温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

编写要求:

三连阴三缩量选股指标。

公式在线网解答:

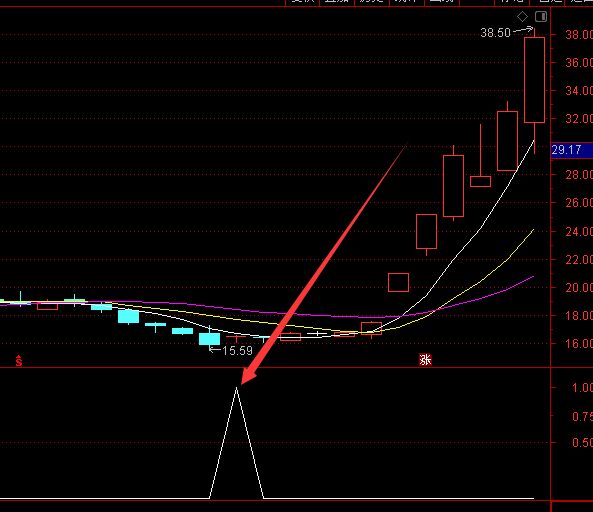

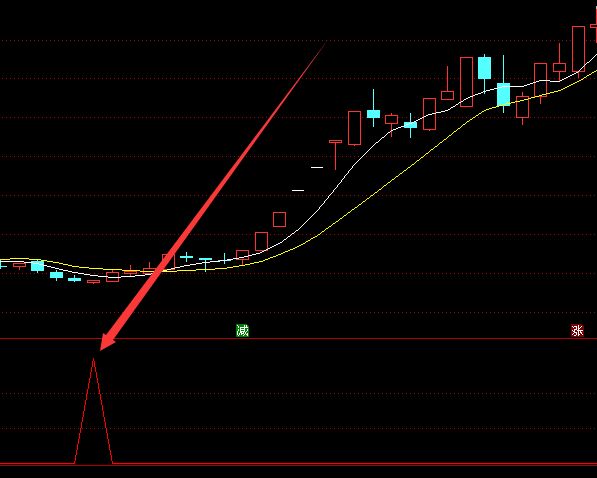

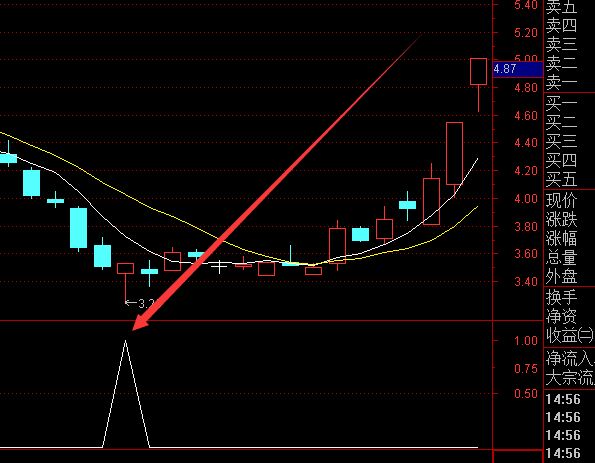

XG:EVERY(C<O,3) AND EVERY(V<REF(V,1),3);

其他写法:

该公式通过EVERY函数检测连续三日阴线状态,结合REF函数实现成交量递减判断。

核心逻辑包含:

1)K线实体为阴线;

2)成交量呈现阶梯式萎缩。

参数N可调整连阴天数,默认设置为3天

{参数设置}

N:=3; {连续天数}

{条件1:连续三根阴线}

COND1:=EVERY(C<O,N); {收盘价低于开盘价}

{条件2:连续三天缩量}

COND2:=EVERY(V<REF(V,1),N); {成交量逐日递减}

{最终选股信号}

XG:COND1 AND COND2;

{可视化标记}

DRAWICON(XG,L*0.98,1);

DRAWTEXT(XG,L*0.95,'三阴三缩'),COLORWHITE;

