温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

编写要求:

kdj的J线小于0后又上穿0并大于0公式

好运哒哒指标公式网解答:

解答如下:

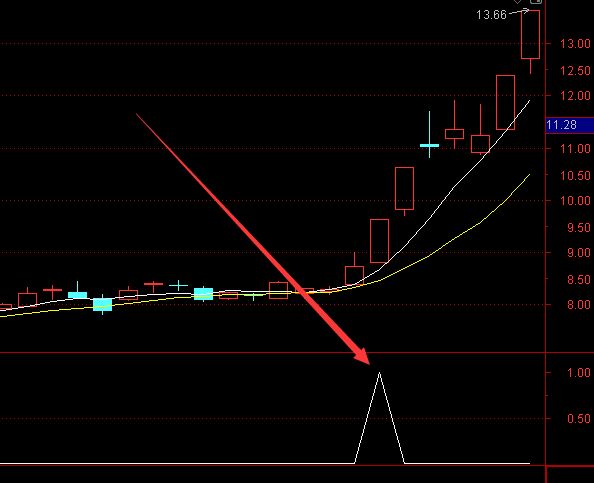

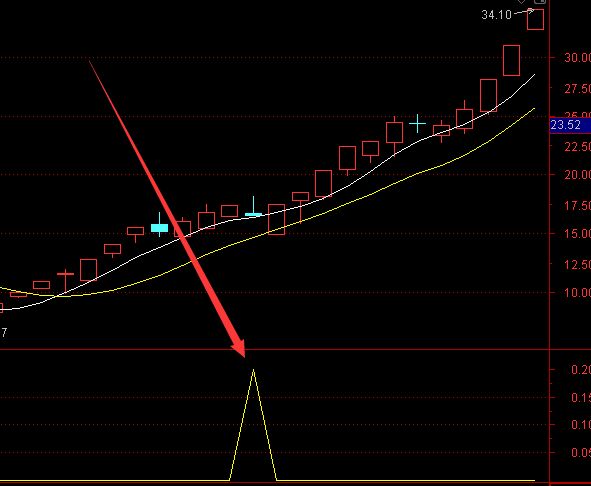

ref(“kdj.j”,1)<0 and “kdj.j”>0;

其他方法:

该公式通过REF函数判断前一日J值小于0,结合CROSS函数检测J线上穿0轴,并确认当前J值大于0,形成完整选股条件。参数N、M1、M2为KDJ标准参数,可根据实际需求调整

{KDJ指标J线上穿0轴选股公式}

{参数设置}

N:=9; {RSV计算周期}

M1:=3; {K值平滑周期}

M2:=3; {D值平滑周期}

{计算KDJ指标}

RSV:=(CLOSE-LLV(LOW,N))/(HHV(HIGH,N)-LLV(LOW,N))*100;

K:=SMA(RSV,M1,1);

D:=SMA(K,M2,1);

J:=3*K-2*D;

{选股条件}

COND1:=REF(J,1)<0; {昨日J值小于0}

COND2:=J>0; {今日J值大于0}

COND3:=CROSS(J,0); {J线上穿0轴}

{最终选股信号}

XG:COND1 AND COND2 AND COND3;

{画线提示}

DRAWICON(XG,L*0.98,1);

DRAWTEXT(XG,L*0.95,'J线上穿0轴');

