温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

一、基本概念

-

T+0

- 定义:当日买入的股票可当日卖出,资金可即时回笼并重复使用。

- 特点:高频交易、流动性强,但投机风险高。

- 现状:我国股票交易实行T+1,但资金结算仍为T+0(卖出股票的资金当日可用)^^。

-

T+1

- 定义:当日买入的股票需次日(T+1)才能卖出,但卖出资金当日可用。

- 实施时间:我国自1995年1月1日起实行,旨在抑制过度投机^^。

-

T+2

- 定义:交易后需隔两日(T+2)才能完成清算交割,反向操作延迟更长。

- 特点:降低交易速度,减少短期波动风险,常见于部分国际市场^^。

二、我国现行制度详解

-

股票交易规则

- T+1制度:买入股票次日方可卖出,但资金结算为T+0(卖出后资金当日可用)。

- 例外:债券、ETF、货币基金等部分品种支持T+0交易。

-

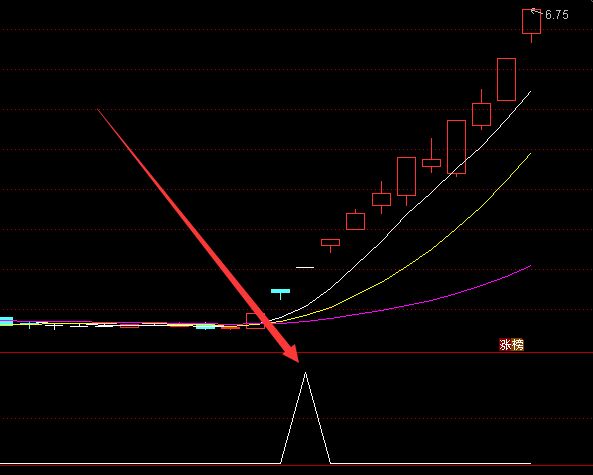

涨跌停板制度

- 限制幅度:A股涨跌幅为10%(科创板、创业板为20%,新股首日除外)。

- 目的:防止价格剧烈波动,保护投资者利益(1996年12月实施)^^。

三、国际对比与风险提示

-

国际差异

- 成熟市场(如美股):普遍实行T+2交割制度,但允许T+0交易。

- 新兴市场:部分国家(如印度)曾尝试T+0,后因风险调整至T+1^^。

-

风险与策略

- T+0风险:高频交易易导致亏损,需严格止损。

- T+1优势:降低散户投机冲动,促进长期投资^^。

四、常见问题

- 为何资金T+0、股票T+1?

平衡流动性与风险,避免资金闲置同时抑制短线炒作。 - 哪些品种支持T+0?

可转债、部分跨境ETF、外汇保证金等^^。

(注:我国制度以沪深交易所最新规则为准,历史背景参考1995年及1996年政策文件。)

