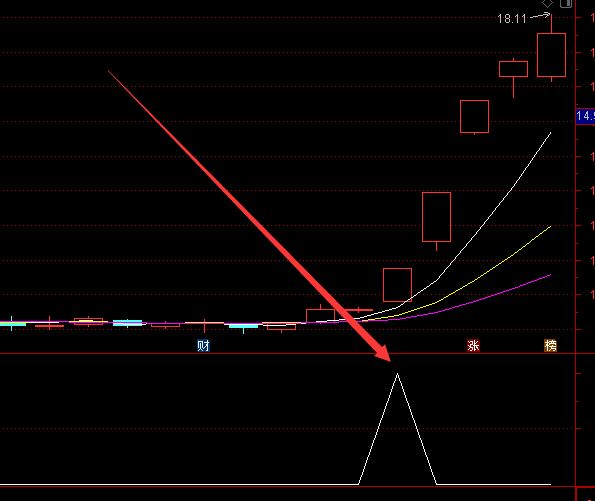

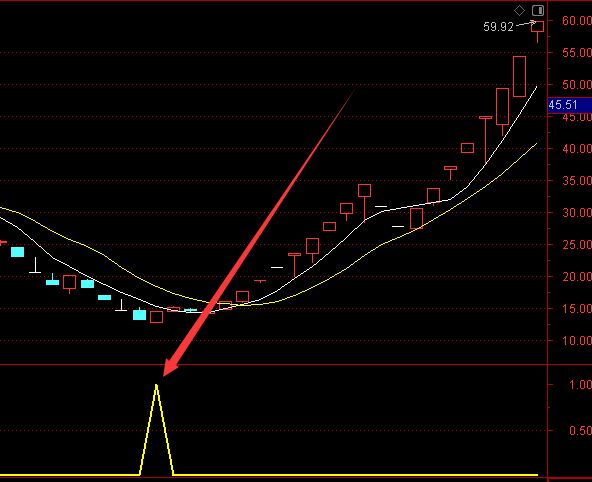

MACD绿柱二次缩短的选股公式。

编写方法:

macd:=”MacD.maCD”;

AA:=BArslAst(MACD<=REF(MACD,1))=1;

XG:AA AND COUNT(AA,BARSLAST(MACD>0))=2;

其他写法:

该公式通过BARSLAST函数定位MACD转负位置,结合SUMBARS函数统计绿柱缩短次数,实现二次缩短条件检测。

核心逻辑包含:

1)当前绿柱缩短状态判断;

2)确保前次缩短发生在红转绿之后。

参数SHORT、LONG、MID可调整周期参数

{参数设置}

SHORT:=12; {短期EMA周期}

LONG:=26; {长期EMA周期}

MID:=9; {DEA计算周期}

{计算MACD指标}

DIF:EMA(CLOSE,SHORT)-EMA(CLOSE,LONG);

DEA:EMA(DIF,MID);

MACD:(DIF-DEA)*2,COLORSTICK;

{条件1:当前绿柱缩短}

COND1:=MACD<0 AND MACD>REF(MACD,1);

{条件2:前次绿柱缩短发生在MACD>0之后}

AA:=BARSLAST(MACD>0);

BB:=SUMBARS(COND1,2);

COND2:=BB<AA;

{最终选股信号}

XG:COND1 AND COND2;

{可视化标记}

DRAWICON(XG,L*0.98,1);

DRAWTEXT(XG,L*0.95,'绿柱二次缩短'),COLORWHITE;