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0Umt2ZlRqLzZic0pQL0oxUGxwTDkzUVExNzJsVWcrNjhKV1RwN2thYUI0ZTA3YjBnaXNFNVA3WENWcEZzMzF6QVpoaGVRRlNhdW11RlFER1ZEdi9CM0pwcVltUVNkeVhuTWxvdEdJZnEwOVpCdXdyemlyUENtd0NtSFZIdndQck91RFBWZmMyRkxPTnMvN202ZkxFTTIyQ2VhWm0zcDNRd3pBNGdYTngwUDRVT1QwMStkWHZaMjhteVRuMFlTTkpYVW56cm1qWUxVQ3ZRL2tEeU0yTHhrVTROM2NZSHkwcWNBM3lHNEVMOFY5WS9oLy9jM0owYjBjS3E3WENkT3RDR0FvbkQxSG90aUZsbUVMREVOT3B4cmNXc0xjMWNGdGJtTUQ0UllpV1FFejluOGVHTys0alRPUTl4ZHpQb2NSSjh6dE1DTy9UMVdoeWNQaDgxVXgrTmJCVHRMTEEyazc4YVBpYlJQVnM1Umh0SlAxa1lnSzFMWWQwT3Nrd2lZVDNwOXVwdkJ1RWNpdXEzRE5PU0ZUZjZxZlFoOUd2OGhneExheEZrK2JXZk1qUzdDWFB1c2lWYzg1ZzZINzVHaUlkVitoNWRtTDI0R2pBdktFOW9ya1VlcWFnYWVGakUvT3loWStKYkoxcTRGZHlvWU03YURrY1pPN2w0eDBZUnM0T05La3dvZHk3YXByMWVHS1pYM0E5Y1pLOXpoUmNNTVZDS3ErWXljRnFxRmRhanFsNVkxYWd5TExJVUI4ajJKZkhqUmtzbWM3ZDhvVzVybFVrbWE3d2dHZE1HNzVPV1Y1Mm9INjhzeEJOOUJMWkxMVFN6RG9BVjY0dTVBQTJoei9jQkJmQSt4RmpBMmVoSXZGSDNOUXg4L1hORWtYTHY4M0RycEhKcmlvV1pqTjZuZ25rUWliV3djMisvbnk3RThJU0dqc3Q5aFB5NW55NGRSbkIrbWI5aGZtMkxwcmV3WDVMVVZIS2xBRUg5elAvbVZiekdNOUZFNmRiR0F5VmZLVjhhZWkrMnUyRmZGM3VIZEdHbTRxWndlNGZCNXB1Z0hUa09YeWdrMEtYc2hEWTFZOGJYYk03ZUJXbE4rbFdoR1VMcHU3cTdQaXVMMDNOb1B4ZW1jTEZPajBqL2g2aGxoYk5MMVFKUDl2cHdMY0s2bTNYR2x2blgwNmdQZDlpZVFtTXltVjhGNkl5N0xGenM2RkdycVUvdkZzT3hwK1BVWXEwWHFpdmlpTG5yVW9LMjlhVXFvc21hS3hpT1k1empIUUcvQUYvbG1OS0tZTjdtYkZ6My9GWEk4aTFOU0k5LzcrdGlvZWxYSitlNHQyUjUzVEh1c3ZlNWxYVzd3TlkzVlNsZzI1UWFNb1A2REVuVWtyQU9LNUFRNEpnc3Vtc0JxR08vSm13aGlBM3MwY3NkRnNkdzFQNThkeG81SDFxUTZmM2RNeHJ2clpuUnFIMU5Db1pXcVRPdTZFUEFDb2dYVGtZYzZhQUM5QWZlcVNrZTJkbTFYQS90SDVQQy8zMW5QWjlXL1RmRXZVU0VIUUVJLzIwUERuQnk4bVFiVjBjVm9paVkzcStoSDNJU3lORWE3ckM3SkxSSXQrd01qVEVyTTdyNDB5VXhYenErNTNDcVljMkx1S3hIS3NKd3gzSzhaR3FXKzNpOVRsMGRXL1dCRElWc2JxSEdDWTVqMkxxandWU3hnRHNYd1dTY05WTm5FQ2E5VXZWYnBKaHVpNkJpeVk2NzdISUN4SHpjc3RkeWNRVk5pbDVuc1laVTQ1eXNJdmxPT3lYSjBlNzhsZUpyOXZoVHZmcVR3OXRSNGxXb2lRbjkwWEpmaUlMQlo0WUJHWVByMSs2N3hrS3pNQWtYR3ZldHNEa2tMNnVFaWRINUJXdWN6Z3cyRHFRTjBBOTlWV29GNFkrSjlibHBOcG1yUXpjdzdwMTkrajFzcGR0UklJdFlKRXJ5d014NzNERGQzU05UMDgwR0wrNFdUUjQyMlAzQmY1YVA1c3QwZXJsRUxIV25QL2FSQmwxNEZIaEJ3Z0g3MEZEcVdvNExya25XbHc0OURvVWRrOTZybk05Z1BWcEVub00yYzB4MVg5RlpOMEVlSkY3TEIvOG9VdVJ4ZGI5Y2JvL2g1S2d0bCs5MjUvanl2c1ExbzUvWEJ0OXVQZFFrcUtsWkxaVlV0K095WTNLclF0UmlOTUo0ckUwQ3d2bkdkTGwrZ3dyblBpR0g5SXJaTTZ1OHUxc0dscmFKSVRERjROQmtEVWE0T2FaRlJFdjI5TVpvd21XNVlaK3pEb1VDckVQQUo5RU9KUHdLSlJEK0hJYllPd21Dak5wSWVaUU04KzliNFhtd2JtTGlOL3NKR0pjVEFsV0Q5bjlkZmxlcUU4azZ3elRSY3NuN2tudzUwM0JVdENZRjNvK1dsWXhBa3pHVVMrd0ZjOVhSSFF3aVUweHliOUdyN0kxcTMyalBTaFUrMEwvZGw5WVpzcTFhR05TZXJUUVQrS2UyNWo1M2V0cHIxT004RkxQZG90KzgyRlo1UDV1dER4cFZmV21XM29MU1lXRVhWQldvSTlyMHl6RGFyaWVTOUVESVRMOHpKY3ptVVVtc3NUeXNTaUZOSjE2VkZFMXJmOW9nWUlTQ3FYYnRWY1FsT05ORGJ6ZkFwTXk3Z3lrb0htQmZQWHJlRzhUNVVNZVhyUkRzekdoRFdVM2w1WElaV3d0U0hQVHZTZ2FWQlFFYlVzQXFXdkRjY3grQVdJRDFVbU1aa2dtak5sQmhoSU5JL2g5