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0UjdobG9KSWxmNUt2NzlTVHRrK1ZDMDZCaDF3eUFCb2RxUUNKNFkrdXVtdEI5YWR3UXEyUjdNY2lKNWwxWkF4RUd0bnJHaWVDRkZoTHpua1pEdlB6M2YydUNtRFBUT1RETndYOFZXd2pVc1pva0loQ1NBYWRBVDcxWWlEemx0cnpzT2hKdmhLT1pEWlQxK1k3KzVYQllnbzd6bDdkK2lBWThCb0d4YjRQc0pKcVYzcFI4MFd5SVBuSmN3ak5ac1B5VVZqczBNd1JHdUtaOUVjYWxYY3IzL1VlZ3VPdWZqYUdNeXQ5RFVwRG1ZK09ibC9kM0xGcFBQRUZZRWxjYlJQN1JEcWJESUNqNFZ1Yy9mUU5MSCtCODN6K25RQ1ZhZzk5VE1NcTRhRjcvZVJPUGNyVVJaQThUWklIVTBYVHNJTklaVXNqOVBWdEhlOGRaeVhXMmdQTnpBYStCR0lHbm9HdlZzVzRJaVp6aVJ0cmZDbGFnRjE2bktaWFFYRCtkTmZYVXZsTUptSzVHRVVqdy95U2dGOVV0RGJVVFZXbnF4TThGQXhkWU8yR01IN3hLVlZURkJqUjdqb2ZqTWlvdWJXNWcvalJDeTFhOGZsdFVtbHFCcEE3b1pmQ1cxQUdNRDZaOVpZZGQrVGE5WURJclQ3a1RXSnRIUDZWdWxkYzhFQThHR1Fwdy95TzZlcHM2am5QY0ZuR2hpOGpHN29JTjNTUnpOQmV3K3ZBcnpHeVpaUWlZS0plUHpqYnd1UVBSZ2JpT2dkQmF5c2pacWNENzBNNTE5OUg4ZTFRZVp3VW1GYmFOMUFJL1N2dUpQZDZ2cDFKVUM2ZWlIUDBuSm9MUXdSeVA2cHNhaDZLQ2hoUlA1a1ZGclFjOWcvUmVHUmZoTHNXVFRaSEM5YWJIcVpPdHhqV2xnUUo1VXFvVWZ1TnNSNXk1OUFYNjNONWVNY0s5ME5Qa3puYklJeFhBTWQyMkdQOU5PVldpSU9oamRSVjVESDMxaFlrblExbDJOZ1ZwaU9OQzRpbG9ZWWxhMWJGR205N0NoZHJPSU9RejZPY2R2bXZuWWl3WnVraVA5Uk1NbjBEOXlQYmkxalhHZ0xRcC9ZQytVc0laWnp4OU91Qm9mbitXWGNMVGg0TklReS9LSWJmc0xEc1E3NmI4Q1lEY3R5dlNrZitaVVk2c3ZWdkhYMlpUbjFOUlhwV0RubnFJeHpCQ2JBanQxaUpyd2VjampTZmtzc1BvSU9kcGxFNXE5bldaOEJMQVZKMjVoRytNUU9peVUvamg3cXJFTmxhZnIxRU9RTnBIbG5Ud3RncGpWcktMejhGNVYzYzI3MElKWFZ5aEppK3BKQndMNVFYN2Ftd1BlRDhOWUNBR2o4N0dVRWdTM3NWT21sUE5NTitlZ0dCNmVqc1hkaDFlZ0o0cE9Wa2ZXM2Urd0c2aHhJNnpoTHUxaHZjeVltNFZmVGZYR1VlOVg0TmpWR1NJZGwyTHdQbXp5OGZDQTNoTEplN29aTXM1dVlPZytmTUs3UU5taDlNcHB4dElZcm5TTmRaTDI4Q3B3bXlPaWYySngva1l0M0lGZ01UNUN2YnNkbW1uWks1VHVTZENNTnVLQ2g0NDErTENvWjUxZG5odHVkL1h3Ylpob3d6YlkrMlh1WFZwVUMvVW1wdzZQSmRzVE9OZXJpQkJZcG9hc09iSWhEOHBiMmpFM0h0dUhocHFGMVhEeUNNTFBBL3YrbFhFcDhxWHlGT2hoTnRvN3BRTFV6dm5HeThKZlJTWXIwRElmdllabUNBMEdqZmxHOHRVb0l3cDJCT3dkNG5XVjFGZXQvNDZoaWlmN21PRUlUOVRoS0lxY25NOWE3aWUxdE1SNkVRcGptS3JnU1Jvc2NEZG02YVFCZXBnaDRnT2NCQ0xLVCtEbFkzS040UXV5a3VTK00zMWEwSUZTMmdZcmJ0QUI4R0lnbXV2blhqZDV1SUhjbk5tREpncTBpaVNYR3h6NlhIeFpqaGcvM0xrL1QzYVdGUXV1WVFpaWJ3Z1VuaHRUVGNKRmIzVmdIS0FuelkyVStHWFdHeW41RVNwbGxMaytFMDI4RUY2MmlFSUh2aVVOU1MvK0FLVmdFLzRxa2xwMWQ4ekd4dmQzeXVMUlJrdGpGN2oydGVLZE5qb2NFY0cxdFNLalBFMkV4Qm9HL0txTExvN2UvL0RmNEh3L1lkd3FndVJPOVJUMWYzNWNReXhzSCtFVWJNMnpnNW1YUnN0MGVaOGpDZS9UUW9CaTdXN3g3Z0V5YjdSekVRbVdPMCtNYnZUb1l0b0RRak1BMkVlQ0doVnhhM2w2VitKWTU5Z0hMUnFybVpDVTUrR1U2TTJ1UTljWmorUTVLbEwxZFBEcU5kYVF0bXVZcWdGejQrUUZOMklKaXA3RUd5SmJ5TlNZaDZDM2RqYW5NSjBxOGNzMGxWYnJvZmlPMVdaeTBxVjJSN3JJS2dtZHNhZFBmODVsejlTanJQYUhpU2RvdkJwMHVpRFRLYmJYNXNUMnFHVVlaOVp2K1J6cHY2SFBmT0NtbmxiQXczckw2dWcrcE1tdFh2WjdWWmJ3ODh6SnN5TkZCUDQzRG81eDNaSW5FZXdibUM3aTFMcnBZNjRQMlJKemJvU1lnd1FtRDBmUEIwS1d5WGJ1SkdSVFFJdHViOVRpVHo2dTZOQ3RocXRHSUh1MHJCcTErUTg0WFMra0wzVXYyWmdBZlNPRUZ4SFZnUjNlU0pnMFJwV29rY1BHZjVmZUN0T3RMSnRlM0IzaWV5dEJVajhHU1BvWm1WLzVlQ3V6cFNCblgxWGRqeEVmck1hVGkzQ3lORXRtdTljQ1B0MzVSdWh5SW50amE4V0dCQTdLTFRKQm43MVhxdGtSTTdDa1h4SyttcHVpZVhieXBkclAyT01OZTlUSHFtNmdXZ0JHMDQvT0svdmc1ak9tM2lUTEthK0VnNE1scG9GMS9mSDlCblEyWE9vR1FkZVNMNXVPTndvajRIcXk2R3BndTdhV3VGSzVHOFlQUmM5c0dVK3pE