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0WkZYRUhRYzV4Ykp4RzZmKytCUENadm4xSXIyYWllQUs2MHNtOTQ4QkZPR0UydUNuUjRTeHUvckppVER6bURhL2Z6MFhRMVVzaWx5OWYvaHcrOG02Z1FESEJoVHN0NS9ieXhnaTRUNHl1ZXBvU3B0dS9FNjVwRHl2eWhmUmdkZ0xQQU5YY2t1Mm91TFhwMGlaNHZDeGNqQWV0bkM5VGpzR1BjcmJCTEpncWVrNXFXRnk0cS9MT25PdkR3Mk5peDJOTms2THFXbWxrN3NSc2drYXZHTlpFaXEzNFJ6SktWOWRuK3d3SEtadXJrZFJ0VzZkNW56c25pZGczMnVqdnkraGl1SWtTcHVqVGN3MkxsdE9acDFnUGNyUEgvRFFRUlArbFBRRDlhOU84TkdFa2IrYkFaRThiRHBSWEVyNklCQXFqSE5PU0FWWnpNK01lbnFBb0kvZU5QWWV5UFNkcXh4NkZLMytZclYvYUpCK05UTlhQZk9DZnhiRG5ISmNJbWVVVWJsdVo3cmFRKzMyUDlML2xaSVN0SXcySjVQaDdsY1ZHRmlPbzFEUG0zU0xKc0h2SGV2R1FCWVF0cjVBUXUrSGhYRGxKb0xhVkFoMCt1aVJXc3gxb1MyVkU2WVVvcCtpTlZjSjlXYmdtaU1qeml4WC85cEFoZDMrc3FBb0drOUs2U3I0MU0rbG5EYm10WWhUNUhhVno1VGR3UE9Lc0lMakdoN044TXJicVorM0RiejYrZytRT3N5Sk1pQ2pDL3N4Z3NsRmVqR0pMbTdDem81TllIWVR2cUl5MzJyMVFBVlpxRExkTENITTQvT3llQU9FejcyV1F4QnJmcC9jTjBoWlIwdDBzQ1BGeTlqMnpIOU9xMmxvb2E4clArMjdrY1JQbk9ubWNKQWhoNmUwdnk1YXdwQTRoSHRsOGZkMHJsSitUbWxuMDEvN3hGdk1va0lyam84OEtGZ3JUTjlxaXVQSVBzeEdXVHZWQ0d0SjJGV0Z4azF2bTNlK1FUclFqdlNXSTUzR0tuNHB3MDdZOFZMZFkwOU9mWUxQUFV1c2R3bUhtOEdmUVYxUUhIdmJNRXNyU3YwbXJNczZiVkZTd0x0b1hIa0ZkdzZBOFR2Q3pwdlJJYTRTVlJWMnRSTnZ5UWtpODB3c0NqMWFscWpJcEZTMmJhV2pQRVZzSTgyTGFTeG1xVzJiRnBMM0hsMzNuclQrTU40NzU5b3k1Vk0yemV5MXJrVkQ3SlJsWVhUOW9oRjVuTDlKSXJSYlVPckRVckZaVkZURmtCdmZqbzhxTW9pV1l2cWN5TzQvMDdLVDJ5LzNJbW1PUnZxdEEyN3UzNXlTSjFuK0FJUmlucHUxTDUwbkorTnVtblRzUTN5S1JVZ1NMVi9wbFZzUk92M3ZQQjczSmVSZW1ZaEgzWHZ2bFBhRWhFcy9lR2RJTzVLeVd0V21naHhnc05rTDY1RDhURUJ2MGxYRWxLbDdFS2RheXRUVHFON1pPWFpMc0ptWXdhVmcvU043VjhPVkZucmJHYWZFNFBFRGJjbEdyRWUwMmhDbnZ1VmVXUW1UZGRnYjJFQW1ad3pRRFU4alNZL2tYSytNT0RJcThpdXdrajRzVlhFS3o5d3VKaHJYRDJQRHN1YzhxLzQxdEpKdzQ3bTVKaGI4d1ZvQ1NpL01MRlZLUW81RDdURmpXSnk5NFBheUxnZCswcVV3cTROdk1zY21oQXovRFBWa3ZBR2grZ3ZoYmsrMkNzVTBEeEJQa2pUT0lQVTZTd05LRUlTK1F0cE5xM25mL0c5OGkrMjNRV0dmbTAvemtVRVlLTzFvUExHSkN3b09VMFZqcUNLSzkxOVR3RVdZbWd1bFVZV1VHY3JvbTJDNzVWYm0ya2gvMkI2N3czcnlOb1JiaGNvemZaUStsMXQ2bnRhRXVJdWU4QUZQNm5jWkRLUmxpcXdPWVZvWE5HRm11ekVaVEo0YllwSGlOVVV0OHQ3ZmJ0a1hTT3AwNlN1QXUzN3FTOVJ1am02L0VDQ05mZUN4VWhDZWw4WU8rNWJiNk5xTFlqM3ZsV2N4MUFRRlREZERWV0RHZGtqcjI2SU82UnlVK3ZTZ21mVFp3S3ZoamlacFFpQmRzdlNCZG9rV3pTc2hzai81M3BSNXFSZndzSklaTFgxMWh2aTRuNWVwcTljeTA0SEFzcXcwd3RhRnduZm5pZFlLUTZmWWRXRnBMTCthUFNsWDRGUWtRbnRJb0pwUmowdE5uSjVaODNtOGxETmlSMmlUdHZwaldtcmk5V3FSaS9mRkFUclA4MHRIRzh6WHpqS2xpcmhYL0RCSUlKeW80UkEwOVk0aGJuMEZpaG1VbjIxOElhbU1tazZFSVYvaVo5SEFLb3FUck1MTm5lWTRQMmdoUldhZFhMSVZ1NXhWd0lrbmViR09pbHBhakc1eDc3d0JTUTNxRVgxM01XVlU0UCtmeWpNMnBTZytVWEpYWXVCa3dUUTZLV3RvSlBYUHk5TWYxZG1MQVhPOWRUWHdZYzBoNDVDS1ZPd1dqbFlKZHRNUXNsN0xPYzhDazkwZENjaGxXREQzVE9VcDlKVDJJdHFjd1BLdG9YbjJYaHlkL0pkVVIwZDRIaTFVWCtiL3dYbnErTnNrQ2t0RHNlS2ZqZTlPcFl3aXMzQTd2cVlyYmZ4bGdteE5PV3FSTTRKaFdnbTBLNVg5MVRuTXAwTG1GeldjTDlqd2tPQjQvcnN4T3h5QWJ2VmhuL2hKNjBjN3JRQXJDckxYWVpKVkJQckVtcmVwc1l5b0p1c2ZsOTVBbGozSjRDai9RYUlJOUJpQlprZUc2bXJPeXZJUW5mbXhMa2pJTVh2bTJLcW5KYjhpV1RJOXd1NExNaFVaSDFjYUFVRm5LT3NJVnJNb3dLV2VkdXhtekpXY210WnM2NHc2WE1iajh0MWc5dTUvUlk4clJuTExzK2NaV0pzVnN6RGdiYTM2aHRFemd4dUZqVzhERktUd3BaZzA1TVVTS3VaSDZ4TE5hYmx4SGlLOFdHU3EralpvSGU2S1hzWEIxUWYvL1pFbUlSQmNBVFpzYmxWazE4YUFSMEFHUHRzNG91TWdPdkZNRTlvcWlPMWJFeFZFWnNBU1UrbUlJU0o1alFSOTBRN0dXL01pNE9mTUpsWTgzbFpNSVg5UjhteVRFSHREQUs4aWxwazBvYzJ3SHBLbmRTRm9zSTRiUG9PYWhDNHkwQW5WTG1KbDZXMWJvQThDeEwwdkI1MWtwVFF3QmZXNldFPQ==

