温馨提醒,技术指标有其本身局限性,一旦不符合预期,立即清仓控制风险。指标仅供参考与学习,请勿商用或实战,否则后果和损失自行承担!

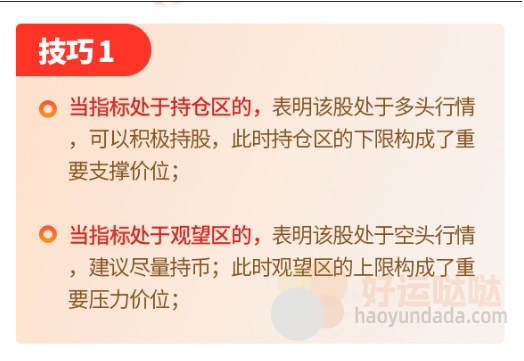

技巧 1

当指标处于持仓区的,表明该股处于多头行情,可以积极持股,此时持仓区的下限构成了重要支撑价位;

当指标处于观望区的,表明该股处于空头行情建议尽量持币;此时观望区的上限构成了重要压力价位;

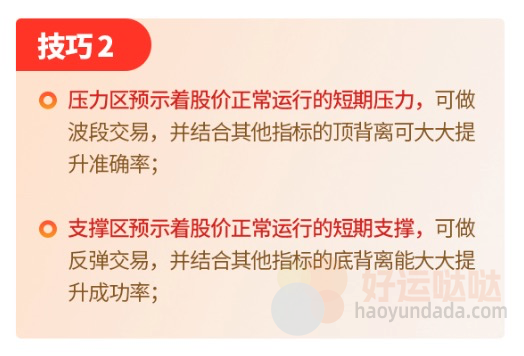

技巧 2

压力区预示着股价正常运行的短期压力,可做波段交易,并结合其他指标的顶背离可大大提升准确率;

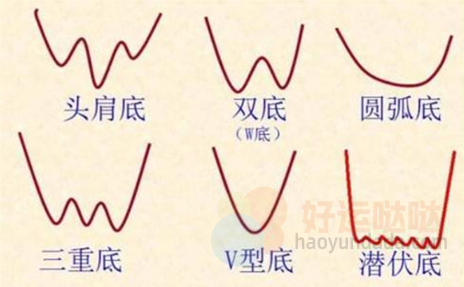

支撑区预示着股价正常运行的短期支撑,可做反弹交易,并结合其他指标的底背离能大大提升成功率;

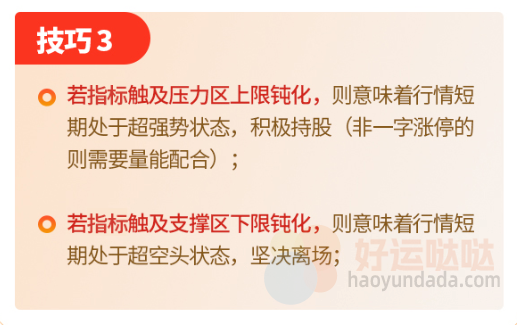

技巧3

若指标触及压力区上限钝化,则意味着行情短期处于超强势状态,积极持股(非一字涨停的则需要量能配合);

若指标触及支撑区下限钝化,则意味着行情短期处于超空头状态,坚决离场;

