温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

编写条件:

macd三次底背离的选股公式。

编写方法:

DIFF:=Ema(CLOSE,12) – EMA(CLOSE,26);

DEA:=EMA(DIFF,9);

A1:=BArslAst(REF(crOSS(DIFF,DEA),1));

A2:=REF(CLOSE,A1+1)>CLOSE AND DIFF>REF(DIFF,A1+1) AND CROSS(DIFF,DEA);

三次底背离:COUNT(A2,60)=3;

其他写法:

以下是通达信MACD三次底背离的完整选股公式代码:

DIF:=EMA(CLOSE,12)-EMA(CLOSE,26);

DEA:=EMA(DIF,9);

MACD:=(DIF-DEA)*2,COLORSTICK;

T:=BARSLAST(CROSS(DIF,DEA) AND DIF<0);

T1:=SUMBARS(T=0,2);

T2:=SUMBARS(T=0,3);

M:=BARSLAST(CROSS(0,MACD));

M1:=SUMBARS(M=0,2);

M2:=SUMBARS(M=0,3);

D1:=REF(DIF,BARSLAST(DIF=LLV(DIF,M+1)));

D2:=REF(D1,T1-1);

D3:=REF(D2,T1-1);

LT:=BARSLAST(L=LLV(L,M+1));

MT:=BARSLAST(DIF=LLV(DIF,M+1));

L1:=REF(L,LT);

L2:=REF(L1,T1-1);

L3:=REF(L2,T1-1);

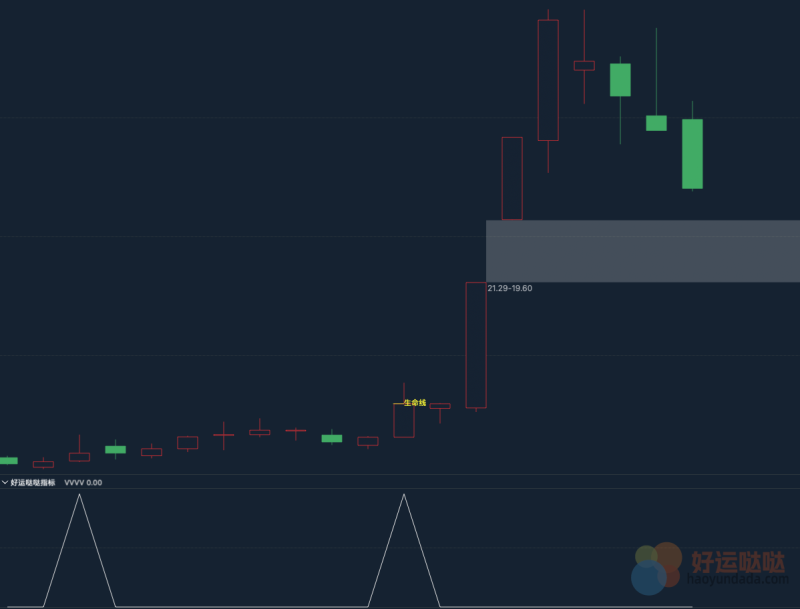

XG:T=0 AND L1<L2 AND L2<L3 AND D1>D2 AND D2>D3;该公式通过检测连续三次MACD金叉时DIF值递增(D1>D2>D3)而股价递减(L1<L2<L3)的条件实现三次底背离识别。

核心逻辑包含:

1)记录最近三次金叉位置;

2)比较各阶段最低价和DIF值;