RVdTOUtDenh1c1RzcTJZc216SUM0Umt2ZlRqLzZic0pQL0oxUGxwTDkzUVExNzJsVWcrNjhKV1RwN2thYUI0ZTA3YjBnaXNFNVA3WENWcEZzMzF6QVpoaGVRRlNhdW11RlFER1ZEdi9CM0pwcVltUVNkeVhuTWxvdEdJZnEwOVpCdXdyemlyUENtd0NtSFZIdndQck91RFBWZmMyRkxPTnMvN202ZkxFTTIyQ2VhWm0zcDNRd3pBNGdYTngwUDRVT1QwMStkWHZaMjhteVRuMFlTTkpYVW56cm1qWUxVQ3ZRL2tEeU0yTHhrVTROM2NZSHkwcWNBM3lHNEVMOFY5WS9oLy9jM0owYjBjS3E3WENkT3RDR0FvbkQxSG90aUZsbUVMREVOT3B4cmNXc0xjMWNGdGJtTUQ0UllpV1FFejluOGVHTys0alRPUTl4ZHpQb2NSSjh6dE1DTy9UMVdoeWNQaDgxVXgrTmJCVHRMTEEyazc4YVBpYlJQVnM1Umh0SlAxa1lnSzFMWWQwT3Nrd2lZVDNwOXVwdkJ1RWNpdXEzRE5PU0ZUZjZxZlFoOUd2OGhneExheEZrK2JXZk1qUzdDWFB1c2lWYzg1ZzZINzVHaUlkVitoNWRtTDI0R2pBdktFOW9ya1VlcWFnYWVGakUvT3loWStKYkoxcTRGZHlvWU03YURrY1pPN2w0eDBZUnM0T05La3dvZHk3YXByMWVHS1pYM0E5Y1pLOXpoUmNNTVZDS3ErWXljRnFxRmRhanFsNVkxYWd5TExJVUI4ajJKZkhqUmtzbWM3ZDhvVzVybFVrbWE3d2dHZE1HNzVPV1Y1Mm9INjhzeEJOOUJMWkxMVFN6RG9BVjY0dTVBQTJoei9jQkJmQSt4RmpBMmVoSXZGSDNOUXg4L1hORWtYTHY4M0RycEhKcmlvV1pqTjZuZ25rUWliV3djMisvbnk3RThJU0dqc3Q5aFB5NW55NGRSbkIrbWI5aGZtMkxwcmV3WDVMVVZIS2xBRUg5elAvbVZiekdNOUZFNmRiR0F5VmZLVjhhZWkrMnUyRmZGM3VIZEdHbTRxWndlNGZCNXB1Z0hUa09YeWdrMEtYc2hEWTFZOGJYYk03ZUJXbE4rbFdoR1VMcHU3cTdQaXVMMDNOb1B4ZW1jTEZPajBqL2g2aGxoYk5MMVFKUDl2cHdMY0s2bTNYR2x2blgwNmdQZDlpZVFtTXltVjhGNkl5N0xGenM2RkdycVUvdkZzT3hwK1BVWXEwWHFpdmlpTG5yVW9LMjlhVXFvc21hS3hpT1k1empIUUcvQUYvbG1OS0tZTjdtYkZ6My9GWEk4aTFOU0k5LzcrdGlvZWxYSitlNHQyUjUzVEh1c3ZlNWxYVzd3TlkzVlNsZzI1UWFNb1A2REVuVWtyQU9LNUFRNEpnc3Vtc0JxR08vSm13aGlBM3MwY3NkRnNkdzFQNThkeG81SDFxUTZmM2RNeHJ2clpuUnFIMU5Db1pXcVRPdTZFUEFDb2dYVGtZYzZhQUM5QWZlcVNrZTJkbTFYQS90SDVQQy8zMW5QWjlXL1RmRXZVU0VIUUVJLzIwUERuQnk4bVFiVjBjVm9paVkzcStoSDNJU3lORWE3ckM3SkxSSXQrd01qVEVyTTdyNDB5VXhYenErNTNDcVljMkx1S3hIS3NKd3gzSzhaR3FXKzNpOVRsMGRXL1dCRElWc2JxSEdDWTVqMkxxandWU3hnRHNYd1dTY05WTm5FQ2E5VXZWYnBKaHVpNkJpeVk2NzdISUN4SHpjc3RkeWNRVk5pbDVuc1laVTQ1eXNJdmxPT3lYSjBlNzhsZUpyOXZoVHZmcVR3OXRSNGxXb2lRbjkwWEpmaUlMQlo0WUJHWVByMSs2N3hrS3pNQWtYR3ZldHNEa2tMNnVFaWRINUJXdWN6Z3cyRHFRTjBBOTlWV29GNFkrSjlibHBOcG1yUXpjdzdwMTkrajFzcGR0UklJdFlKRXJ5d014NzNERGQzU05UMDgwR0wrNFdUUjQyMlAzQmY1YVA1c3QwZXJsRUxIV25QL2FSQmwxNEZIaEJ3Z0g3MEZEcVdvNExya25XbHc0OURvVWRrOTZybk05Z1BWcEVub00yYzB4MVg5RlpOMEVlSkY3TEIvOG9VdVJ4ZGI5Y2JvL2g1S2d0bCs5MjUvanl2c1ExbzUvWEJ0OXVQZFFrcUtsWkxaVlV0K095WTNLclF0UmlOTUo0ckUwQ3d2bkdkTGwrZ3dyblBpR0g5SXJaTTZ1OHUxc0dscmFKSVRERjROQmtEVWE0T2FaRlJFdjI5TVpvd21XNVlaK3pEb1VDckVQQUo5RU9KUHdLSlJEK0hJYllPd21Dak5wSWVaUU04KzliNFhtd2JtTGlOL3NKR0pjVEFsV0Q5bjlkZmxlcUU4azZ3elRSY3NuN2tudzUwM0JVdENZRjNvK1dsWXhBa3pHVVMrd0ZjOVhSSFF3aVUweHliOUdyN0kxcTMyalBTaFUrMEwvZGw5WVpzcTFhR05TZXJUUVQrS2UyNWo1M2V0cHIxT004RkxQZG90KzgyRlo1UDV1dER4cFZmV21XM29MU1lXRVhWQldvSTlyMHl6RGFyaWVTOUVESVRMOHpKY3ptVVVtc3NUeXNTaUZOSjE2VkZFMXJmOW9nWUlTQ3FYYnRWY1FsT05ORGJ6ZkFwTXk3Z3lrb0htQmZQWHJlRzhUNVVNZVhyUkRzekdoRFdVM2w1WElaV3d0U0hQVHZTZ2FWQlFFYlVzQXFXdkRjY3grQVdJRDFVbU1aa2dtak5sQmhoSU5JL2g5

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容