网页唯一标识识别码

RVdTOUtDenh1c1RzcTJZc216SUM0ZWZET1ZYbnhDS0ZtdGc1L2lWbnNzazl5SmEwMnFReG15RTh4Vm1EQU5jNVY2VkhmdEk3QWlRMi9rQmNUQXZEa2dnRkpHMlo3WXFRVFNOSzVVM2lhQjNwcmtYbk5jY2hxWmwzSVVzR25JVysyVDdUUzJyS0F4S0lCRTA3WFd3bjFmY25VTFdxM3NaN0VDTG1uR21Ca3M3QmZVU0IvZXlSY0ZVc0F6TmRRbDljV1FxaENYNkkrd3cvbVo2bEFSRzl6d2treW1VWkV5MGlNNkNnU3dtQlRWd2ZQTHlIaURNYXVGVm9WVHc4Z0k4b1N3ODVtaG13RXMyazBCZ2Jha1ZsYTFUUy9Pais2d21zbHhPUTQ0ajB2aVZtTTBPZ29pRUFyeEVlMWJDS2FOWGRxVDhJSmRqT3FvbmtRWjN4MXAvbVB4T213c0FoWGJXMytYNjlpNVQ4bnh0MythbiszRkpzbzJEYVIzZlJscm81ckpvZ3k3UUwyMFE0THNoNDN1Zm5wTWowV3VlUFl5R0grTXRDcW9hTVdBanpscWswcjhLbWdvSjZEaVlyOGk5dzR4ZTVrZ1YzdHJURkorU1JxeHVIK0FCUGVuSGFNeVpBeGtPU3hIdVhFRk1HdFdOZFh1OGhKSXpicnhmUjlhVDhYMVBDWEJ1WVZFTTdxd0hycXVhK2FnZEliMkRYVFhLb1ZhajV5TXZDTlA3aGRrK1VSY0tiVTJpZVp0VUR5cUlPQ2ZPeGZyK05kd1dMaUJkUitXd2VVbFNJd3JiNEJjTmMxeEdaNkNMYWt0UzNIaFhVZzZVYnBmNVBCWHJpNFBrN29saXJmNHdUNWJuM1M4bWhkeUNOMEJFZHR5Rk4yS0JldnZWbE9tbTRvMmh4ZmZRbUVsSUpEOEpGNHpPeFRGQk00Zy9RZzdOczM2Y015YnV0eVhaM3laTmVwcXlsaGFHcy9rZXVrSU1YSnZ3Y1N2K2hvbW94MURrNVdRQThtdldtUi85dEFVZ3M5MW5sQ0poeVF4R1hRTG55VjlIUzl2MSt6U2dZVlQvdEc0UldoaHA1b0JWbWh1c1l3TklMUXhOWnpKaWI0dmdxQWtucnJUbXI1aVVpS0daRlFOajlmZmxYZEdEbXFWUTFZMVo0L0NhN2FtbUQ5TmF1SzVSZExXR05vNHJ3Ymx6cy9NbUlzamtYaXlsMm51VHQ3ZStuUDNGcmpaT1FSaVBsR3ZuZ1A2WnBDdmc4TGdkaEtTRVVEY256dUZFQWgvZzllWlZWdUkyVXdkRENYVENOMWlTSHZyYlRxT29NTFFKRU53eXRXWU1kZlNJbFRwUFNBSHE2bGczcnVvTjhGU3ZERjR3a3hVNnRvNGJRMWpuY0Qxa2RvckF0K2VxcldlSVNCMWFrRm9LaFYweFRBbVpZc2czM0UrSzlLcFhiUVNDbXp0Q2ZsZFhndFRhS1ZTSytDTkZJZmZSMndsUXJ4SUw2SkdzWm1HMVExT0RHcWxuemxIS2Q2cThxMkRtTlNTY3JwQVRlSHdGUm1ObXJxemlvclJ6NFl5eUsvRlBIYjJxbmY5ckpicGxnQVg4eXVwNUtTNWdBN3hNVUJiUVM5WXBUL2p1WXpKRWZOak9GR2tTRkNFNlp6SGV4RXVKRi9QbGlWMUdmNllwY1M3cFY3ek83eDBUeGtzR2VncENUZjNnZGFsRVl1UUUvSUNlYUNNMWpjWUY0cVoxQ2JqMHlOaTJHL3hRaGt0S2FER0tPYllZbk4yUmcyUFduazlIajZPOVdXdS9TK0dzWk1vTWpUaVlQY2t4Q2ZhMCtjTFNyaVFvRERWSUpDNXlod29Ici8rWVJlUGkrUExGNGUza2cySkFKOGxhUDBYejgwc3BVc2RKL2pwQ294aWJISVZRY01DN01TSmN1SWMzMGlPeGZiSmVGRGd5MlExamRBSXkvTUJJNEJrTklOZnNoMXRaamFHa3Zva3JJcmNRbTdPQWdkdFJjbHhlUE95cWxVbVp6akxoMG82a0k0WHk0Skp1OFAyMzJmbmJ2dmYxMTlTeTZUcmJ6bUIzdDlYaWRIMElocVZscmltQlQ4S3VTSFVJUVhWS1M1SkZSMTJ2SWQ3S3JZV0FQb3Y3elFaTDhIWndjb0RBT3pBN1k3eWRqSmFEdnU4QzNMNUovNXJORmlac0FQZjlRd1FxQS80VHRPN0F5T2VHWnYvSFl2VU5kQW9tRjhDYXhTSHYzOGV1T08rQm91YVpUMUNESmR2QXhVZXExMTFrUmlCc1VPeGxab0VuajVkSEZUWFNIQStSckhZR1NFYnVlL1JNeXVhaGlSS2dyRzdqWHNKQ2FhTzVkL0J3ckU1YkFkcUJKUzNmMm5wRUlEcDA1MXlabVBvakxOcjBZVGwrbSt2WFV2MlBJUVlYWko0aW9MS2FpeU82VnJyRXA0QXp4OWpsUnpTb2FmU1pNQkx1YllmTFRxN2M0NzlvYVptNnpHNGg0dlhhalNraTZuS2NWdUxRNWxMb0NWQ2pWMTIyVzJ2UklQdHpWVy9zQjJrUWVpSWZJNjEyTmNseDUyR0I5VmtSUEVuc1dWak5FOGpaamdLZXdzS1BuQ2VFakpRMWNiZnErYkhoN1MvK3ZnTm9GblZRbzFVbWxoRHgyK0szYUxuSllKQVh1YjVqVGFvYXIrQnkwMExDTkVERnJFYVlXRFl4V1N2b1JmRk1pRkRFL2RIZnhWNUpaU2JnY003eldxOXJ1d2VaY1Mwek81T3pTY096cVd6c2RJWllGSE5BVzlOaGQ0TVJPdkhOZ0w1ZlFKM0Zjd2g0WHYvM0dBaysyWWRQU1dxU0VUR1VUVkI1NUw0NDNzTk40Um80REV3QTZzTlIrbER0UkJ1dXA5aHEwbjRKSFVhSTRaWm54cXRRWkhHVEgwaUZZVGljMkpOVFh1K296KzZVQnp6Sk0vU3M4WE9ub3EzQUd2bVMyNFZjN3FybWhjSVl6NHBieHlwSHZXcnJtK1JBZVBPUjh5VEdBQ0pWVlEyTkZYYUppZWhYWWp3ZkV1azhSTmFRT0hUNXFRbUlwa1AxTk13VWdZamJ0Rm9Oai9WVVlQT2gzSVVjd2xKZ2JIZWJCek9VTUErNnI3b1lDUVJUWlBHVVhaR0FReGdxZFpadlR3SkJCMmtSdzUzd21rZ3NjUlBQb3ZmNXAvRVJ5Ti9kL29KVzVBdmlDRC9XNXRJQkxvVU9QV2RrY245cktlSUFOTzl5anBORklQYTUrQ05MN1ZVcGFFQ3FyMGN4K0tDNDlLRUJyUk5SVWFyTEZhSTVxSDhKN1BLeVNxNHpFR21oZWlWTTFrRnN6NFhLMnMrVVhKVDhxL2R4ZVl6QXAwcm8xaEdkQkVNR0tjZktqYnpSWGFZV055SXc4K2dSd05nVllBTEhJZEZEK01xODBYL01RZUVTdmIzOFlJVVZMamhyMWFxd1lTU3p5WXoxa1YvMVFVUE9BVEJ0Z1JDMVUrMGVENmQyVDQ1NGRLN0l4ckRIckVlVnlvQy9YeFJ4eVBvQXZZZVBTZ1Fza1JlaUVDelpCRWw0Z0FONTI2V0doY2NVQkNUYURVbEhKWUFkMitrZ2N6NEZxN1VQdXB3L3V6MTVpTlFUT2kzTFlsbnM0ZllWYnFhd0xJZURhblFsQnEvdEcwTnVyakNlKzQ5d1h0dGdqS2QxY2tTaUN0cHUxRHlnQ29kT2VrNTREd1hSQStScWVGTGliMHlqUE9XRzZleGRUUjZzWVloWUNrWG5PYjRSVG14REpmK0dlOEt3K3RxcitxVmxaZjgzQldoODcwR2swR2pCQks4MElWVGNxUWwwUC9mdFY5Zk1zT2FSOHRsRGE0eHNhcnZYcFpaWkQ5OUFmU2JsT2ZpUjB1UnF2d1hERQ==