3)要求金叉发生在零轴下方。

使用时建议结合成交量等指标增强准确性。

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0WDZkcWFnUVZjQXRPNmJpVWxTSDg1Y1FOd00vVk1zUE1IZm9vWFBnK1puTksxaXFzSFZZalMvU0FuSGtXZnIrTXdSOXptK3llaVZpVFJEVnNMb1JtNy95VmpEVUYvSXRVMXZaYjlKM0dTbWc2a0F2Wkl1R3lra29VaHNKUmI2ZldrbklyK09nMzN5K3VCbGVjYXkvd2hwVFZMeE9POHp0OVRyMG80alg4ck41YnREc0Qzb1Y4MG9McEdiU0doWTRUczUxRFBzZzFCSWwvamVtdTl4ei95SXZQdEptcFo1cUJsd1J6OHUzWEhIcDJDNEpFaFN1L2xOVi8rUmUzelJzczdNdXA5SnZuZGZrdEl0VktCZVR1aHRKbDlvaEMxZGJzQ2ZHT2pxZ0JVZG56NUl2VTVDNkNzaXhiN3Rlb3FpU2hydlpuUmZIb0trYVdaWUpQQWhZREEwaDk5c2Z3NE5DVU4zY25PaWptZ0gwc2FNWWZZajJleG9sbDhWb0phK2hLbHBBNEdNRDQzK3RMNjNTaDREc1RtTE5NL3FlRzlBb1pVdURGNy9xTE52OHR3Y213MFM4NG8rMGFyc0JmQmJUYXNsczlPdU1YV2NsaTRpY09DeWtBZlY2VlpVVmFvU2pYa0dxWVVwRUZmVlpqYWdBVU5LN04zZmpMNVFDdkdKN0xHbXVhVW5VSmtoTGFhTVh2UzdldGxYWEhCZS9PL0dGUzh5aVQ3QWNVd045cDNWKzFYOW1LYmw5L0hQR0l1YmVlR2dUeVZVWnA2OThlT0NqenYxS2IvNW5aMHhpOEtURG5kdzFnVVA0WmtIQ2dYRFZjb3diaDVRem5WR3RnZHA1TktxdUphRTdzNTM2UFpxNitsMUtpa1B6d2p0eXc2VzBpQUJHTlR2L0VFWi9xZ3pyT1BxanNjazZ3K0g3aGRGL1JMOVlLYUtNeFZ4blgzR1J5WXJFdllVSytLd0FhbFpNU3RKZHZsTDU3K2N6L1NPUHhreUY4cmRkR3IxSmpabUk0VjlIQ0M5bnpTRnQ4YTgzNTAvVjNDMVZuYkxTK09YaTA3UlJ1NitaTFludm9icGNRYnQ2c3dPZ2F0V0lwMldHOXZLWTVOdEFsTU4zeTlUUGFvakVDZVVPcGVXcjdLU1hoZjl1eFF0UVBjMHA3UXFnY05CbC9iS3pLT0lYUDBtLzlmMEdnODd3QU1yeURtTGUydGpLaEpUUHg0bnJRY1huRkszNmJyQS92UHo1OUJhaU5QWHRYRkVxWklUeTFYb0J2VmxpN2lvb0U1eVdoRXNrU3hwVlk2K3lXZXZ2NDc5ZXoyQkVTaHFuU29pTEpkQTFQV2c5UGtCTmR4Ylo2SFI4OWVqc0dxT05QOERYL3k4aDRqem9hZWh5KzAwVlpoYWI0T0lia0k3SEExZjExMnp0WXVRYitJbGdDbGREM05vWWNxT3VjNitFbFl5WjZia3ZIRW9ReEZ1WHkrNVgvTXZ2LzBTSHBVS0tEZllVVHM0V2cvM0NrMUNjNThKTzc1dUJxU3hPT1FodEtTRXpZSGFtWURFYmI0UlIweCtoS3VLVEdNeE1DTm1MQVdJUGlyU0R1bnRhSEtvOGtYdHdHOWg4T1ExYmdmYVlsMC9Kdmd0TnVBdUNwaXlEaFpJdnc2WkI0RWFwRWQ3aUZ2cWZXZkNlVnFDcWg3TTR3RlRvbFNYaGVpalRsNm5qK3dlaHNXdExuTjlCQ25aSHl6K0laRXkwdElITXl2VEZtZnpoYWNWR2haczByaXgvTXFFSjgyYWpQRllkeVdEMEpybEE3YXN0QThTSlpTOHV0a1FEQkdOQ041VTV3V2dMSWtFbEpSaElBTElXazJNbjgyRXNyMTFwenpFbFRPTUp5WC9qUGRmN0ozOVR5OXAvT3hjQkRRWWZsK3oyVEZYOG9lQzlwUkEzVWhzbm5pV3BzUDRMaWtkcGxxZHYvcDdDODJpZitlVW5ScmtQckZLM2laRDVTeFVWQ1A1UmhESWl6bVhvejZ3bzZuNUQ2S1VIYU16RkxtQXdjSWVYNzdUNUVpK2lYQVdOZzFKd2hZdE1HR3RITjA2bDlzRzZRZGVIakozcEZ6dTdXSU56KzBYZkFJUXQyeTQxM3EvVUtMMzAwQ0loc1lmTG5QSVBWVkhMVTM0M1N6R2FCcUdXWVlCOG5YU2lNZXZuYmJrU3N6WWV2YlVHVEtaV3ZwZUE5ZWdIS1U2NDNsZmNGUFpoUUdlYVpYU3licWppRmtjTjJod3JjSWpBOW1ZaVJzTll3SWRzRk5TZVYrTTJXSlRnUEI0U3NPR0tNMDhYS3AyOXcwU2x0ZDRmMmg2VjYzNGlWd0tXdEtOMjd3UG1kOG1YQzg0dG93V2c2UUxGeDBWOHp3ZnRYSWlucmhGK3dqeG9yV1IrYWlXMWhqcXJhTXNJZ2Y4N2tFcUdXSzZYWVg5L2M1K2x6WUpkSFRqSWNGMXVEWXErNWpOa0lMWVFkMi8xeEkrbjNXUFRlY1k1Q0tKQ1p0REtYUjExU2VRUytpNlNPeVVkSkdxWnZpREJYQnpaWE05Y05TK0ZEZFh3VEFyczBlN1Z2ZHVzenovQmlhQlhUZW5lWkQzc0krenpMNDk4dUs3T0t6ZkVGbVFtUTRHZEpaMHZyWmdFWTJhK0ZxbHE2VGRqZ3pqZk1xbXY2VW5QUmt4NDhDaXFaUWx5V29nWWQxSytjQVR0TVZoNTRNb0hDNlpKRjJoZE1ZSUh6c2NsNHQ3UXIreGVoeG9VSGp1YUp4WUwxYjRQVzgwaEU0ZGZ3UGs5c1NCZk0yY3JrRzhHVUVNUHhVcm1wWUZacG1zZTBJRkgrck40cXczd3BpRU4vTkVQWGhNVmNrcVNFUExiaFhHWkx0KzJCWlVsWUxkb3pJc2tQMlZsNnZrZjlhY0tiRTgwZlpjZjJPeGVnN295Q3dsakU3QjlqVHBTdEJZS3Q3eEpvMmJCbGtSSmdIU3I3NkhaOVdINm8rNnpoeVFKMlpjNDBPKzlLS2JtemRoNHJjaWVPQlovMzg5TFpGL0p1c3AvN2tpcXVrWFkySkF6ZHpSYithVEQwQzdBSmdENjlHMk1jYjdsdzBBSSt3MkprdC8vaERLYUVpcHR5UjZ3aHZudzlheFpWT21Ja2JXVDN2U3ZqZzdRaC9MV3Zpa2c5ZHlhK0h0b3MvQXFkSFRzcjVQK2g1MGpqNFFPSXo1Tmh3RXgzeVU1djM1bkkxL3dxbTJlblkxMU1VcHZTYXZBZ3N3RTRsdkovS1krMW40VHlsMWxUeS9WZXlOaWI1ZW1jYkRaeGVDVmlTK2p6N0lBQmVPMy9nQjVENUY1dXJ0UDdDWDQxYytpQ2FWMHZrWCtDbTJCSDQwY1hvSEZaVUFDdFNabk5FYzQ0bElHbnc9PQ==