RVdTOUtDenh1c1RzcTJZc216SUM0WkZYRUhRYzV4Ykp4RzZmKytCUENadm4xSXIyYWllQUs2MHNtOTQ4QkZPR0UydUNuUjRTeHUvckppVER6bURhL2Z6MFhRMVVzaWx5OWYvaHcrOG02Z1FESEJoVHN0NS9ieXhnaTRUNHl1ZXBvU3B0dS9FNjVwRHl2eWhmUmdkZ0xQQU5YY2t1Mm91TFhwMGlaNHZDeGNqQWV0bkM5VGpzR1BjcmJCTEpncWVrNXFXRnk0cS9MT25PdkR3Mk5peDJOTms2THFXbWxrN3NSc2drYXZHTlpFaXEzNFJ6SktWOWRuK3d3SEtadXJrZFJ0VzZkNW56c25pZGczMnVqdnkraGl1SWtTcHVqVGN3MkxsdE9acDFnUGNyUEgvRFFRUlArbFBRRDlhOU84TkdFa2IrYkFaRThiRHBSWEVyNklCQXFqSE5PU0FWWnpNK01lbnFBb0kvZU5QWWV5UFNkcXh4NkZLMytZclYvYUpCK05UTlhQZk9DZnhiRG5ISmNJbWVVVWJsdVo3cmFRKzMyUDlML2xaSVN0SXcySjVQaDdsY1ZHRmlPbzFEUG0zU0xKc0h2SGV2R1FCWVF0cjVBUXUrSGhYRGxKb0xhVkFoMCt1aVJXc3gxb1MyVkU2WVVvcCtpTlZjSjlXYmdtaU1qeml4WC85cEFoZDMrc3FBb0drOUs2U3I0MU0rbG5EYm10WWhUNUhhVno1VGR3UE9Lc0lMakdoN044TXJicVorM0RiejYrZytRT3N5Sk1pQ2pDL3N4Z3NsRmVqR0pMbTdDem81TllIWVR2cUl5MzJyMVFBVlpxRExkTENITTQvT3llQU9FejcyV1F4QnJmcC9jTjBoWlIwdDBzQ1BGeTlqMnpIOU9xMmxvb2E4clArMjdrY1JQbk9ubWNKQWhoNmUwdnk1YXdwQTRoSHRsOGZkMHJsSitUbWxuMDEvN3hGdk1va0lyam84OEtGZ3JUTjlxaXVQSVBzeEdXVHZWQ0d0SjJGV0Z4azF2bTNlK1FUclFqdlNXSTUzR0tuNHB3MDdZOFZMZFkwOU9mWUxQUFV1c2R3bUhtOEdmUVYxUUhIdmJNRXNyU3YwbXJNczZiVkZTd0x0b1hIa0ZkdzZBOFR2Q3pwdlJJYTRTVlJWMnRSTnZ5UWtpODB3c0NqMWFscWpJcEZTMmJhV2pQRVZzSTgyTGFTeG1xVzJiRnBMM0hsMzNuclQrTU40NzU5b3k1Vk0yemV5MXJrVkQ3SlJsWVhUOW9oRjVuTDlKSXJSYlVPckRVckZaVkZURmtCdmZqbzhxTW9pV1l2cWN5TzQvMDdLVDJ5LzNJbW1PUnZxdEEyN3UzNXlTSjFuK0FJUmlucHUxTDUwbkorTnVtblRzUTN5S1JVZ1NMVi9wbFZzUk92M3ZQQjczSmVSZW1ZaEgzWHZ2bFBhRWhFcy9lR2RJTzVLeVd0V21naHhnc05rTDY1RDhURUJ2MGxYRWxLbDdFS2RheXRUVHFON1pPWFpMc0ptWXdhVmcvU043VjhPVkZucmJHYWZFNFBFRGJjbEdyRWUwMmhDbnZ1VmVXUW1UZGRnYjJFQW1ad3pRRFU4alNZL2tYSytNT0RJcThpdXdrajRzVlhFS3o5d3VKaHJYRDJQRHN1YzhxLzQxdEpKdzQ3bTVKaGI4d1ZvQ1NpL01MRlZLUW81RDdURmpXSnk5NFBheUxnZCswcVV3cTROdk1zY21oQXovRFBWa3ZBR2grZ3ZoYmsrMkNzVTBEeEJQa2pUT0lQVTZTd05LRUlTK1F0cE5xM25mL0c5OGkrMjNRV0dmbTAvemtVRVlLTzFvUExHSkN3b09VMFZqcUNLSzkxOVR3RVdZbWd1bFVZV1VHY3JvbTJDNzVWYm0ya2gvMkI2N3czcnlOb1JiaGNvemZaUStsMXQ2bnRhRXVJdWU4QUZQNm5jWkRLUmxpcXdPWVZvWE5HRm11ekVaVEo0YllwSGlOVVV0OHQ3ZmJ0a1hTT3AwNlN1QXUzN3FTOVJ1am02L0VDQ05mZUN4VWhDZWw4WU8rNWJiNk5xTFlqM3ZsV2N4MUFRRlREZERWV0RHZGtqcjI2SU82UnlVK3ZTZ21mVFp3S3ZoamlacFFpQmRzdlNCZG9rV3pTc2hzai81M3BSNXFSZndzSklaTFgxMWh2aTRuNWVwcTljeTA0SEFzcXcwd3RhRnduZm5pZFlLUTZmWWRXRnBMTCthUFNsWDRGUWtRbnRJb0pwUmowdE5uSjVaODNtOGxETmlSMmlUdHZwaldtcmk5V3FSaS9mRkFUclA4MHRIRzh6WHpqS2xpcmhYL0RCSUlKeW80UkEwOVk0aGJuMEZpaG1VbjIxOElhbU1tazZFSVYvaVo5SEFLb3FUck1MTm5lWTRQMmdoUldhZFhMSVZ1NXhWd0lrbmViR09pbHBhakc1eDc3d0JTUTNxRVgxM01XVlU0UCtmeWpNMnBTZytVWEpYWXVCa3dUUTZLV3RvSlBYUHk5TWYxZG1MQVhPOWRUWHdZYzBoNDVDS1ZPd1dqbFlKZHRNUXNsN0xPYzhDazkwZENjaGxXREQzVE9VcDlKVDJJdHFjd1BLdG9YbjJYaHlkL0pkVVIwZDRIaTFVWCtiL3dYbnErTnNrQ2t0RHNlS2ZqZTlPcFl3aXMzQTd2cVlyYmZ4bGdteE5PV3FSTTRKaFdnbTBLNVg5MVRuTXAwTG1GeldjTDlqd2tPQjQvcnN4T3h5QWJ2VmhuL2hKNjBjN3JRQXJDckxYWVpKVkJQckVtcmVwc1l5b0p1c2ZsOTVBbGozSjRDai9RYUlJOUJpQlprZUc2bXJPeXZJUW5mbXhMa2pJTVh2bTJLcW5KYjhpV1RJOXd1NExNaFVaSDFjYUFVRm5LT3NJVnJNb3dLV2VkdXhtekpXY210WnM2NHc2WE1iajh0MWc5dTUvUlk4clJuTExzK2NaV0pzVnN6RGdiYTM2aHRFemd4dUZqVzhERktUd3BaZzA1TVVTS3VaSDZ4TE5hYmx4SGlLOFdHU3EralpvSGU2S1hzWEIxUWYvL1pFbUlSQmNBVFpzYmxWazE4YUFSMEFHUHRzNG91TWdPdkZNRTlvcWlPMWJFeFZFWnNBU1UrbUlJU0o1alFSOTBRN0dXL01pNE9mTUpsWTgzbFpNSVg5UjhteVRFSHREQUs4aWxwazBvYzJ3SHBLbmRTRm9zSTRiUG9PYWhDNHkwQW5WTG1KbDZXMWJvQThDeEwwdkI1MWtwVFF3QmZXNldFPQ==