RVdTOUtDenh1c1RzcTJZc216SUM0ZWZET1ZYbnhDS0ZtdGc1L2lWbnNzazl5SmEwMnFReG15RTh4Vm1EQU5jNVY2VkhmdEk3QWlRMi9rQmNUQXZEa2dnRkpHMlo3WXFRVFNOSzVVM2lhQjNwcmtYbk5jY2hxWmwzSVVzR25JVysyVDdUUzJyS0F4S0lCRTA3WFd3bjFmY25VTFdxM3NaN0VDTG1uR21Ca3M3QmZVU0IvZXlSY0ZVc0F6TmRRbDljV1FxaENYNkkrd3cvbVo2bEFSRzl6d2treW1VWkV5MGlNNkNnU3dtQlRWd2ZQTHlIaURNYXVGVm9WVHc4Z0k4b1N3ODVtaG13RXMyazBCZ2Jha1ZsYTFUUy9Pais2d21zbHhPUTQ0ajB2aVZtTTBPZ29pRUFyeEVlMWJDS2FOWGRxVDhJSmRqT3FvbmtRWjN4MXAvbVB4T213c0FoWGJXMytYNjlpNVQ4bnh0MythbiszRkpzbzJEYVIzZlJscm81ckpvZ3k3UUwyMFE0THNoNDN1Zm5wTWowV3VlUFl5R0grTXRDcW9hTVdBanpscWswcjhLbWdvSjZEaVlyOGk5dzR4ZTVrZ1YzdHJURkorU1JxeHVIK0FCUGVuSGFNeVpBeGtPU3hIdVhFRk1HdFdOZFh1OGhKSXpicnhmUjlhVDhYMVBDWEJ1WVZFTTdxd0hycXVhK2FnZEliMkRYVFhLb1ZhajV5TXZDTlA3aGRrK1VSY0tiVTJpZVp0VUR5cUlPQ2ZPeGZyK05kd1dMaUJkUitXd2VVbFNJd3JiNEJjTmMxeEdaNkNMYWt0UzNIaFhVZzZVYnBmNVBCWHJpNFBrN29saXJmNHdUNWJuM1M4bWhkeUNOMEJFZHR5Rk4yS0JldnZWbE9tbTRvMmh4ZmZRbUVsSUpEOEpGNHpPeFRGQk00Zy9RZzdOczM2Y015YnV0eVhaM3laTmVwcXlsaGFHcy9rZXVrSU1YSnZ3Y1N2K2hvbW94MURrNVdRQThtdldtUi85dEFVZ3M5MW5sQ0poeVF4R1hRTG55VjlIUzl2MSt6U2dZVlQvdEc0UldoaHA1b0JWbWh1c1l3TklMUXhOWnpKaWI0dmdxQWtucnJUbXI1aVVpS0daRlFOajlmZmxYZEdEbXFWUTFZMVo0L0NhN2FtbUQ5TmF1SzVSZExXR05vNHJ3Ymx6cy9NbUlzamtYaXlsMm51VHQ3ZStuUDNGcmpaT1FSaVBsR3ZuZ1A2WnBDdmc4TGdkaEtTRVVEY256dUZFQWgvZzllWlZWdUkyVXdkRENYVENOMWlTSHZyYlRxT29NTFFKRU53eXRXWU1kZlNJbFRwUFNBSHE2bGczcnVvTjhGU3ZERjR3a3hVNnRvNGJRMWpuY0Qxa2RvckF0K2VxcldlSVNCMWFrRm9LaFYweFRBbVpZc2czM0UrSzlLcFhiUVNDbXp0Q2ZsZFhndFRhS1ZTSytDTkZJZmZSMndsUXJ4SUw2SkdzWm1HMVExT0RHcWxuemxIS2Q2cThxMkRtTlNTY3JwQVRlSHdGUm1ObXJxemlvclJ6NFl5eUsvRlBIYjJxbmY5ckpicGxnQVg4eXVwNUtTNWdBN3hNVUJiUVM5WXBUL2p1WXpKRWZOak9GR2tTRkNFNlp6SGV4RXVKRi9QbGlWMUdmNllwY1M3cFY3ek83eDBUeGtzR2VncENUZjNnZGFsRVl1UUUvSUNlYUNNMWpjWUY0cVoxQ2JqMHlOaTJHL3hRaGt0S2FER0tPYllZbk4yUmcyUFduazlIajZPOVdXdS9TK0dzWk1vTWpUaVlQY2t4Q2ZhMCtjTFNyaVFvRERWSUpDNXlod29Ici8rWVJlUGkrUExGNGUza2cySkFKOGxhUDBYejgwc3BVc2RKL2pwQ294aWJISVZRY01DN01TSmN1SWMzMGlPeGZiSmVGRGd5MlExamRBSXkvTUJJNEJrTklOZnNoMXRaamFHa3Zva3JJcmNRbTdPQWdkdFJjbHhlUE95cWxVbVp6akxoMG82a0k0WHk0Skp1OFAyMzJmbmJ2dmYxMTlTeTZUcmJ6bUIzdDlYaWRIMElocVZscmltQlQ4S3VTSFVJUVhWS1M1SkZSMTJ2SWQ3S3JZV0FQb3Y3elFaTDhIWndjb0RBT3pBN1k3eWRqSmFEdnU4QzNMNUovNXJORmlac0FQZjlRd1FxQS80VHRPN0F5T2VHWnYvSFl2VU5kQW9tRjhDYXhTSHYzOGV1T08rQm91YVpUMUNESmR2QXhVZXExMTFrUmlCc1VPeGxab0VuajVkSEZUWFNIQStSckhZR1NFYnVlL1JNeXVhaGlSS2dyRzdqWHNKQ2FhTzVkL0J3ckU1YkFkcUJKUzNmMm5wRUlEcDA1MXlabVBvakxOcjBZVGwrbSt2WFV2MlBJUVlYWko0aW9MS2FpeU82VnJyRXA0QXp4OWpsUnpTb2FmU1pNQkx1YllmTFRxN2M0NzlvYVptNnpHNGg0dlhhalNraTZuS2NWdUxRNWxMb0NWQ2pWMTIyVzJ2UklQdHpWVy9zQjJrUWVpSWZJNjEyTmNseDUyR0I5VmtSUEVuc1dWak5FOGpaamdLZXdzS1BuQ2VFakpRMWNiZnErYkhoN1MvK3ZnTm9GblZRbzFVbWxoRHgyK0szYUxuSllKQVh1YjVqVGFvYXIrQnkwMExDTkVERnJFYVlXRFl4V1N2b1JmRk1pRkRFL2RIZnhWNUpaU2JnY003eldxOXJ1d2VaY1Mwek81T3pTY096cVd6c2RJWllGSE5BVzlOaGQ0TVJPdkhOZ0w1ZlFKM0Zjd2g0WHYvM0dBaysyWWRQU1dxU0VUR1VUVkI1NUw0NDNzTk40Um80REV3QTZzTlIrbER0UkJ1dXA5aHEwbjRKSFVhSTRaWm54cXRRWkhHVEgwaUZZVGljMkpOVFh1K296KzZVQnp6Sk0vU3M4WE9ub3EzQUd2bVMyNFZjN3FybWhjSVl6NHBieHlwSHZXcnJtK1JBZVBPUjh5VEdBQ0pWVlEyTkZYYUppZWhYWWp3ZkV1azhSTmFRT0hUNXFRbUlwa1AxTk13VWdZamJ0Rm9Oai9WVVlQT2gzSVVjd2xKZ2JIZWJCek9VTUErNnI3b1lDUVJUWlBHVVhaR0FReGdxZFpadlR3SkJCMmtSdzUzd21rZ3NjUlBQb3ZmNXAvRVJ5Ti9kL29KVzVBdmlDRC9XNXRJQkxvVU9QV2RrY245cktlSUFOTzl5anBORklQYTUrQ05MN1ZVcGFFQ3FyMGN4K0tDNDlLRUJyUk5SVWFyTEZhSTVxSDhKN1BLeVNxNHpFR21oZWlWTTFrRnN6NFhLMnMrVVhKVDhxL2R4ZVl6QXAwcm8xaEdkQkVNR0tjZktqYnpSWGFZV055SXc4K2dSd05nVllBTEhJZEZEK01xODBYL01RZUVTdmIzOFlJVVZMamhyMWFxd1lTU3p5WXoxa1YvMVFVUE9BVEJ0Z1JDMVUrMGVENmQyVDQ1NGRLN0l4ckRIckVlVnlvQy9YeFJ4eVBvQXZZZVBTZ1Fza1JlaUVDelpCRWw0Z0FONTI2V0doY2NVQkNUYURVbEhKWUFkMitrZ2N6NEZxN1VQdXB3L3V6MTVpTlFUT2kzTFlsbnM0ZllWYnFhd0xJZURhblFsQnEvdEcwTnVyakNlKzQ5d1h0dGdqS2QxY2tTaUN0cHUxRHlnQ29kT2VrNTREd1hSQStScWVGTGliMHlqUE9XRzZleGRUUjZzWVloWUNrWG5PYjRSVG14REpmK0dlOEt3K3RxcitxVmxaZjgzQldoODcwR2swR2pCQks4MElWVGNxUWwwUC9mdFY5Zk1zT2FSOHRsRGE0eHNhcnZYcFpaWkQ5OUFmU2JsT2ZpUjB1UnF2d1hERQ==