RVdTOUtDenh1c1RzcTJZc216SUM0WDZkcWFnUVZjQXRPNmJpVWxTSDg1Y1FOd00vVk1zUE1IZm9vWFBnK1puTksxaXFzSFZZalMvU0FuSGtXZnIrTXdSOXptK3llaVZpVFJEVnNMb1JtNy95VmpEVUYvSXRVMXZaYjlKM0dTbWc2a0F2Wkl1R3lra29VaHNKUmI2ZldrbklyK09nMzN5K3VCbGVjYXkvd2hwVFZMeE9POHp0OVRyMG80alg4ck41YnREc0Qzb1Y4MG9McEdiU0doWTRUczUxRFBzZzFCSWwvamVtdTl4ei95SXZQdEptcFo1cUJsd1J6OHUzWEhIcDJDNEpFaFN1L2xOVi8rUmUzelJzczdNdXA5SnZuZGZrdEl0VktCZVR1aHRKbDlvaEMxZGJzQ2ZHT2pxZ0JVZG56NUl2VTVDNkNzaXhiN3Rlb3FpU2hydlpuUmZIb0trYVdaWUpQQWhZREEwaDk5c2Z3NE5DVU4zY25PaWptZ0gwc2FNWWZZajJleG9sbDhWb0phK2hLbHBBNEdNRDQzK3RMNjNTaDREc1RtTE5NL3FlRzlBb1pVdURGNy9xTE52OHR3Y213MFM4NG8rMGFyc0JmQmJUYXNsczlPdU1YV2NsaTRpY09DeWtBZlY2VlpVVmFvU2pYa0dxWVVwRUZmVlpqYWdBVU5LN04zZmpMNVFDdkdKN0xHbXVhVW5VSmtoTGFhTVh2UzdldGxYWEhCZS9PL0dGUzh5aVQ3QWNVd045cDNWKzFYOW1LYmw5L0hQR0l1YmVlR2dUeVZVWnA2OThlT0NqenYxS2IvNW5aMHhpOEtURG5kdzFnVVA0WmtIQ2dYRFZjb3diaDVRem5WR3RnZHA1TktxdUphRTdzNTM2UFpxNitsMUtpa1B6d2p0eXc2VzBpQUJHTlR2L0VFWi9xZ3pyT1BxanNjazZ3K0g3aGRGL1JMOVlLYUtNeFZ4blgzR1J5WXJFdllVSytLd0FhbFpNU3RKZHZsTDU3K2N6L1NPUHhreUY4cmRkR3IxSmpabUk0VjlIQ0M5bnpTRnQ4YTgzNTAvVjNDMVZuYkxTK09YaTA3UlJ1NitaTFludm9icGNRYnQ2c3dPZ2F0V0lwMldHOXZLWTVOdEFsTU4zeTlUUGFvakVDZVVPcGVXcjdLU1hoZjl1eFF0UVBjMHA3UXFnY05CbC9iS3pLT0lYUDBtLzlmMEdnODd3QU1yeURtTGUydGpLaEpUUHg0bnJRY1huRkszNmJyQS92UHo1OUJhaU5QWHRYRkVxWklUeTFYb0J2VmxpN2lvb0U1eVdoRXNrU3hwVlk2K3lXZXZ2NDc5ZXoyQkVTaHFuU29pTEpkQTFQV2c5UGtCTmR4Ylo2SFI4OWVqc0dxT05QOERYL3k4aDRqem9hZWh5KzAwVlpoYWI0T0lia0k3SEExZjExMnp0WXVRYitJbGdDbGREM05vWWNxT3VjNitFbFl5WjZia3ZIRW9ReEZ1WHkrNVgvTXZ2LzBTSHBVS0tEZllVVHM0V2cvM0NrMUNjNThKTzc1dUJxU3hPT1FodEtTRXpZSGFtWURFYmI0UlIweCtoS3VLVEdNeE1DTm1MQVdJUGlyU0R1bnRhSEtvOGtYdHdHOWg4T1ExYmdmYVlsMC9Kdmd0TnVBdUNwaXlEaFpJdnc2WkI0RWFwRWQ3aUZ2cWZXZkNlVnFDcWg3TTR3RlRvbFNYaGVpalRsNm5qK3dlaHNXdExuTjlCQ25aSHl6K0laRXkwdElITXl2VEZtZnpoYWNWR2haczByaXgvTXFFSjgyYWpQRllkeVdEMEpybEE3YXN0QThTSlpTOHV0a1FEQkdOQ041VTV3V2dMSWtFbEpSaElBTElXazJNbjgyRXNyMTFwenpFbFRPTUp5WC9qUGRmN0ozOVR5OXAvT3hjQkRRWWZsK3oyVEZYOG9lQzlwUkEzVWhzbm5pV3BzUDRMaWtkcGxxZHYvcDdDODJpZitlVW5ScmtQckZLM2laRDVTeFVWQ1A1UmhESWl6bVhvejZ3bzZuNUQ2S1VIYU16RkxtQXdjSWVYNzdUNUVpK2lYQVdOZzFKd2hZdE1HR3RITjA2bDlzRzZRZGVIakozcEZ6dTdXSU56KzBYZkFJUXQyeTQxM3EvVUtMMzAwQ0loc1lmTG5QSVBWVkhMVTM0M1N6R2FCcUdXWVlCOG5YU2lNZXZuYmJrU3N6WWV2YlVHVEtaV3ZwZUE5ZWdIS1U2NDNsZmNGUFpoUUdlYVpYU3licWppRmtjTjJod3JjSWpBOW1ZaVJzTll3SWRzRk5TZVYrTTJXSlRnUEI0U3NPR0tNMDhYS3AyOXcwU2x0ZDRmMmg2VjYzNGlWd0tXdEtOMjd3UG1kOG1YQzg0dG93V2c2UUxGeDBWOHp3ZnRYSWlucmhGK3dqeG9yV1IrYWlXMWhqcXJhTXNJZ2Y4N2tFcUdXSzZYWVg5L2M1K2x6WUpkSFRqSWNGMXVEWXErNWpOa0lMWVFkMi8xeEkrbjNXUFRlY1k1Q0tKQ1p0REtYUjExU2VRUytpNlNPeVVkSkdxWnZpREJYQnpaWE05Y05TK0ZEZFh3VEFyczBlN1Z2ZHVzenovQmlhQlhUZW5lWkQzc0krenpMNDk4dUs3T0t6ZkVGbVFtUTRHZEpaMHZyWmdFWTJhK0ZxbHE2VGRqZ3pqZk1xbXY2VW5QUmt4NDhDaXFaUWx5V29nWWQxSytjQVR0TVZoNTRNb0hDNlpKRjJoZE1ZSUh6c2NsNHQ3UXIreGVoeG9VSGp1YUp4WUwxYjRQVzgwaEU0ZGZ3UGs5c1NCZk0yY3JrRzhHVUVNUHhVcm1wWUZacG1zZTBJRkgrck40cXczd3BpRU4vTkVQWGhNVmNrcVNFUExiaFhHWkx0KzJCWlVsWUxkb3pJc2tQMlZsNnZrZjlhY0tiRTgwZlpjZjJPeGVnN295Q3dsakU3QjlqVHBTdEJZS3Q3eEpvMmJCbGtSSmdIU3I3NkhaOVdINm8rNnpoeVFKMlpjNDBPKzlLS2JtemRoNHJjaWVPQlovMzg5TFpGL0p1c3AvN2tpcXVrWFkySkF6ZHpSYithVEQwQzdBSmdENjlHMk1jYjdsdzBBSSt3MkprdC8vaERLYUVpcHR5UjZ3aHZudzlheFpWT21Ja2JXVDN2U3ZqZzdRaC9MV3Zpa2c5ZHlhK0h0b3MvQXFkSFRzcjVQK2g1MGpqNFFPSXo1Tmh3RXgzeVU1djM1bkkxL3dxbTJlblkxMU1VcHZTYXZBZ3N3RTRsdkovS1krMW40VHlsMWxUeS9WZXlOaWI1ZW1jYkRaeGVDVmlTK2p6N0lBQmVPMy9nQjVENUY1dXJ0UDdDWDQxYytpQ2FWMHZrWCtDbTJCSDQwY1hvSEZaVUFDdFNabk5FYzQ0bElHbnc9PQ==

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容