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0Y0wxZGg4UzlSQkJidFZLa25aNitLTDdiQUw3UkxaRVVRejBINW91eEU5RlBMZldkZktWbnkxOXFvZ0kwSnE0eVM2T1N5K09TZW5zZmFOdVhMcytuSzdXRXcweHlCZWRnZGRUbjBGbCtvN1o2RjV1UGpSbEwxTVozMk13NENsbG9PRnh2VUpkd29MaVRTejhaSUJ6M1hWZGd2WGx6dDV6VjlGYnowUWFrb01XMlZiZFQ3V1BrY2d1SEprYTY2aHMrUHlkUmZGbFhGb3FVckRNRTdwMDUzMktaM3haZDBFU1pFOXNiSXphTXk5elB5MUhFWVVQOHh4RE5ZekJ3d2hmNUVHTFhVNi9NbHdTTkhwYUQyUXJVSnRMRUg5YzJQQlR1RTNFeHp4RXIrUFdlZ2ZrQ2hDR2J3ZHBwM25PYmVBUWRRUTlJMno4UHI1UC9kQlZVTVcvMzJsTm41dUg3T3FVTzVvVUl4SWNWdjJ1dFp3cTVjeVlNLzlTYkRDNVRpb29mNjRqZ1ovTTN2US9aL3VvV0ZmVGE0VU9uV05QclBhTExzODNON1lGRG1Vb2NkSzA3TklzbkxaSkwxa0RxaG8vWUpRYUtEV3hxNENRUDMwYSttZzhVRjRpSmRzUDRsazAzb0VTWnhEV3FkYk1PajhaQ0FIWUpsMUxyUDRPMVFhSWgrMThmTDlsN0t1U2IrUXlCZ2I5ZlJuZ0tZRjNMMTJkdEJZemt6c2hlczI4OGdlWHowV3RyZndMVzZZdWR6TWp3c0FjZkJEK0VFQmdMUy9ZMGVMVUhyVG0wQW5XU0RHb21YdGdHYzR4Z0JiZHZhcHFac0xZTnA5Mk5xOGtyMm5UdDNERE9sN3pYWlhha2ZmSXZ1NU5FbENWSDcramJ3dkdvMlgrcVlQb0JXbGZuWnoxS00xTFZtY3lpenlQd2FTZk84QXMvT1diMG5MdkNNQUpxdVAvWS9ZYXVtV3hCdFEyM2p4cW9CUk04TWVKditad3V6aWl2b0xMMWp6eUlKMFZILzRYbWVnVGlBVUFvOGV0aGFMNDJCZUI3QmZ1V2Ira2h6WS90d0RnUVlsVlpmVWw1c1RZeEFPNEtPbU9CbWpvUVdtMmo3a0Vpb1FOb2paSDNlOGx1dUFVaDZQSzE2dnJRaUxrVkRqRytLM2x3ZlQxN0xkV21YRk9vbXU3cXlsY2hXUkxQNTZKSnJ5RDA4UTMyK0QwMGdnc3k2ZEFwK0NkS0xSNzJYOFhjV1dHams2a29obWx0RDhMem02YmRFZDhNQkYydHltUEhscVVJVlhCcVpkbU56aUJaeUhtQlBOeTZGZnJuZ0JYNGpKRmk1OXNXTURmNWFvTHJqaWxhL0JCd0Fsa0d0aC9CYVlrRjdiaUk0RmJpQWxHM0dmLzVvS1NHbGxCYWN0ZmxhYzFNQ0RtNXA4WDRBWGVIS3luOHBqQzZyL0ZPRkZWYWQxdFlDZHZkRHlhY2NjakN5STlBU0tNTVlEeHFhbUFzYWp6cDBDdEg3NGhtR0RjM1ozL2VHNGRrUktPeDNja3JEK2Q1Zlo0eUV1SDNvcTY2SnN5Z3kxMVhONlJFUk04cEsvYWR3OC9qNkF6VEoyYVdMd1IzRUtud2FhcGpJMUFpbU1aQm1Ua2FhL1dNTHZPUFRXRlUwaUZyNlJ6SlRyNXhFV1JmYk1QL2NVeWJLYjgxVVg0THljMW5wdUdEVmxUYS92cnNPUUpRdVRYMmpoeVU2NkVHdzJWZlBPYkUvZjdIYTF4T1Y5aU5BSXM4UERwZ3EwN01aeDFER1QvZEh1b1FRK3ZIeGZEck9uYW1Uc1M1SHJFUFFBMnRUNDE5STdyZ1BaSDBML0JkYVNZMTBkeEt6Nm5mT3hRV1ljZ0xmL2ZKYUdjeU5LRG9WSVpsV2NvTUxnTjJvVFFpLzJoNzF3MS85Q3ZDV0plVG1CQ0Fzb1c0aEY2VWxHQkdZWCtZbmVuN2JORlVFRnc1YWl0WGRWVlFSdk0wYjJtRUJkV3FGT1o4OVlhWmJXUEtEZlQxRFluZTdnenNYYS9iZVBIbzhlRUllUDBSdjYrR0xiSlNMSVllZ2Q0RmZqOG4wTDJWTFZmc0o2MmZHUDE4SDFVMG9PZ0FYVGV6ZmNjTmg4N050d0J1QzZMOVlodFhTT1MrVDhKZDRSMDNsMDM3SUt6TDFDb24xOExwb2pZYWRkeVZXY3l1QjlKSXBzaXFtTk90N042R3ZNcmM5dzJ3TXNIa2Z6L0JlekRFQTQyUHJWRTRzb1FZcFVxZktSQ3ArQWc0Wnl4SGs3TTg5OERRbjV2ZzdMa015T1dYNDRLSXV1WFBQYWhLb3hDSGJ6NG8yRnFUcFZ3ditkblpPMmZZaE1xdHRQWVZCd1d5eWErMjdPWFQyZ2MveTB4NjdtcGF3cGs4cEg0d01reHkrNTFNUk5vOHR2ZDAzdHVrZUFBcU5hZmR2ckh5QzVJWE50QUN2T2ZNV0FVNGUzbE82S2NtU1VCeVluTW84bmlDeDd1RU9FbFIyaEJmeXRxTGRJb0U5dEQzbHFISXM5S2lFc282Ym1XSlEvQ1hKbnUrb0VCWFhPUXkwTTY4ekRYY1huUnRuMWN2MUtnckRKRUo1cndSV1o5Tk9KRFNiM0pscksvZmkzcHhKcjJ5YzUwWjlnM3ZGSVg3N2NBU2RYZGtVcDRlNkhwVXY3UVB6Z2xYdy80QmNMenZnWTRoajg2UENWMzh0TGVaZzJRZTExTDd6U3d2VFpLeFc4dzk0cjBZVzRBZ0NnbWlKcHBsVmF6QVU5dHJrYm1PRnNUOC9ieDNoNWRNL1Z2N1hBTERIK3NvejhBcWlCeEpMRldCVG5GYW9QSkdWaFd6V2s1bG5pL3dTa3RlTFdLNmlpUUpFUWJOa01neHphcXdTcE1KV3JQalFJZUpHM2tpak94UmtINmhjOGJhaWRacERFd1M1dlQ5T1oyS0NKNXJ2elo4UG5QWEM1bmNvWCtha2VSenNVS3dMaVFpMXdaZ2MxT01EcndITTBTRnA5cWdKbDZWdnRxdys0WE1VbjRmMjZzWk15RmVaVHNWNmh0dkN4bzVvRXk0YU9jL09ONnphaGw5dXNhbElTdG5pMzM1aUdSbitjRVcxb0s2S0N3RXc1WWdlb3d3L1RKaDB0KzVzSDJSalphQXFrY012ZVRldisrM2hIb2owR3pnS1NkcTFDMGdoWmVHWUh1YjJRWEl1b2NhRjM5bGJPY1hUajV6eWlDdGp5cjdpY2x3SEc1Q3pjQnRUZ3lKWkhSaWlzaU5vaEQ3Z2U1SzFWSWxGY1Y0b2dWMjg3WStyRFZQVStJWkJidnRRemZKUlVCUitkWExRWkhHSlI2ckhNNll2RDd3MW5HM1dkd3JYK01YTld1OW5nWU1CRWErT2RiNTZmRk1rcVRzaklhdlZSdWJqelZZNWs5Q0s1SU5sTDV6M05jVDB1OHdLTzBXZWJhTTh6YTBxS2VERDVHREpRTEkrL20wc3QwM0k5bTU3aWRSemh4ZTFnbWxOaDlKQURaLzk0MjhyU1VXK0JXaEY5ZExVUE4vcEdBbjNNUXkxSTMrOGtvWjlPVklaWUd6UlJkaTVteW9LS0w1K2pnWFhmSG11NzJLblRXOXNvOVpTVURTdGRJR1I1UGZkSy9xTkJ2TGVscTFXL3NjeUQ3cHFuY3ZzYUpwMTE0VzhDY3hKOVJWVmR2citFRDhIYytsUXFYTlNQSXR4cjBMVlZYK3hHY2dtSnJKVDdIM00wdmQ4bHowQU5wM01Od2RQTVVtUGNFOUh2RG9qTjhPSE43VWV3ZHcvUWVlWlh5KytvSHdLWEV5MVM4QXBMcFV3L1ZYUXJTR1YvVHA5UFlxWnJhdm5qK09sTE52bUxhWXZkVitwdWkwL1lBMkxhdmVPU2RKUWdwTXhCNEw0ZjdsTS9EYzFRVzQ5bjhoWDRyTGFPSjNMMFZmVmZ3Nmt6azBnSlFHTHhmQjZ5T2w4LysvMFNkbmJFM2F4WlBWRUU2VFRMSTdvQ3VpUmROWU1rWXRXNmlDNGc0ZU12UDN3cnFEODBhMW5WOG1XWDRZbGlMdytxRnYweG5uWC9VVHJpdGliZlBxSDNYMkQxQnF6bk1uMFpsTE4yc1RQZmd1V0hGbVlNTllieXJHZjUyWStlcWpnT2R1bVFjcklIb2twaWsweU0rT2ttNkR2NlRpZE5BK3NkNDlTanVnTXhIZ1hCVDFmRWxoVWFUdDNHYjU2N28xdUNZTUVsNnphYXVHUU9zQTZLY2h6RXNWaEdjSi9ITnY4TGY1VWMyaTFJMUR3ajYydlh0K3BkM3o2ZU9kN3R2cGxDNUNFYkh5K2JrcXRCSzNoQW1SZ3hScytDQlFtSTJzZkZaNHA0K2xiUHBPWGdqbWI1cVRHbmJJWk5acWRFWUl0dHgydXU4NHU4Q0UzK2Qyc254OE8yU29GMmpXVkdkd2w1aEQvNmJKeWRiVitKOHE5cS9sdi9scWcxV29QTjFPN2hhRkk5aFhZNDBTa2NRdWdmTXM4QWJwSElyaEUyMjhYR0k3L1RJMElIcWhXRGlnSHlZeHR5bXYzVzc4d2JMNVZUZTNFN1ZvV012eWNTT0RqY1Z0T21oMzV1eVdqdVpWcDlmTW5Da0xraEtIZmpRMHZsOGdPeEF2dHdRUmZLZXdId1F3K3huUzVNNTBhdGtSUHpJcXdVZ0lBQXAzVjFndi85ZWsweUhweEtLVGlyUWREb215REQ1My9kZzlMMU5GaU1QQmJuaGJ2QnlRY0JpU09GeFBGTUZ1YWZiMTJoTnpJUlhxOS9oZTU3dElURmI1NWZhSG9iZFVTOFYzVGJuUzBmQTRKTFlUQnd4eGhDckg0aURJTTM0c0kvUUU1TzZyWnlHTExZc0NycjdLQnRqSkJRYlZzN0JPQTA5cEdqSy9YSUhkWEFqRlZjVHZ2QjhPK3N4bzViVUoySnR2VlJOa05DTkFZQy9tUC9IZmhJNzIxd0hDdEJ2NDVVZGJ3TXBKa1pzSzJHS21EeTh3ZVN3SVZUQUZZaGlCOVllRXpQeFVOTUZ6ZjJ1U2ZPMXFuL1lDOHBlWXJ3WUUxZTZCc3hHUUF0ck9sYXZLdXp2dWVoSlFydDFQV3J5U1ArTEE4V1ZZM1BhUWsvZGlXenBlZCszTjhWbzFua2xHMlN5R0k0VE9tZ2I4aytOYzU3dVBpei82cmRwRmhvdmhURkUvbDdLQ2U5d2Vnc2U3VFByOG9YeW9rc0RKbkdTN20rWnc0eUR0MkF4TU1aVU1oUXBMaFZLUXZIRVlHSEIwMlYzOGlKNlN3aVR4NkdnbWZRRWRGWWFtSTRCajdBcUJTUGhtNjBrcHBPMHFlVTFjUE5zVkVTRC9BUmg0Wk5QZ1hzSEp2aDdvRDlnOGJ6MEdMQmY3UzFYTHJrNUM4bG5FSlNNeHdWdkZ2TjJtRXN3OVJCYUF6aktDakFia2pFTVhhNVdRdHBsM2g3VmdnQlVWSHNZQkVmaGVIZ2REZzJHcUVZSDR2TjN2YVoxWElxOWhzQ2xKa2h5Uk9IZHdYL29EMW9uOUcyaHJaREpCeUwvQnNjbGNKaHNWS3JNbEZJZytoeHpqOUVJZ01JTE5yR2VVVmRYVUZ2K2lKSWJ4dVZiQ09VSEF4bVBUMXBLM091dWU5TVNjNXpweHR0Y28rbzc5TmpURnEyR1dYbVdRb3dzWHJZNUpjVjJMVlFZWENrQWY5dGNhZHJ4ek1aTHpYMmtGOTVuZEN5YUNHS0JDOEZpRitEV01VUFl3d1ZLZDBHN0dGYnhsQm10cU5zQ0JYMFMzT1dKd1F6SDVONDF4SklxRjUzYjlrTE5kbVZOSkFaS0xvSUJpZjd5VXROLzBSRGhhdUhKU3hXREZaeWhndlV3RVFQaURtR0E2ak1zT2wxN2RaNDQ1SEpHaUJCMWl5K3dweS9qMVQwQkRlZTlnVSs2a2RUQzVHc3dxTVVQL3g0SlN6OEZZdFg0YmIwOUJRUVB2TEhvTXFrdkc0eGQ=