RVdTOUtDenh1c1RzcTJZc216SUM0UjdobG9KSWxmNUt2NzlTVHRrK1ZDMDZCaDF3eUFCb2RxUUNKNFkrdXVtdEI5YWR3UXEyUjdNY2lKNWwxWkF4RUd0bnJHaWVDRkZoTHpua1pEdlB6M2YydUNtRFBUT1RETndYOFZXd2pVc1pva0loQ1NBYWRBVDcxWWlEemx0cnpzT2hKdmhLT1pEWlQxK1k3KzVYQllnbzd6bDdkK2lBWThCb0d4YjRQc0pKcVYzcFI4MFd5SVBuSmN3ak5ac1B5VVZqczBNd1JHdUtaOUVjYWxYY3IzL1VlZ3VPdWZqYUdNeXQ5RFVwRG1ZK09ibC9kM0xGcFBQRUZZRWxjYlJQN1JEcWJESUNqNFZ1Yy9mUU5MSCtCODN6K25RQ1ZhZzk5VE1NcTRhRjcvZVJPUGNyVVJaQThUWklIVTBYVHNJTklaVXNqOVBWdEhlOGRaeVhXMmdQTnpBYStCR0lHbm9HdlZzVzRJaVp6aVJ0cmZDbGFnRjE2bktaWFFYRCtkTmZYVXZsTUptSzVHRVVqdy95U2dGOVV0RGJVVFZXbnF4TThGQXhkWU8yR01IN3hLVlZURkJqUjdqb2ZqTWlvdWJXNWcvalJDeTFhOGZsdFVtbHFCcEE3b1pmQ1cxQUdNRDZaOVpZZGQrVGE5WURJclQ3a1RXSnRIUDZWdWxkYzhFQThHR1Fwdy95TzZlcHM2am5QY0ZuR2hpOGpHN29JTjNTUnpOQmV3K3ZBcnpHeVpaUWlZS0plUHpqYnd1UVBSZ2JpT2dkQmF5c2pacWNENzBNNTE5OUg4ZTFRZVp3VW1GYmFOMUFJL1N2dUpQZDZ2cDFKVUM2ZWlIUDBuSm9MUXdSeVA2cHNhaDZLQ2hoUlA1a1ZGclFjOWcvUmVHUmZoTHNXVFRaSEM5YWJIcVpPdHhqV2xnUUo1VXFvVWZ1TnNSNXk1OUFYNjNONWVNY0s5ME5Qa3puYklJeFhBTWQyMkdQOU5PVldpSU9oamRSVjVESDMxaFlrblExbDJOZ1ZwaU9OQzRpbG9ZWWxhMWJGR205N0NoZHJPSU9RejZPY2R2bXZuWWl3WnVraVA5Uk1NbjBEOXlQYmkxalhHZ0xRcC9ZQytVc0laWnp4OU91Qm9mbitXWGNMVGg0TklReS9LSWJmc0xEc1E3NmI4Q1lEY3R5dlNrZitaVVk2c3ZWdkhYMlpUbjFOUlhwV0RubnFJeHpCQ2JBanQxaUpyd2VjampTZmtzc1BvSU9kcGxFNXE5bldaOEJMQVZKMjVoRytNUU9peVUvamg3cXJFTmxhZnIxRU9RTnBIbG5Ud3RncGpWcktMejhGNVYzYzI3MElKWFZ5aEppK3BKQndMNVFYN2Ftd1BlRDhOWUNBR2o4N0dVRWdTM3NWT21sUE5NTitlZ0dCNmVqc1hkaDFlZ0o0cE9Wa2ZXM2Urd0c2aHhJNnpoTHUxaHZjeVltNFZmVGZYR1VlOVg0TmpWR1NJZGwyTHdQbXp5OGZDQTNoTEplN29aTXM1dVlPZytmTUs3UU5taDlNcHB4dElZcm5TTmRaTDI4Q3B3bXlPaWYySngva1l0M0lGZ01UNUN2YnNkbW1uWks1VHVTZENNTnVLQ2g0NDErTENvWjUxZG5odHVkL1h3Ylpob3d6YlkrMlh1WFZwVUMvVW1wdzZQSmRzVE9OZXJpQkJZcG9hc09iSWhEOHBiMmpFM0h0dUhocHFGMVhEeUNNTFBBL3YrbFhFcDhxWHlGT2hoTnRvN3BRTFV6dm5HeThKZlJTWXIwRElmdllabUNBMEdqZmxHOHRVb0l3cDJCT3dkNG5XVjFGZXQvNDZoaWlmN21PRUlUOVRoS0lxY25NOWE3aWUxdE1SNkVRcGptS3JnU1Jvc2NEZG02YVFCZXBnaDRnT2NCQ0xLVCtEbFkzS040UXV5a3VTK00zMWEwSUZTMmdZcmJ0QUI4R0lnbXV2blhqZDV1SUhjbk5tREpncTBpaVNYR3h6NlhIeFpqaGcvM0xrL1QzYVdGUXV1WVFpaWJ3Z1VuaHRUVGNKRmIzVmdIS0FuelkyVStHWFdHeW41RVNwbGxMaytFMDI4RUY2MmlFSUh2aVVOU1MvK0FLVmdFLzRxa2xwMWQ4ekd4dmQzeXVMUlJrdGpGN2oydGVLZE5qb2NFY0cxdFNLalBFMkV4Qm9HL0txTExvN2UvL0RmNEh3L1lkd3FndVJPOVJUMWYzNWNReXhzSCtFVWJNMnpnNW1YUnN0MGVaOGpDZS9UUW9CaTdXN3g3Z0V5YjdSekVRbVdPMCtNYnZUb1l0b0RRak1BMkVlQ0doVnhhM2w2VitKWTU5Z0hMUnFybVpDVTUrR1U2TTJ1UTljWmorUTVLbEwxZFBEcU5kYVF0bXVZcWdGejQrUUZOMklKaXA3RUd5SmJ5TlNZaDZDM2RqYW5NSjBxOGNzMGxWYnJvZmlPMVdaeTBxVjJSN3JJS2dtZHNhZFBmODVsejlTanJQYUhpU2RvdkJwMHVpRFRLYmJYNXNUMnFHVVlaOVp2K1J6cHY2SFBmT0NtbmxiQXczckw2dWcrcE1tdFh2WjdWWmJ3ODh6SnN5TkZCUDQzRG81eDNaSW5FZXdibUM3aTFMcnBZNjRQMlJKemJvU1lnd1FtRDBmUEIwS1d5WGJ1SkdSVFFJdHViOVRpVHo2dTZOQ3RocXRHSUh1MHJCcTErUTg0WFMra0wzVXYyWmdBZlNPRUZ4SFZnUjNlU0pnMFJwV29rY1BHZjVmZUN0T3RMSnRlM0IzaWV5dEJVajhHU1BvWm1WLzVlQ3V6cFNCblgxWGRqeEVmck1hVGkzQ3lORXRtdTljQ1B0MzVSdWh5SW50amE4V0dCQTdLTFRKQm43MVhxdGtSTTdDa1h4SyttcHVpZVhieXBkclAyT01OZTlUSHFtNmdXZ0JHMDQvT0svdmc1ak9tM2lUTEthK0VnNE1scG9GMS9mSDlCblEyWE9vR1FkZVNMNXVPTndvajRIcXk2R3BndTdhV3VGSzVHOFlQUmM5c0dVK3pE

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容