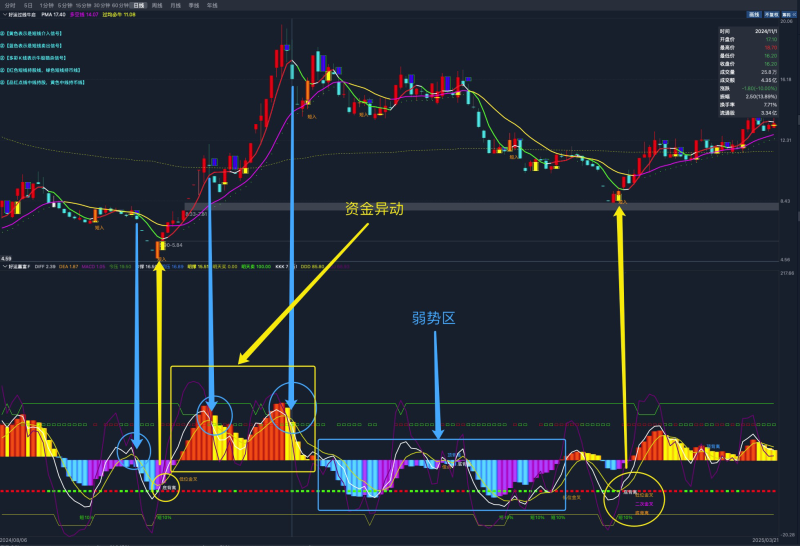

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容