RVdTOUtDenh1c1RzcTJZc216SUM0Y0wxZGg4UzlSQkJidFZLa25aNitLTDdiQUw3UkxaRVVRejBINW91eEU5RlBMZldkZktWbnkxOXFvZ0kwSnE0eVM2T1N5K09TZW5zZmFOdVhMcytuSzdXRXcweHlCZWRnZGRUbjBGbCtvN1o2RjV1UGpSbEwxTVozMk13NENsbG9PRnh2VUpkd29MaVRTejhaSUJ6M1hWZGd2WGx6dDV6VjlGYnowUWFrb01XMlZiZFQ3V1BrY2d1SEprYTY2aHMrUHlkUmZGbFhGb3FVckRNRTdwMDUzMktaM3haZDBFU1pFOXNiSXphTXk5elB5MUhFWVVQOHh4RE5ZekJ3d2hmNUVHTFhVNi9NbHdTTkhwYUQyUXJVSnRMRUg5YzJQQlR1RTNFeHp4RXIrUFdlZ2ZrQ2hDR2J3ZHBwM25PYmVBUWRRUTlJMno4UHI1UC9kQlZVTVcvMzJsTm41dUg3T3FVTzVvVUl4SWNWdjJ1dFp3cTVjeVlNLzlTYkRDNVRpb29mNjRqZ1ovTTN2US9aL3VvV0ZmVGE0VU9uV05QclBhTExzODNON1lGRG1Vb2NkSzA3TklzbkxaSkwxa0RxaG8vWUpRYUtEV3hxNENRUDMwYSttZzhVRjRpSmRzUDRsazAzb0VTWnhEV3FkYk1PajhaQ0FIWUpsMUxyUDRPMVFhSWgrMThmTDlsN0t1U2IrUXlCZ2I5ZlJuZ0tZRjNMMTJkdEJZemt6c2hlczI4OGdlWHowV3RyZndMVzZZdWR6TWp3c0FjZkJEK0VFQmdMUy9ZMGVMVUhyVG0wQW5XU0RHb21YdGdHYzR4Z0JiZHZhcHFac0xZTnA5Mk5xOGtyMm5UdDNERE9sN3pYWlhha2ZmSXZ1NU5FbENWSDcramJ3dkdvMlgrcVlQb0JXbGZuWnoxS00xTFZtY3lpenlQd2FTZk84QXMvT1diMG5MdkNNQUpxdVAvWS9ZYXVtV3hCdFEyM2p4cW9CUk04TWVKditad3V6aWl2b0xMMWp6eUlKMFZILzRYbWVnVGlBVUFvOGV0aGFMNDJCZUI3QmZ1V2Ira2h6WS90d0RnUVlsVlpmVWw1c1RZeEFPNEtPbU9CbWpvUVdtMmo3a0Vpb1FOb2paSDNlOGx1dUFVaDZQSzE2dnJRaUxrVkRqRytLM2x3ZlQxN0xkV21YRk9vbXU3cXlsY2hXUkxQNTZKSnJ5RDA4UTMyK0QwMGdnc3k2ZEFwK0NkS0xSNzJYOFhjV1dHams2a29obWx0RDhMem02YmRFZDhNQkYydHltUEhscVVJVlhCcVpkbU56aUJaeUhtQlBOeTZGZnJuZ0JYNGpKRmk1OXNXTURmNWFvTHJqaWxhL0JCd0Fsa0d0aC9CYVlrRjdiaUk0RmJpQWxHM0dmLzVvS1NHbGxCYWN0ZmxhYzFNQ0RtNXA4WDRBWGVIS3luOHBqQzZyL0ZPRkZWYWQxdFlDZHZkRHlhY2NjakN5STlBU0tNTVlEeHFhbUFzYWp6cDBDdEg3NGhtR0RjM1ozL2VHNGRrUktPeDNja3JEK2Q1Zlo0eUV1SDNvcTY2SnN5Z3kxMVhONlJFUk04cEsvYWR3OC9qNkF6VEoyYVdMd1IzRUtud2FhcGpJMUFpbU1aQm1Ua2FhL1dNTHZPUFRXRlUwaUZyNlJ6SlRyNXhFV1JmYk1QL2NVeWJLYjgxVVg0THljMW5wdUdEVmxUYS92cnNPUUpRdVRYMmpoeVU2NkVHdzJWZlBPYkUvZjdIYTF4T1Y5aU5BSXM4UERwZ3EwN01aeDFER1QvZEh1b1FRK3ZIeGZEck9uYW1Uc1M1SHJFUFFBMnRUNDE5STdyZ1BaSDBML0JkYVNZMTBkeEt6Nm5mT3hRV1ljZ0xmL2ZKYUdjeU5LRG9WSVpsV2NvTUxnTjJvVFFpLzJoNzF3MS85Q3ZDV0plVG1CQ0Fzb1c0aEY2VWxHQkdZWCtZbmVuN2JORlVFRnc1YWl0WGRWVlFSdk0wYjJtRUJkV3FGT1o4OVlhWmJXUEtEZlQxRFluZTdnenNYYS9iZVBIbzhlRUllUDBSdjYrR0xiSlNMSVllZ2Q0RmZqOG4wTDJWTFZmc0o2MmZHUDE4SDFVMG9PZ0FYVGV6ZmNjTmg4N050d0J1QzZMOVlodFhTT1MrVDhKZDRSMDNsMDM3SUt6TDFDb24xOExwb2pZYWRkeVZXY3l1QjlKSXBzaXFtTk90N042R3ZNcmM5dzJ3TXNIa2Z6L0JlekRFQTQyUHJWRTRzb1FZcFVxZktSQ3ArQWc0Wnl4SGs3TTg5OERRbjV2ZzdMa015T1dYNDRLSXV1WFBQYWhLb3hDSGJ6NG8yRnFUcFZ3ditkblpPMmZZaE1xdHRQWVZCd1d5eWErMjdPWFQyZ2MveTB4NjdtcGF3cGs4cEg0d01reHkrNTFNUk5vOHR2ZDAzdHVrZUFBcU5hZmR2ckh5QzVJWE50QUN2T2ZNV0FVNGUzbE82S2NtU1VCeVluTW84bmlDeDd1RU9FbFIyaEJmeXRxTGRJb0U5dEQzbHFISXM5S2lFc282Ym1XSlEvQ1hKbnUrb0VCWFhPUXkwTTY4ekRYY1huUnRuMWN2MUtnckRKRUo1cndSV1o5Tk9KRFNiM0pscksvZmkzcHhKcjJ5YzUwWjlnM3ZGSVg3N2NBU2RYZGtVcDRlNkhwVXY3UVB6Z2xYdy80QmNMenZnWTRoajg2UENWMzh0TGVaZzJRZTExTDd6U3d2VFpLeFc4dzk0cjBZVzRBZ0NnbWlKcHBsVmF6QVU5dHJrYm1PRnNUOC9ieDNoNWRNL1Z2N1hBTERIK3NvejhBcWlCeEpMRldCVG5GYW9QSkdWaFd6V2s1bG5pL3dTa3RlTFdLNmlpUUpFUWJOa01neHphcXdTcE1KV3JQalFJZUpHM2tpak94UmtINmhjOGJhaWRacERFd1M1dlQ5T1oyS0NKNXJ2elo4UG5QWEM1bmNvWCtha2VSenNVS3dMaVFpMXdaZ2MxT01EcndITTBTRnA5cWdKbDZWdnRxdys0WE1VbjRmMjZzWk15RmVaVHNWNmh0dkN4bzVvRXk0YU9jL09ONnphaGw5dXNhbElTdG5pMzM1aUdSbitjRVcxb0s2S0N3RXc1WWdlb3d3L1RKaDB0KzVzSDJSalphQXFrY012ZVRldisrM2hIb2owR3pnS1NkcTFDMGdoWmVHWUh1YjJRWEl1b2NhRjM5bGJPY1hUajV6eWlDdGp5cjdpY2x3SEc1Q3pjQnRUZ3lKWkhSaWlzaU5vaEQ3Z2U1SzFWSWxGY1Y0b2dWMjg3WStyRFZQVStJWkJidnRRemZKUlVCUitkWExRWkhHSlI2ckhNNll2RDd3MW5HM1dkd3JYK01YTld1OW5nWU1CRWErT2RiNTZmRk1rcVRzaklhdlZSdWJqelZZNWs5Q0s1SU5sTDV6M05jVDB1OHdLTzBXZWJhTTh6YTBxS2VERDVHREpRTEkrL20wc3QwM0k5bTU3aWRSemh4ZTFnbWxOaDlKQURaLzk0MjhyU1VXK0JXaEY5ZExVUE4vcEdBbjNNUXkxSTMrOGtvWjlPVklaWUd6UlJkaTVteW9LS0w1K2pnWFhmSG11NzJLblRXOXNvOVpTVURTdGRJR1I1UGZkSy9xTkJ2TGVscTFXL3NjeUQ3cHFuY3ZzYUpwMTE0VzhDY3hKOVJWVmR2citFRDhIYytsUXFYTlNQSXR4cjBMVlZYK3hHY2dtSnJKVDdIM00wdmQ4bHowQU5wM01Od2RQTVVtUGNFOUh2RG9qTjhPSE43VWV3ZHcvUWVlWlh5KytvSHdLWEV5MVM4QXBMcFV3L1ZYUXJTR1YvVHA5UFlxWnJhdm5qK09sTE52bUxhWXZkVitwdWkwL1lBMkxhdmVPU2RKUWdwTXhCNEw0ZjdsTS9EYzFRVzQ5bjhoWDRyTGFPSjNMMFZmVmZ3Nmt6azBnSlFHTHhmQjZ5T2w4LysvMFNkbmJFM2F4WlBWRUU2VFRMSTdvQ3VpUmROWU1rWXRXNmlDNGc0ZU12UDN3cnFEODBhMW5WOG1XWDRZbGlMdytxRnYweG5uWC9VVHJpdGliZlBxSDNYMkQxQnF6bk1uMFpsTE4yc1RQZmd1V0hGbVlNTllieXJHZjUyWStlcWpnT2R1bVFjcklIb2twaWsweU0rT2ttNkR2NlRpZE5BK3NkNDlTanVnTXhIZ1hCVDFmRWxoVWFUdDNHYjU2N28xdUNZTUVsNnphYXVHUU9zQTZLY2h6RXNWaEdjSi9ITnY4TGY1VWMyaTFJMUR3ajYydlh0K3BkM3o2ZU9kN3R2cGxDNUNFYkh5K2JrcXRCSzNoQW1SZ3hScytDQlFtSTJzZkZaNHA0K2xiUHBPWGdqbWI1cVRHbmJJWk5acWRFWUl0dHgydXU4NHU4Q0UzK2Qyc254OE8yU29GMmpXVkdkd2w1aEQvNmJKeWRiVitKOHE5cS9sdi9scWcxV29QTjFPN2hhRkk5aFhZNDBTa2NRdWdmTXM4QWJwSElyaEUyMjhYR0k3L1RJMElIcWhXRGlnSHlZeHR5bXYzVzc4d2JMNVZUZTNFN1ZvV012eWNTT0RqY1Z0T21oMzV1eVdqdVpWcDlmTW5Da0xraEtIZmpRMHZsOGdPeEF2dHdRUmZLZXdId1F3K3huUzVNNTBhdGtSUHpJcXdVZ0lBQXAzVjFndi85ZWsweUhweEtLVGlyUWREb215REQ1My9kZzlMMU5GaU1QQmJuaGJ2QnlRY0JpU09GeFBGTUZ1YWZiMTJoTnpJUlhxOS9oZTU3dElURmI1NWZhSG9iZFVTOFYzVGJuUzBmQTRKTFlUQnd4eGhDckg0aURJTTM0c0kvUUU1TzZyWnlHTExZc0NycjdLQnRqSkJRYlZzN0JPQTA5cEdqSy9YSUhkWEFqRlZjVHZ2QjhPK3N4bzViVUoySnR2VlJOa05DTkFZQy9tUC9IZmhJNzIxd0hDdEJ2NDVVZGJ3TXBKa1pzSzJHS21EeTh3ZVN3SVZUQUZZaGlCOVllRXpQeFVOTUZ6ZjJ1U2ZPMXFuL1lDOHBlWXJ3WUUxZTZCc3hHUUF0ck9sYXZLdXp2dWVoSlFydDFQV3J5U1ArTEE4V1ZZM1BhUWsvZGlXenBlZCszTjhWbzFua2xHMlN5R0k0VE9tZ2I4aytOYzU3dVBpei82cmRwRmhvdmhURkUvbDdLQ2U5d2Vnc2U3VFByOG9YeW9rc0RKbkdTN20rWnc0eUR0MkF4TU1aVU1oUXBMaFZLUXZIRVlHSEIwMlYzOGlKNlN3aVR4NkdnbWZRRWRGWWFtSTRCajdBcUJTUGhtNjBrcHBPMHFlVTFjUE5zVkVTRC9BUmg0Wk5QZ1hzSEp2aDdvRDlnOGJ6MEdMQmY3UzFYTHJrNUM4bG5FSlNNeHdWdkZ2TjJtRXN3OVJCYUF6aktDakFia2pFTVhhNVdRdHBsM2g3VmdnQlVWSHNZQkVmaGVIZ2REZzJHcUVZSDR2TjN2YVoxWElxOWhzQ2xKa2h5Uk9IZHdYL29EMW9uOUcyaHJaREpCeUwvQnNjbGNKaHNWS3JNbEZJZytoeHpqOUVJZ01JTE5yR2VVVmRYVUZ2K2lKSWJ4dVZiQ09VSEF4bVBUMXBLM091dWU5TVNjNXpweHR0Y28rbzc5TmpURnEyR1dYbVdRb3dzWHJZNUpjVjJMVlFZWENrQWY5dGNhZHJ4ek1aTHpYMmtGOTVuZEN5YUNHS0JDOEZpRitEV01VUFl3d1ZLZDBHN0dGYnhsQm10cU5zQ0JYMFMzT1dKd1F6SDVONDF4SklxRjUzYjlrTE5kbVZOSkFaS0xvSUJpZjd5VXROLzBSRGhhdUhKU3hXREZaeWhndlV3RVFQaURtR0E2ak1zT2wxN2RaNDQ1SEpHaUJCMWl5K3dweS9qMVQwQkRlZTlnVSs2a2RUQzVHc3dxTVVQL3g0SlN6OEZZdFg0YmIwOUJRUVB2TEhvTXFrdkc0eGQ=

指标使用通用经验总结

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容