指标使用通用经验总结

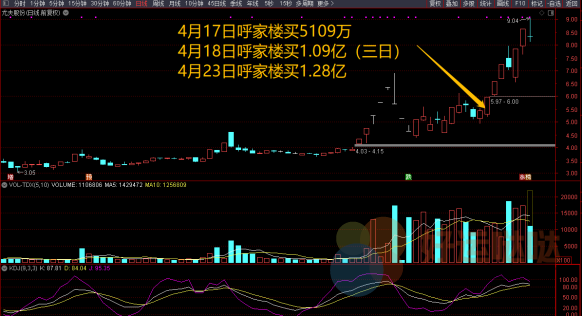

- 一般出现信号不急着立即介入,介入时机一般尾盘半小时判断信号是否可介入;

- 指标信号出现后第二天冲高阴线,立即清仓,等待突破上一个信号点最高价判断是是否介入;

- 指标信号出现后第二天阴线或假阳线,立即清仓,等待突破上一个信号点最高价在判断是否介入;

- 在上涨,现价处于上涨高位的『介入、看多』信号不参与;

- 不是信号一出现就介入,要根据市场环境,量价关系,市场情绪等诸多因素判断是否可介入;

- 技术指标有其本身局限性,宁可错过,也不要做错;

- 拿到指标后,多测试,多练习,看是否符合预期,总结规律;

总之一旦信号失真,不符合预期,立即清仓控制风险 ;

免责声明: 本站所有文章文字内容如无特殊说明,任何个人或组织,在未征得本站同意时,禁止复制、盗用、网络收集、发布本站内容到任何网站、书籍等各类媒体平台!指标公式源码来源于网络收集和用户上传,分享目的仅供参考与学习,请勿商用或实战,如需商用或实战,请购买正版,否则后果和损失自行承担。如若本站内容侵犯了原著者的合法权益,请携带相关版权文件 联系我们进行下架处理。指标公式案例截图仅代表过去,依此操作,责任自负。本站不提供技术培训、安装调试、股票推荐等金融服务。

© 版权声明

文章版权归作者所有,未经允许请勿转载。

若是本站收录内容侵犯了您的权益,请发送邮件说明,本站将第一时间处理。

THE END

暂无评论内容